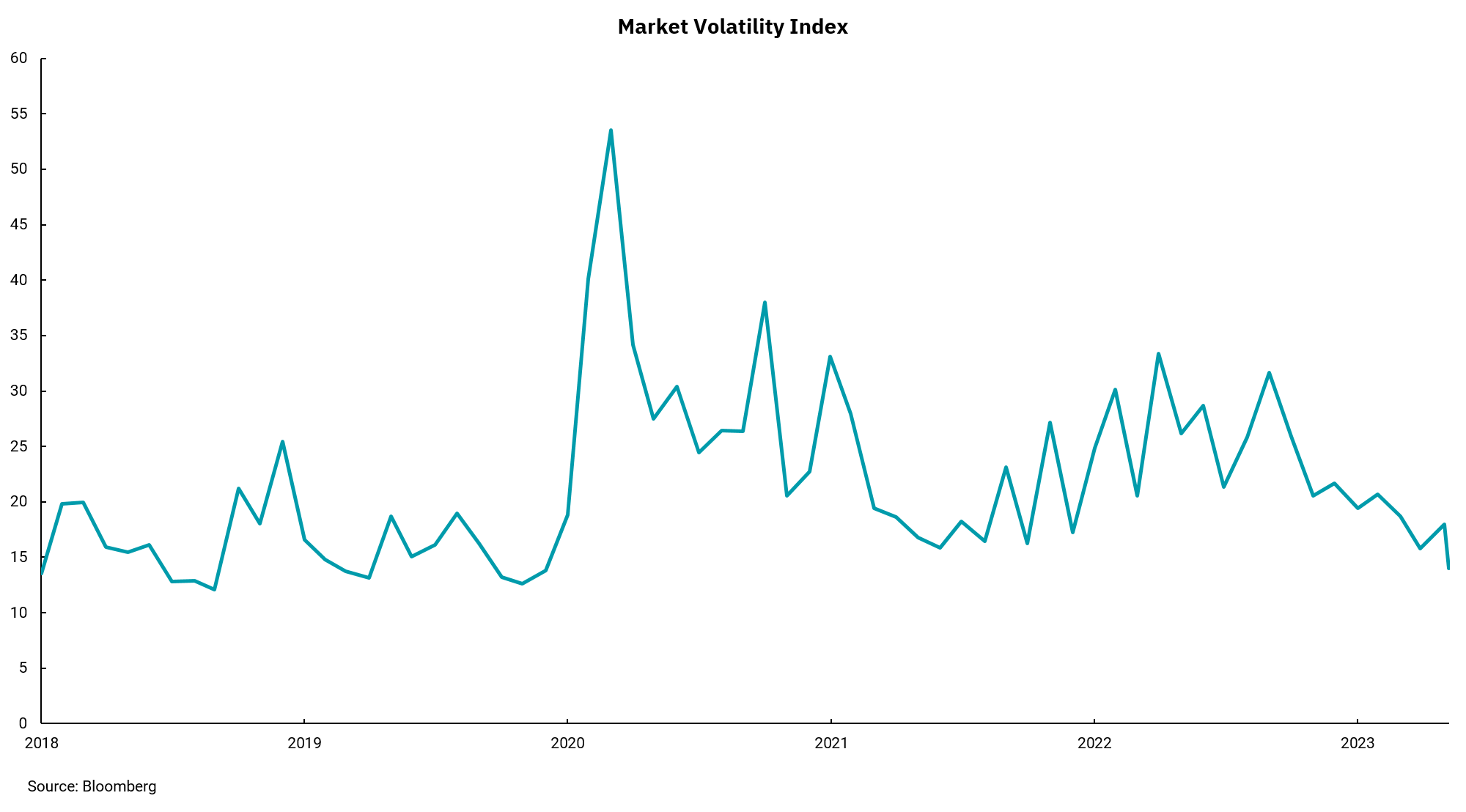

Wall Street ‘fear gauge’ hits three-year low

Debt ceiling resolution helped lower volatility

The Cboe Volatility Index, or VIX, tracks the price of options used as insurance against sharp market moves. The VIX is commonly referred to as Wall Street's "fear gauge.” When it's high, investors see risks in current equity prices; when it's low, there is a lack of major concerns in the stock market. This week the VIX hit a low not seen since February 2020, just before the COVID-19 pandemic hit the U.S.

Volatility has been declining since the fourth quarter of 2022. At that point, rising rates crushed high-growth stocks, and valuation fell in line with long-term averages for the first time in years. There have been several factors pushing volatility even lower recently. The removal of the debt ceiling risk is one example. A widely expected pause in the Federal Reserve's rate-raising campaign is also helping. Employment and consumer spending remain strong, and the World Bank lifted its global growth forecast this week.

The declining fear in the marketplace has translated to gains in U.S. equities year-to-date, but only in a few stocks. The so-called "MegaCap-8" are up an average of 66% this year. Meanwhile, more than half the names in the S&P 500 index have seen negative returns year-to-date. The gains are concentrated in mega-cap growth, with value and small-cap indices far behind. The volatility index's low level appears to reflect the lack of movement in most parts of the market rather than optimism in a very narrow part.

One of the biggest fears when the Fed began to raise interest rates was that it would lead to a recession, as it often has in the past. As the rate-hike cycle nears a close, little evidence exists that a recession is beginning. Inflation is falling without an increase in unemployment, and the longer this goes on, the more investors are convinced we may avoid a recession altogether. Inflation still has a long way to go to the Fed’s 2% target, and perhaps investors need to pay attention to the possibility that a recession could begin after inflation reaches it.

Investors must stay vigilant in evaluating the risks in the economy. The narrow leadership in the stock market is largely driven by AI potential, which could take longer than expected to play out. Inflation could prove more persistent than expected, and rates could be higher, as we have seen in other parts of the world. Still, the stock market rally and decline in fear and panic are welcome changes as we head into the summer months when we typically see lower volume and volatility.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)