Why is September a bad month for stocks?

The trend continues—but with more angst this year

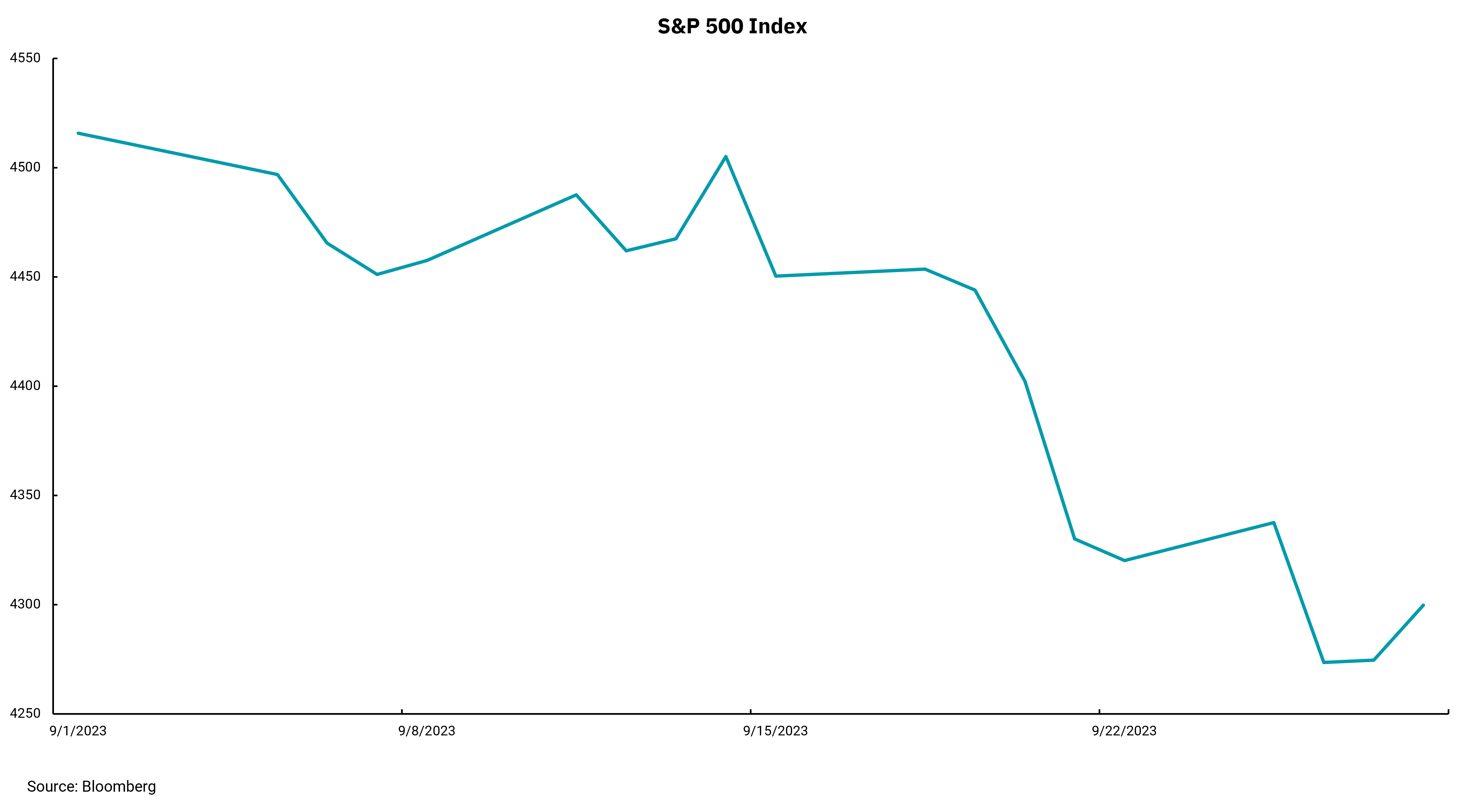

Historically, September has been a poor month for stock market returns, and 2023 appears to be no exception, with the S&P 500 closing down 4.9% for the month. Many analysts in the industry attribute the poor performance in September to a “seasonal bias.” September has been the poorest month for performance for the S&P 500 going back to at least the 1940s.

As the equity market has come under the “September Effect” again this year, it seems a unique set of issues has affected recent market performance. In the short term, we face a wall of worry from factors including the ongoing United Auto Workers (UAW) strike, the resumption of student loan payments, increasing oil prices and the federal government coming to the cusp of another government shutdown. Taken one by one, these issues would likely not cause as much heartburn to stocks. However, these issues have created some angst among financial market participants on top of historically high-interest rates.

At the index level, equity market valuations, like the popular price/earnings ratio, are still slightly stretched compared to historical data. However, if the U.S. consumer remains in decent shape, the economy can fight these issues and come out relatively unscathed. As we consider the consumer's health, focusing on the labor market is chief amongst several factors, including rising debt levels even as interest rates climb.

There is good news as inflation continues to moderate, with the most recent measure of a key price index, core personal consumption expenditures (PCE), coming in at only 0.1%, better than the expected 0.2%. Still, year over year, core PCE inflation is running at 3.8%, well above the Fed’s 2% target. The key to inflation and whether the Fed must continue to raise interest rates will be how the labor market unfolds from here. We will better understand the labor market with the September jobs report from the Department of Labor released on Friday, Oct. 6.

Forecasting the economy and markets is always fraught with risk, this seems especially true at the moment.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)