Level of growth surprising—but not sustainable

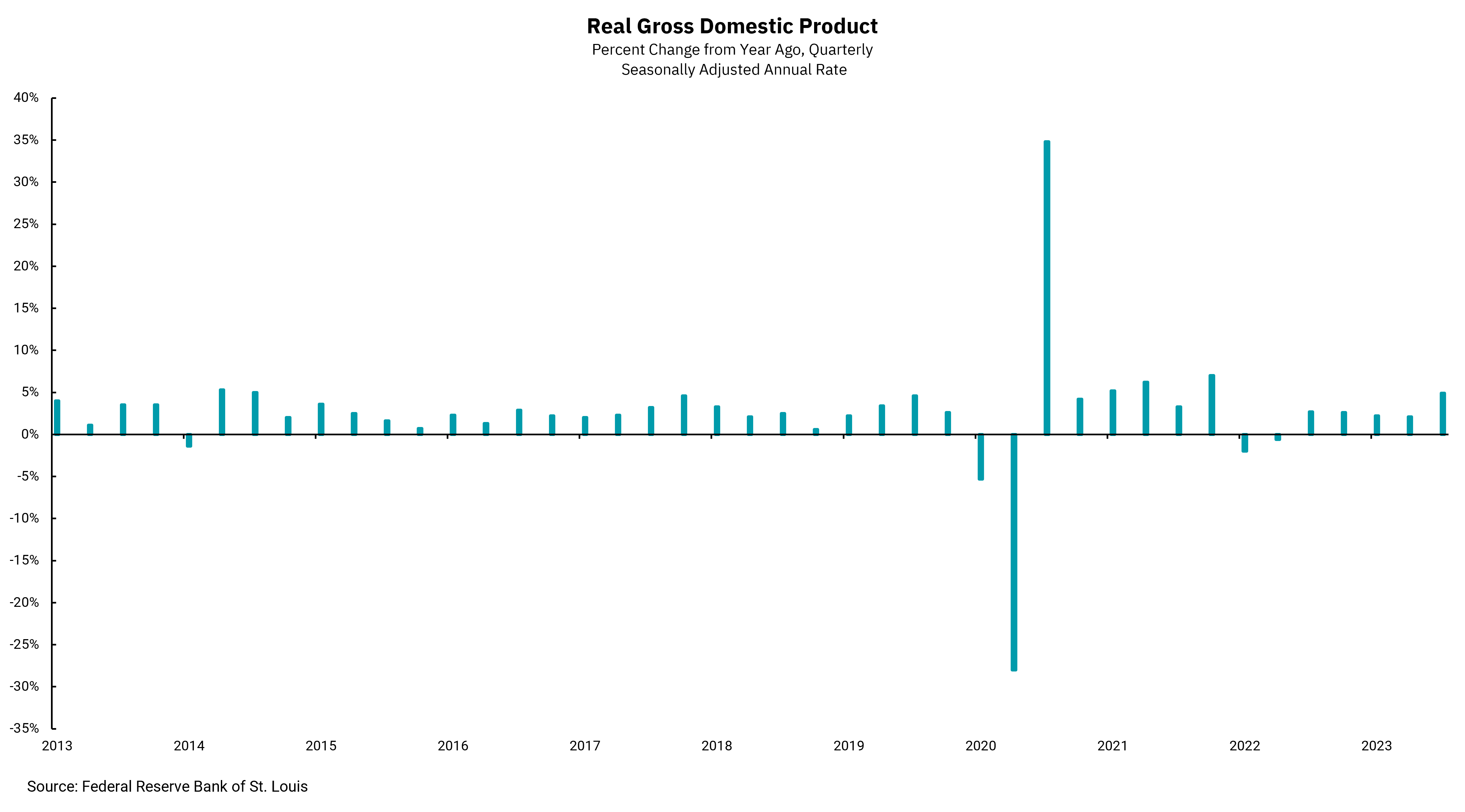

Inflation-adjusted GDP highest in nearly two years

Real gross domestic product (GDP) is the broadest measure of economic activity in the U.S. Hence, GDP is the economic yardstick many investors and economists look to as a gauge of the economy's health. This week, we received the first estimate of real GDP growth in the U.S. for the third quarter, and the data came in strong, showing real growth of 4.9% on an annualized basis. The measure of inflation within the data was 3.5%, meaning nominal growth was a substantial 8.4%. While this level of economic growth is not likely sustainable in the long run, especially in a developed market economy like ours, it is still worth noting. This most recent report is the highest GDP reading since the fourth quarter of 2021, and looking forward to the fourth quarter, the New York Federal Reserve is forecasting another robust economic growth at 2.3%.

Although the National Bureau of Economic Research (NBER) is the final arbiter of determining if a recession has occurred, a rough definition is two negative consecutive quarters of economic growth. As of right now, we're not seeing it in the data. However, economic growth is not a leading economic indicator but a lagging one. Still, in the short run, the domestic economy continues to show strength against higher interest rates, inflation above the Fed's 2% target, a dysfunctional federal government and global geopolitical discord. To the surprise of many, the U.S. consumer has been able to drive the economy forward.

Whether the consumer can continue to support the economy is a question on the minds of many investors. The job market remains strong, but the U.S. consumer savings rate is low. Indeed, much of the data shows the U.S. consumer spending through the excess savings accumulated during the pandemic years. However, if the consumer can remain unexpectedly strong in these headwinds, this economy can stay resilient.

All else equal, the latest reading on GDP provides further ammunition for the Federal Reserve to maintain its current posture toward higher interest rates for longer. For the Fed to achieve its goal of 2% inflation, it will likely require lower levels of real economic growth than 4.9%. At its Nov. 1 meeting, the Federal Open Market Committee will likely hold its target for the Federal Funds rate at 5.25% to 5.5%, but it will keep the most recent GDP report in mind.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)