Fed rate cuts unlikely in the near future

Bond market may be signaling higher terminal Fed Funds rate

The resilience of the U.S. economy has been impressive. Even as the Federal Reserve raises rates aggressively, economic growth remains positive, and unemployment remains low. In recent weeks, however, this resilience has led to concerns about the future of Fed monetary policy. Specifically, may the Fed have to raise rates further than currently expected?

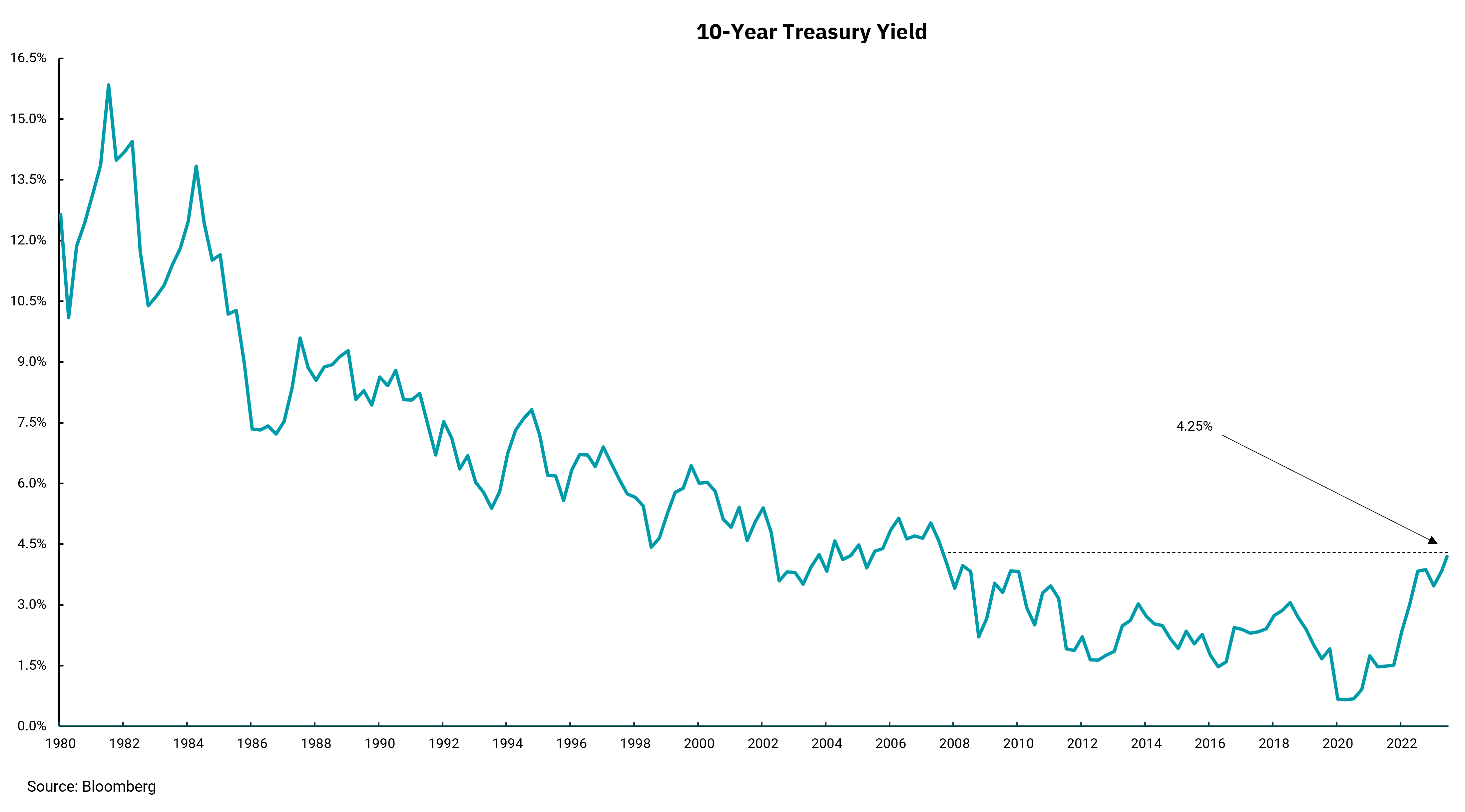

We have noted the increase in longer-term inflation expectations, and this week’s chart shows the impact on the 10-year Treasury note. This chart spans over 40 years, and it is increasingly clear the long downward-sloping path of rates since 1981 is being reversed. The 10-year note is now at levels not seen before the financial crisis. Rates tied to the 10-year, like 30-year mortgage rates, have spiked higher, too.

Only a couple of months ago, the bond market thought the Fed would be ready to begin cutting rates in the fourth quarter of 2023. After all, inflation was, and still is, coming down, and it appeared economic weakness was in the offing. So, what has changed? First and foremost, the U.S. consumer continues to be supported by a strong job market and higher wages have increased personal incomes despite being blunted by inflation. For a while, gasoline prices fell, leading to a fairly rapid decrease in headline inflation measures.

Recent measures of economic activity indicate the domestic economy could even be accelerating a bit, as retail sales were higher than anticipated. Spending data indicates that some of the consumer strength could be from increased credit card use. Still, the rate increase is not having the negative economic impact that many expected.

In this environment, the Fed is forced to consider how restrictive rates are. After a long period of low inflation where small increases in rates led to quick slowdowns in economic activity, are we now in a new period where the levels of monetary, especially fiscal, accommodation are still working their way through the economy? The Fed has repeatedly stated a concern about easing monetary policy too soon. Yet, the bond market might very well be telling the Fed they may need to consider a higher terminal rate, or at the very least, the idea of rate cuts is now being pushed further into the future. As we move forward, we can expect these higher rates to be a headwind for stocks.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)