Fed rate cuts likely pushed further out

Inflation coming down—but still ‘stickier’ than forecasted

Forecasting the economy, markets and the future of interest rates is never easy. As recent events remind us, for all we know or think we know, things that are impossible to forecast and yet have material impacts on global, domestic, and local economies can happen, not to mention the ofttimes high human cost. Still, it can be helpful to think about possible outcomes as an exercise to measure the amount of risk one might be taking or have some idea of the range of returns one might expect.

Fed monetary policy is not the only thing influencing the domestic economy but is a crucial variable. Frankly, we have been surprised at how resilient the U.S. economy has been in the face of a significant period of rate increases and balance sheet reductions orchestrated by the Federal Reserve. Gross domestic product (GDP) growth remains positive, unemployment remains low, and while there are signs of consumer stress, we have recently pushed out our forecast on the possibility of a recession.

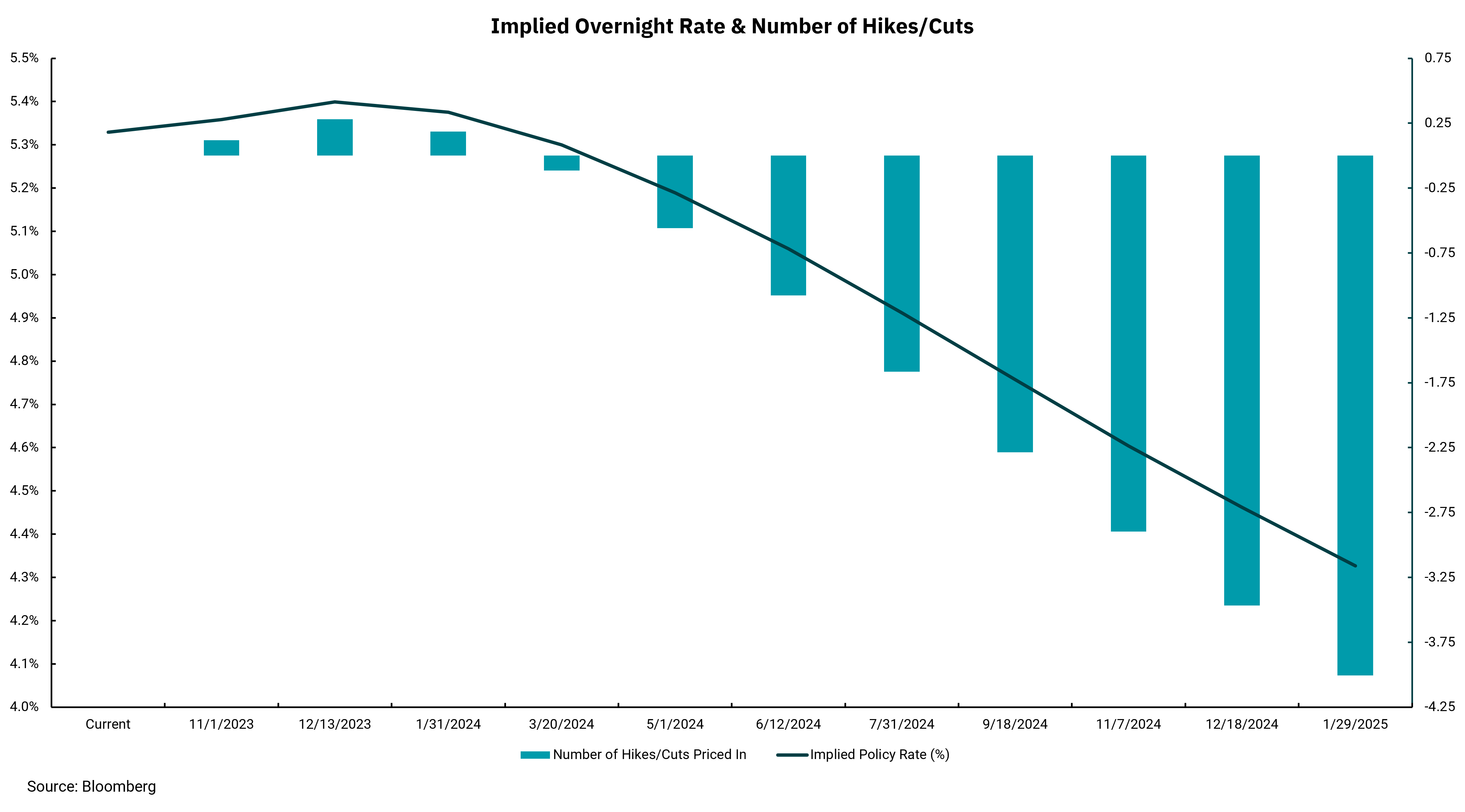

This does not mean the Fed cannot begin lowering rates as we move through 2024. Yet, we also have to understand it was only a few months ago when expectations were for rate cuts in the fourth quarter of 2023 - as in now. Instead, at its most recent meeting, the Fed penciled in the possibility of an additional rate increase between now and year-end. This week's chart shows what is currently built into the bond market based on rates of various maturities and the shape of the yield curve.

The expectation is for inflation to continue its path toward the Fed's 2% target. Slowly, but continuing to decline over time. If this is correct, it should make sense for the Fed to begin easing rates and reducing the restrictive nature of their current policy. As the chart illustrates, the forecast is for overnight rates to fall between 0.75% and 1% next year, putting the overnight Federal Funds target around 4.5% from its current target of 5.25-5.5%.

Variances to this outlook could occur if inflation remains a bit stickier than forecast, and we know the Fed is well aware of the history of inflation coming in waves. This might mean the Fed acts a little differently than we have seen in recent years and is slower to reduce rates to reduce the chances of inflation bouncing back. At the same time, if events lead to the economy and inflation slowing more and faster than we currently expect, we could see rates fall even further than current forecasts. Our sense: Absent an exogenous shock, like further geopolitical unrest, we think inflation might be harder to get down, and the Fed might have to be slightly more restrictive for a bit longer. The Fed does not have to raise rates materially from here, but rate decreases might be slower to materialize.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)