Higher rates not denting housing demand

Lack of supply slowing the fall of home prices

The resilience of the U.S. economy has been impressive. Despite the Federal Reserve having raised rates by 5% over the last 14 months, and another 0.25% hike is anticipated at their July meeting, economic growth remains positive.

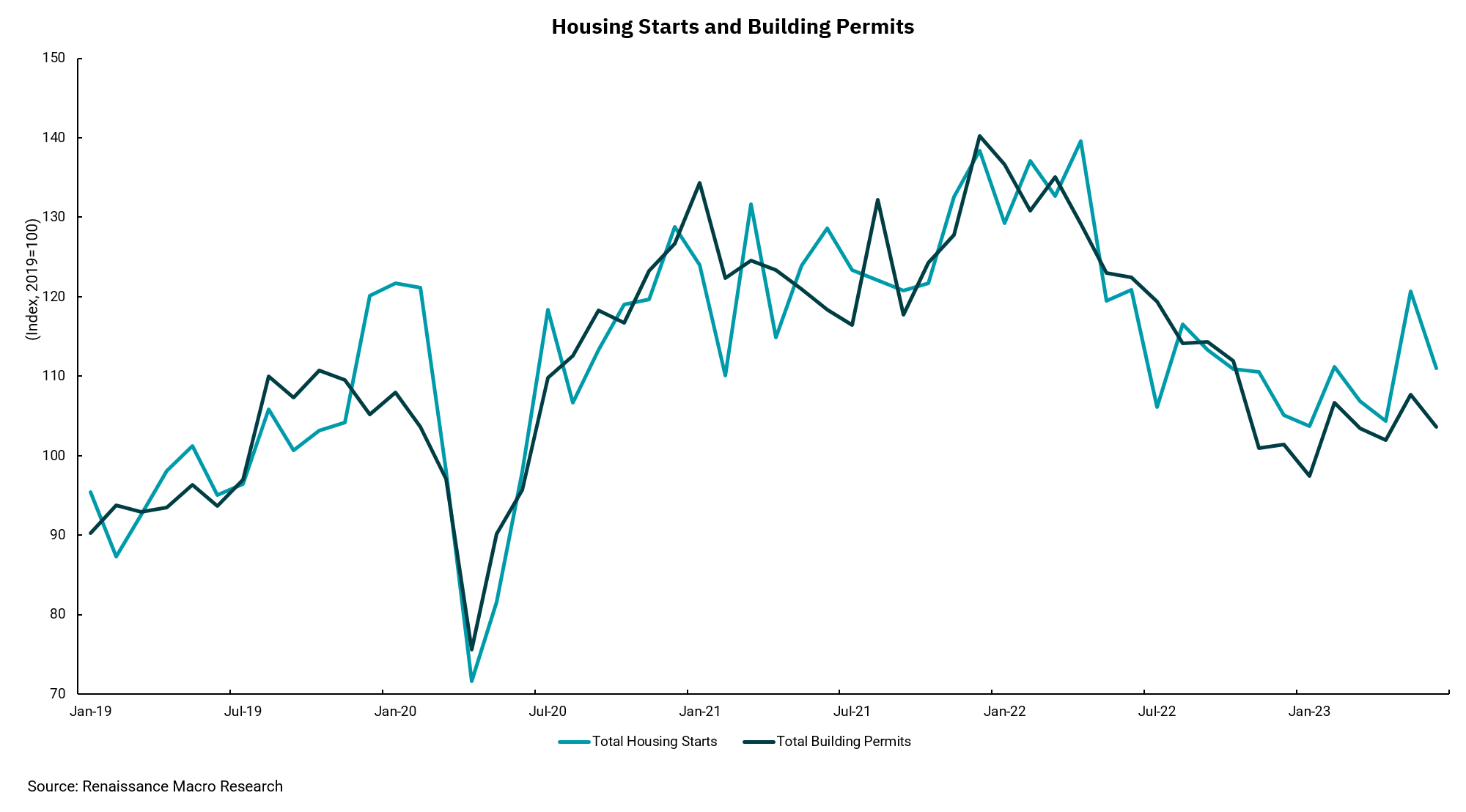

Some areas of the economy are seeing the impact of rising rates. Historically, housing is one of the economy's more interest-rate-sensitive sectors. Not surprising then to see housing starts and permits decline, as 30-year fixed mortgage rates went from nearly 3% to now near 7%. Yet, in the last few months, an interesting development has begun. While we all know about the performance of large-cap growth company stocks year-to-date, homebuilder stocks have also been one of the best-performing sub-sectors of the S&P 500.

This performance might seem counterintuitive. Lower starts and permits should mean lower sales, and higher rates were thought to be a harbinger of a broad decline in housing prices—both headwinds for homebuilder companies. However, some trends have converged, leading new home builders to see improved financial performance.

The first is that the supply of homes for sale remains very limited by historical standards. Since the financial crisis of 2008-2009, there has been a structural under-investment in housing across the country. Compared to household formation and population growth, the longer-term effect has been a chronic under-supply of new housing. So, while higher rates have reduced home demand by increasing mortgage costs, the remaining pool of demand still outstrips the available supply of homes. This still-elevated demand has meant home prices, with some specific regional exceptions, have fallen less than anticipated.

The other factor reducing supply is based on the many homeowners who bought and/or refinanced their mortgages during the pandemic when mortgage rates fell to multi-generational lows. Homeowners who now enjoy these “below-market” rates are loathe to have to sell and move, as this will almost certainly increase monthly housing costs.

The net result is that new home construction has become the primary source of homes, leading to a solid environment for homebuilder stocks. A large supply of multi-family units is coming into the market over the next few months, so rents may continue to get some relief. Still, home ownership remains a competitive environment for buyers.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)