Low supply of homes still plagues market

Housing market reality doesn’t match 2023 expectations

Historically, the U.S. housing market is one of the economy's most interest-rate-sensitive sectors. Therefore, as we entered 2023 and expected additional rate increases from the Federal Reserve, our outlook was for the housing market to be weak and at risk of price declines. The reality of 2023 to date has been materially different.

Thirty-year mortgage rates have moved significantly higher, now over 7%, having the effect of reducing the pool of potential buyers. Yet the supply of homes for sale has declined to near unprecedented levels, meaning the remaining pool of buyers is still larger than the available supply. Why has the supply of homes declined so much? A large majority of homes in the U.S. now have mortgages with rates far below existing market rates. Some 75% of home mortgages are below 4%, and close to 90% are below 5%. This makes the decision to sell a house, even at still elevated prices, difficult as one knows the interest cost to buy a different home will be much higher. This has left newly constructed homes as the primary source of available housing supply.

Until recently, home builders were one of the better-performing sectors in the S&P 500, but the recent response to the Fed's forecast for rates to stay higher for longer may make even the new housing market a bit difficult. The 10-year treasury note, a primary mortgage pricing benchmark, has moved to rates not seen since 2007.

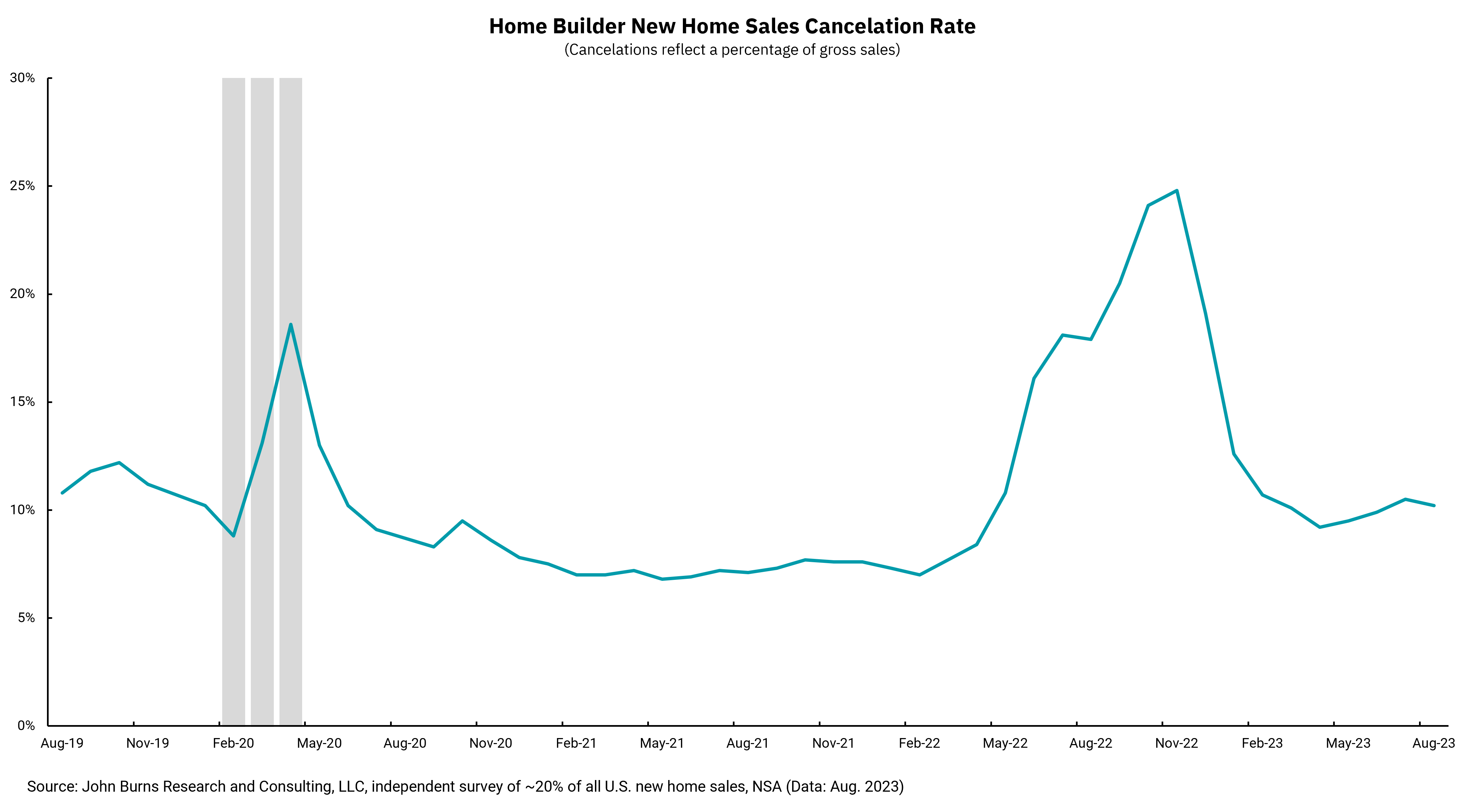

This week's chart shows the level of contract cancellations by new homebuyers. We can see a couple of spikes higher during the onset of the pandemic and then again from August to October of 2022. The spike during the pandemic quickly reversed as the Fed lowered interest rates aggressively, reducing borrowing costs. But the increase we saw last year might give us a better idea of what we might see in the coming months as it occurred as mortgage rates were first moving materially higher and gave borrowers a reason to pause on planned purchases. Over time, home buyers became more accustomed to higher rates and the impact on their budgets, so purchase cancellations fell, yet the recent higher trend could result in a similar shock. Very recent data indicates home contract cancellations are moving higher, which could be another headwind to the housing market in the coming months.

Overall, the strength of the U.S. economy remains resilient. But it would be naïve to think higher rates are not going to have an impact on major purchases like housing and autos. We will watch both markets closely as we move into 2024.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)