The tide may be turning in housing

Longer times to sale, listing price cuts among factors to watch

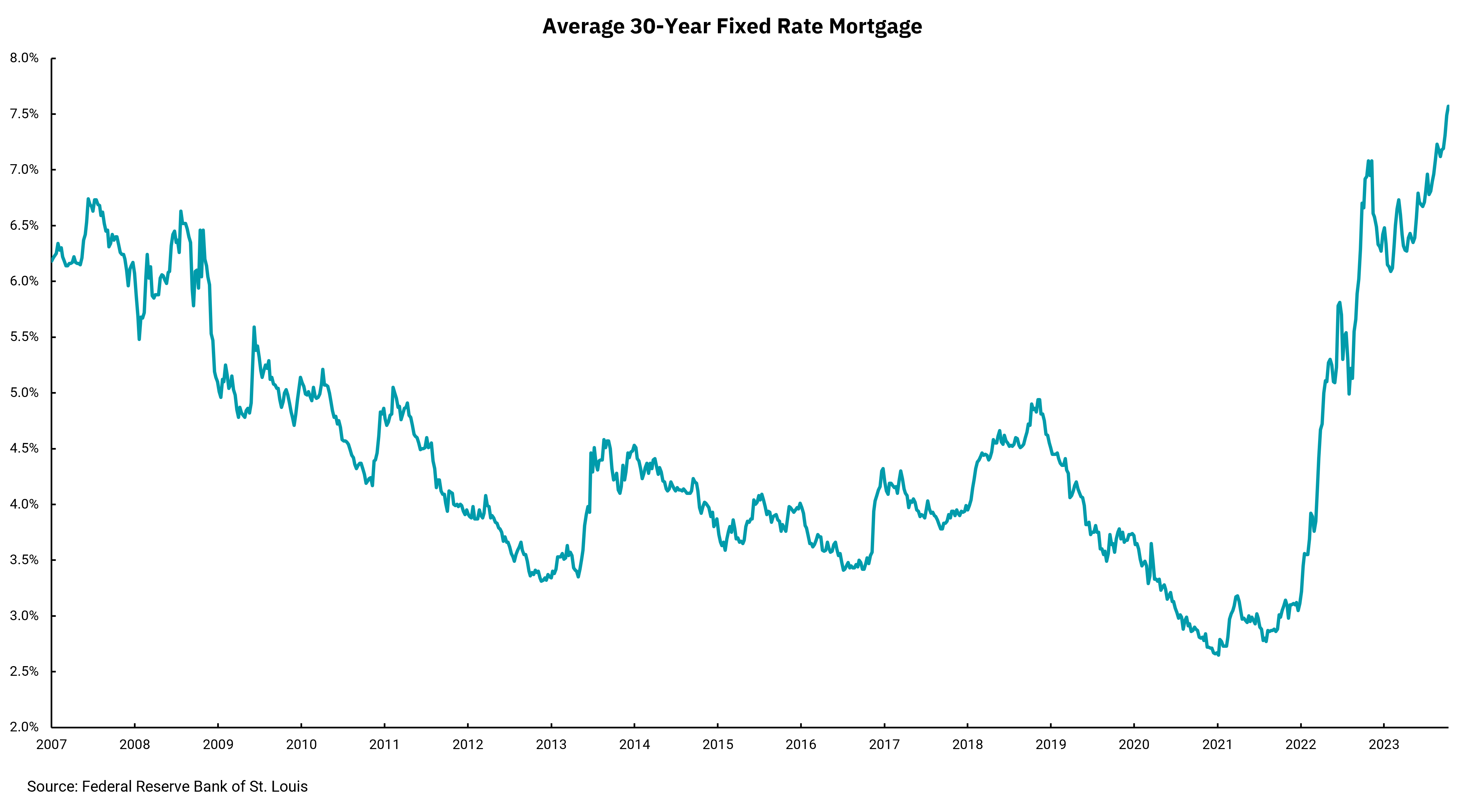

The housing market has been one of the more confounding areas of the domestic economy this year. As interest rates have increased, taking mortgage rates with them, one might expect this to have the impact of falling home prices. Higher financing rates directly increase the monthly cost of housing, meaning consumers can afford less house for the same monthly payment. Over the last 18 months, the monthly cost of principal and interest for the median-priced U.S. home has increased by $1,000.

However, instead of falling, nationwide housing measures show home prices have INCREASED this year, the exact opposite of what we might expect. As with most national statistics, there are specific regions where home prices have declined based on overall valuation or declining population trends. There also are areas where price growth is higher based on those same trends. Yet overall, national price levels are up.

How is this possible? On the one hand, higher rates have reduced the pool of qualified buyers. Incomes have been increasing but not nearly as fast as financing costs. However, the offset to this lower demand has been an even more significant decrease in the supply of homes for sale. We have been under-investing in housing since the 2008-2009 financial crisis. The number of new homes being built fell behind the rate of household formation for various reasons, not the least of which was the memory of the housing bust. This extended period of underinvestment then ran into an explosion of demand as fixed-rate mortgage rates fell during and after the onset of the pandemic. This cocktail of higher demand and low rates led to a rapid increase in home prices and a rush for existing homeowners to refinance at ultra-low rates.

As rates have increased, we see most homeowners with mortgage rates lower, in some cases much lower, than current financing rates. This is a massive decline in the number of existing homes for sale to near-record lows, as current homeowners will not let go of low mortgage rates. This has left new homes as the only source of homes for sale, and these numbers remain smaller than the reduced pool of home buyers, which means prices have remained firm.

We may see a change as we approach 8% mortgage rates. The number of homes with listing price cuts is increasing, sales are taking a bit longer and the supply of homes for sale is increasing. One could argue current mortgage rates are close to the longer-term average, and they are. Still, the housing market might have more rebalancing to do as we consider the idea of financing rates not going back to the levels they were only a couple of years ago.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)