What record credit card debt levels tell us—and don’t

Unemployment levels likely a better bellwether

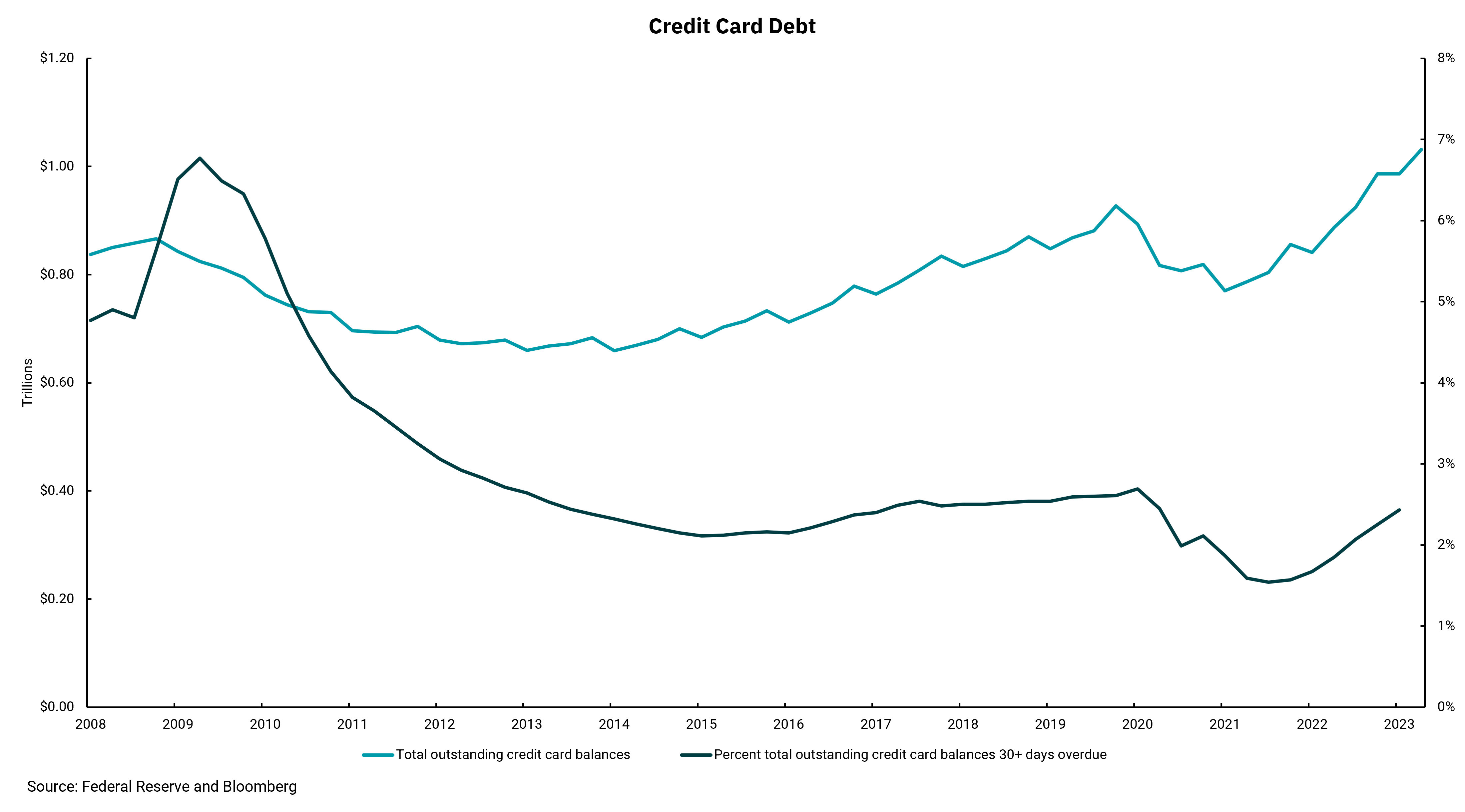

Recent financial headlines have reported that credit card balances, for the first time, have crossed the $1 trillion mark. Economic data such as this can provide insight into the health of the consumer— and the broader economy, as consumer spending is nearly 70% of domestic GDP.

Our chart this week shows this fact, yet in many articles, the insinuation is this is a sign of consumer stress and a harbinger of an impending economic slowdown. Credit card debt has indeed been accelerating quickly after a period of declines driven by significant fiscal stimulus during the pandemic. We also know interest rates on credit cards have risen materially as the Fed has tightened monetary policy in response to higher inflation. Average credit card rates now exceed 20%, so this is not a low-cost source of credit. Meanwhile, other debts, like car loans and mortgages, have also increased, and most student loan repayment moratoriums are scheduled to end soon.

However, credit card debt is at new records as our overall economy, as measured by GDP, is at record levels too. It might be “better” if all of our growth occurred without additional debt, but more realistically, additional debt is part of the economic growth equation. So the absolute level of credit card debt might be a misleading data point on a standalone basis.

There have also been reports of increasing delinquencies on credit card accounts, meaning accounts where repayment is 30 days+ past due. Again, our chart shows this is true, while a longer-term view also reveals delinquencies are coming off very low levels and are still far below the levels we saw during the Financial Crisis in 2008-2009.

As with many statistics and data points, the headline might not reveal the whole story. We can agree the increase in the use of credit cards indicates a shift in how consumers maintain their current spending levels. We can also agree that using credit cards at today’s interest rates means higher debt service costs for borrowers. But the impact on future consumer spending and growth will be materially impacted by the labor market's health. As inflation falls, real wages are increasing, and consumers with jobs are more able to maintain spending. The more important variable will be if the economy slows and unemployment rises. Then deteriorating credit will be a result, but not the cause.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)