Consumer credit card debt increasing

Higher personal debt levels leading to increased charge-offs

Since the U.S. economy is largely driven by consumer spending, consumers’ financial health is near the top of the data points we watch. Consumer spending’s significance helps explain why "full employment" and price stability are mandates for the Federal Reserve as they implement their monetary policies.

We watch the labor market closely as the Fed tries to reign in higher-than-desired inflation by raising interest rates and shrinking its balance sheet. It is an unfortunate side effect of slowing demand that we usually see the rate of unemployment rise, which can make it harder for consumers to pay their debt and increases the rate of charge-offs we see from credit card companies.

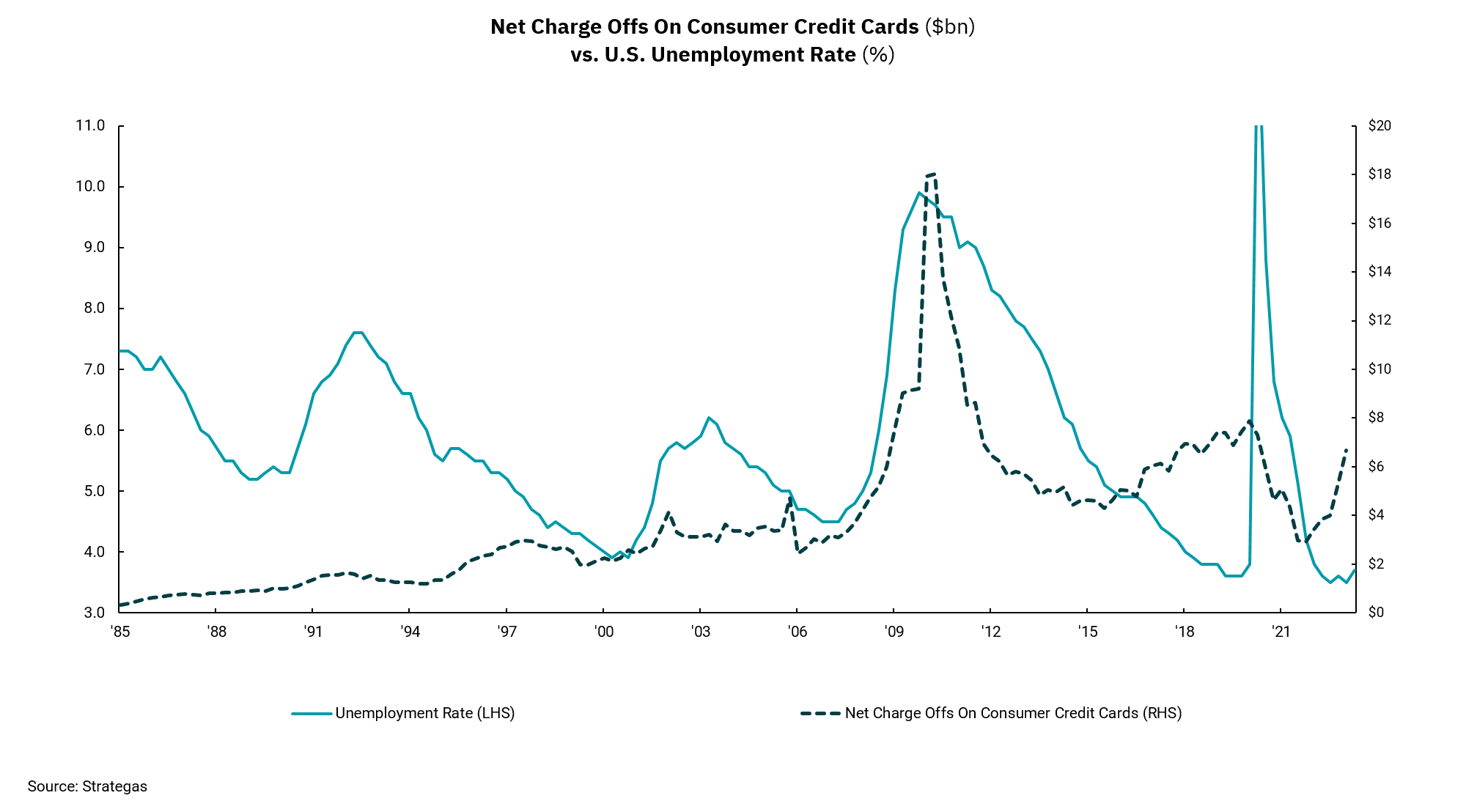

With this in mind, this week's chart examines the relationship between unemployment and credit card company charge-offs. History shows a relatively weak correlation until the Financial Crisis in 2008 and 2009, when higher unemployment contributed to a huge increase in credit card charge-offs. Of course, during that period, losses on home mortgages skyrocketed, too, as consumers had significantly overleveraged their position. It makes intuitive sense for charge-offs to increase during periods of economic stress, as job loss has a material impact on a consumer's income.

The onset of the pandemic, clearly visible in the chart when unemployment surged to over 11%, did not see a corresponding increase in charge-offs. Why? The Federal Reserve’s actions on rates and liquidity, and more importantly, Congress’s material fiscal actions, meant personal incomes did not go down with higher job losses. In fact, personal incomes went up during the pandemic leading to a period of lower charge-offs and de-leveraging by consumers.

As we move forward, however, the chances of fiscal support from the government are less. Moreover, as the Fed has raised rates and credit card interest rates now exceed 20%, the rising cost of credit card debt means we must consider a scenario where job losses might result in higher charge-offs. Already, we have begun to see credit card charge-offs increase even as the unemployment rate remains low. This could be a negative harbinger of things to come as the impact of the Fed's monetary policies has a larger impact on the economy. What is not shown in the chart is consumers’ increased use of credit card debt, as overall credit card usage was much less in the early periods we show, which could add to the negative implications. The Fed may want the labor market to weaken slightly to ease inflation, but we don't want a collapse in employment.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)