Rates may have to stay higher for longer

Unwinding the effects of the pandemic won’t be easy

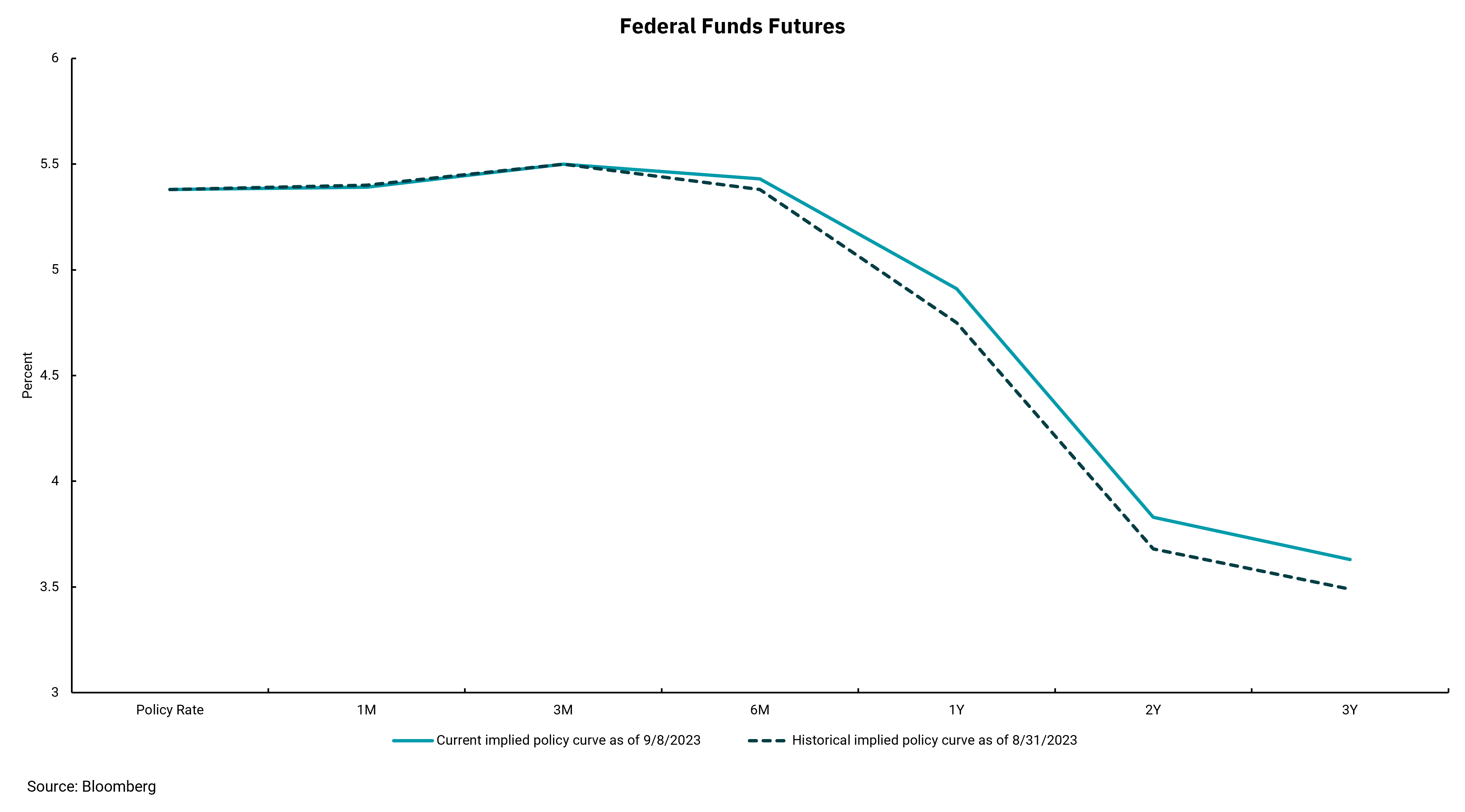

Federal Fund futures are one way to get an idea of what the market expects from the Federal Reserve in future meetings. Only a few months ago, Fed Fund futures were showing a forecast of rate CUTS during the fourth quarter of 2023 based on the expectation an economic slowdown and a decline in inflation would lead to a reversal in monetary policy.

However, the U.S. economy’s resilience is forcing a shift in expectations. As this week's chart shows, the outlook is now for potentially one more rate increase before year-end, a period of stability, and then gradual rate cuts one to two years out. As expectations have shifted, longer-term Treasury rates have increased, impacting consumer borrowing rates, like home mortgages.

The Fed is in an interesting quandary now. It is good news that inflation is falling, and the economy has, so far, avoided anything resembling a recession. Headline unemployment remains below 4%, consumer spending is expanding, and recent data on gross domestic product (GDP) indicates the overall economy could accelerate. Yet this "good news" may also mean recent gains in inflation could slow. Higher economic activity keeps demand for labor high, and a rebound in energy prices could mean declines in headline inflation could begin to reverse.

Even though the Fed has raised rates by 500 basis points, or 5%, "real" interest rates remain relatively low by historical standards, meaning the Fed might not be as restrictive on policy as one might think. Put another way, the rapid and material rate increase is muted as we had "real" interest rates of -6% before the Fed began tightening policy rates.

Like many things, the pandemic's effects continue to alter a more "normal" economic path. Maybe we should not be surprised that unwinding the level of monetary and fiscal accommodation that we’ve seen is taking an unexpected path. After all, we responded to the pandemic with actions unlike any we have taken before. At present, the outlook is for the Fed to be about done raising rates, but we should acknowledge the risk that unexpectedly high rates remain a possibility.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)