More new homes being built despite higher mortgage rates

What factors are causing housing starts to rebound?

While not a massive part of the U.S. economy, the domestic housing market is an important economic barometer. In addition to the direct impact on employment and spending, housing activity and “household formation” impact a broad swath of economic sectors. At its base, owning a home is still a crucial part of the “American dream.”

Access to and the cost of financing are key variables influencing the housing market. Periods of higher unemployment or economic recessions mean access to credit can be more difficult, and periods of rising rates increase the cost of financing a house. So as the Federal Reserve began increasing interest rates in the face of higher inflation, it was not surprising to see housing starts dip. As we exited the pandemic, low interest rates decreased the cost of money, and with strong employment gains, we saw home prices rise rapidly. Inflation also increased the cost of building new homes, which led to price increases.

Recent reports have shown a surprising trend of housing starts rebounding even as home mortgage rates remain near 7% and publicly traded home builder stocks have rallied strongly this year. This might seem counter-intuitive, but looking under the hood of the U.S. housing market reveals why this is happening.

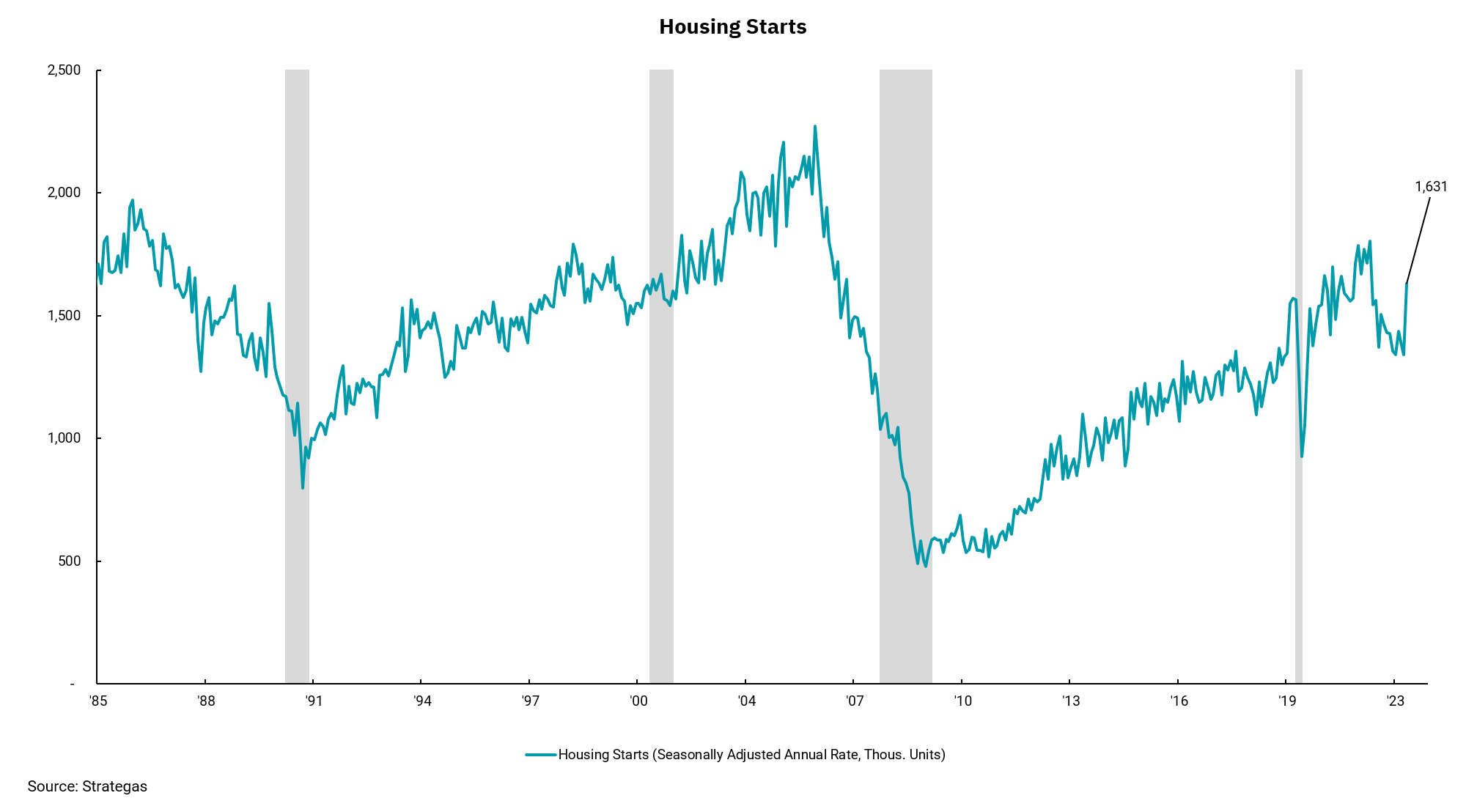

Looking long term, we can see housing starts never fully recovered from the financial crisis/housing bust of 2007-2009. One could understand the slow recovery, but it means we have been “underbuilding” housing even as our population expands. This chronic undersupply of new housing is one reason prices have not fallen as much as expected, given the huge upward move in mortgage rates.

Another reason for the improvement in starts and homebuilder stocks is the dearth of existing homes for sale. Bloomberg recently reported the number of homes for sale in the U.S. is at a record low. Why? Many homeowners took advantage of low mortgage rates available during the pandemic to refinance their homes, and home buyers during that period could finance their purchases at low rates; hence, selling a home now would mean financing a new purchase at today’s higher rates. This means current homeowners are reluctant to sell, reducing supply in the housing market. If existing homeowners are not selling, new construction is the only source of homes to buy. And although nationally home prices are down, recent data shows the demand for housing is still above its supply.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)