What’s going on with the labor market?

The number of new jobs is up—but so is unemployment

The monthly employment report has regularly been an important data set. But its importance has increased since the Federal Reserve has targeted the labor market as a key metric as it considers the path of monetary policy.

The Department of Labor's monthly report includes several measures of the labor market, each important on its own. And as the numbers for May came out on Friday (June 2), they elicited a couple of reactions.

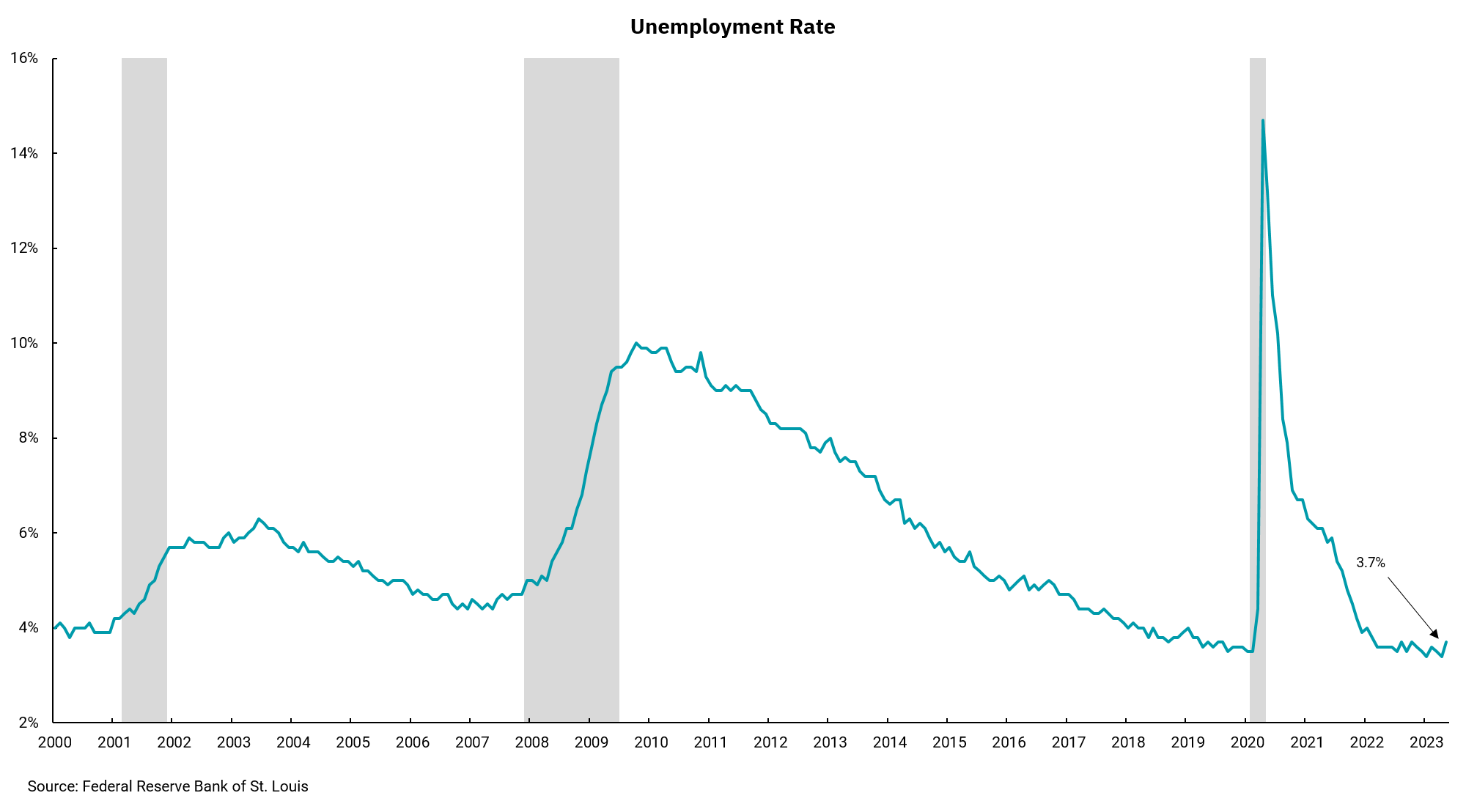

We usually see the number of jobs created first. For May, we expected the report to show an increase in nonfarm payrolls of about 195,000. Instead, we got an increase of 339,000—much higher than anticipated. This garnered a "wow!" reaction, as this increase was much stronger than expected, and the report also provided upward revisions to the previous two months. Then we saw the headline unemployment rate, the U3, which went up from 3.4% to 3.7%, causing a "what?" reaction.

This type of difference between economic indicators is not unheard of, as the number of new jobs is calculated differently than the unemployment rate. But a difference of this magnitude does not happen often. We should see the two methods used in the unemployment report move toward each other over time, but this release fits with the mixed data we have been getting around the economy for a while—with some areas showing strength while others showing weakness.

Another aspect of the monthly report is a measure of wages. Recall that the Fed has targeted wages as a key metric as it thinks about inflation and the direction of monetary policy. On that front, average hourly earnings (AHE) were reported at +0.3% for the month, which annualizes at 4.3%, the same as last month.

Recent comments from some Fed members and the mixed economic data have led to speculation that the Fed will hold rates steady at their upcoming meeting. The employment report shows the labor market remains robust, and while it appears the Fed is no longer behind on inflation, the core rate of inflation, led by wages, remains well above the Fed's target of 2%. The Fed might skip raising rates this meeting, but there is still work to do before they can say inflation is declining toward their target.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)