Bond market forecasting ‘somewhat positive’ economic growth

Stock prices may benefit, but Fed may have to keep rates high for longer

Having started my investment career as a bond salesman in January 1982, I have always tried to pay attention to the “message” of the bond market. While the stock market gets more press and, frankly, can be a bit more interesting, one ignores the bond market at their peril.

The bond market comprises many kinds of debt, from governments to corporate issuers to car loans to home mortgages. How these different types of bonds trade on an absolute and relative basis can offer important information about investor outlooks for the economy's future. For example, if bond investors demand a higher spread over treasuries to buy corporate bonds, it can indicate an outlook for slower economic growth. As growth slows, more corporations could have trouble repaying debt, leading investors to demand more return in compensation for risk.

The U.S. treasury market is at the base of the bond market and, in a broader sense, even the stock market. U.S. treasuries are viewed as the global riskless security; hence, the angst recently as the risk of inaction on the debt ceiling introduced the risk of a U.S. government bond default. That idea of U.S. treasuries as “riskless” means every investment outside treasuries has some measure of higher risk. The Federal Reserve controls the short end of the bond market, normally defined as bonds two years and less in maturity, with monetary policy and their overnight Federal Funds target rate. But the longer end of the treasury market, defined as ten years or longer, is less influenced by overnight rates and more by the perception of longer-term economic growth and inflation. The 10-year note is usually the basis for 30-year fixed mortgage rates for consumers.

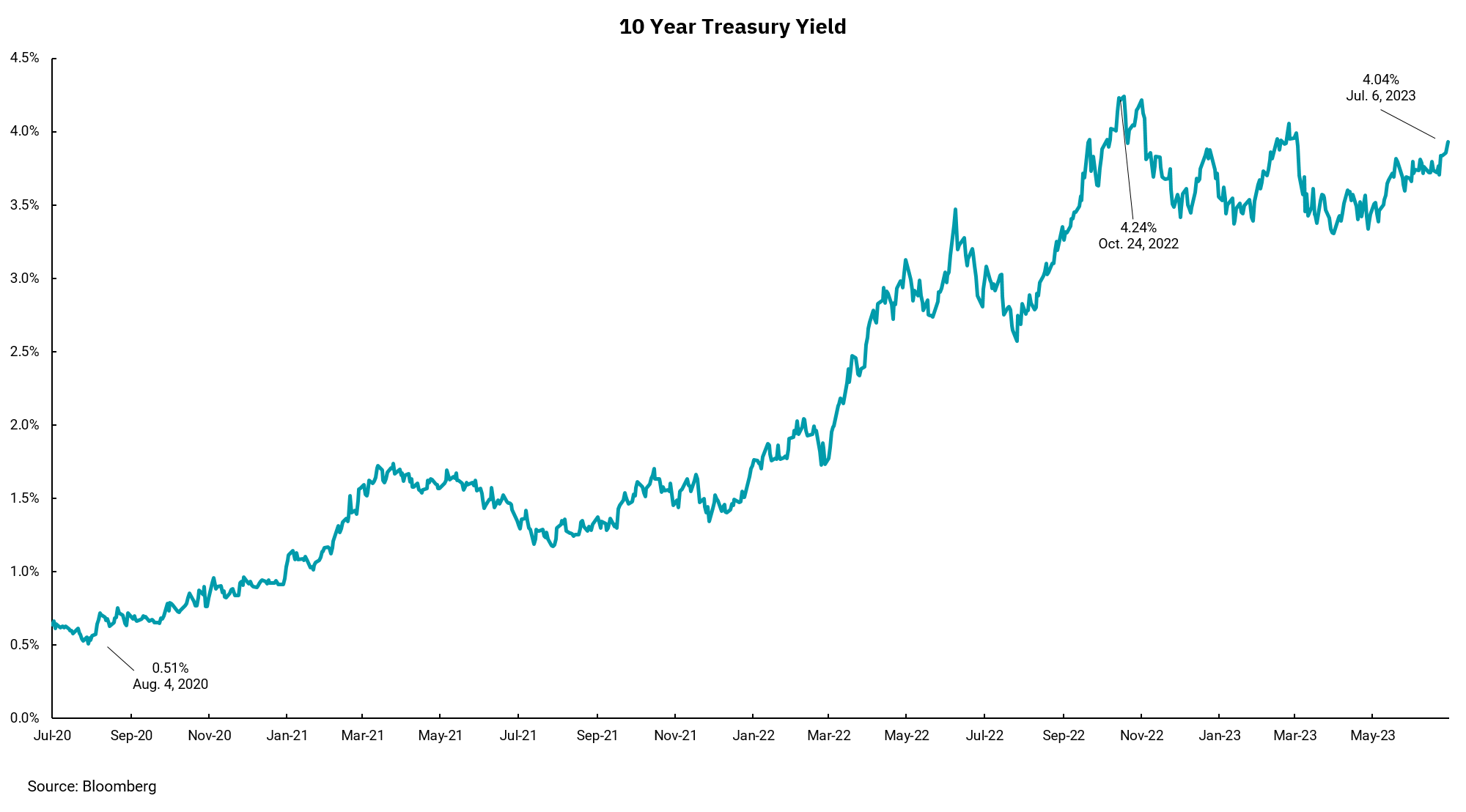

We watch longer-term rates and their relationship to shorter-term rates as one marker in our economic outlook. Our chart shows the material move higher from the lows we saw during the depths of the pandemic, where future growth prospects seemed bleak, to today, where inflation is still higher than the Fed’s target. Note the recent trend back towards high yields of around 4.25%. The “message” of this move is somewhat positive from an economic growth standpoint. Higher rates could portend positive growth but also indicates that the market expects the Fed to keep rates higher for a longer period. For stock market investors, higher rates can be headwind to higher stock prices. Of course, the variability of the chart shows opinions can change, but our outlook is for the Fed to remain firm on rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)