Job growth slowing overall

Lowest new job creation in months makes rate hikes less likely

Considering our growth outlook, the domestic job market is front and center. Two-thirds of the domestic economy is supported by consumer spending, and consumers generally need income to spend. Consequently, the Federal Reserve considers the job market to be key to its outlook for inflation and the need for changes in monetary policy. Periods of tight labor markets, which put upward pressure on wages, have been associated with inflationary cycles. Hence, a labor market where the demand for labor exceeds supply keeps the Fed on edge about inflation and leaning towards restrictive monetary policies.

We find ourselves in such a cycle now, where the number of open jobs exceeds the number of unemployed persons, and upward pressure on wages has been pronounced. Although inflation is declining from the levels we saw last summer, the Fed will need to see some period of below-trend growth and somewhat higher unemployment to get inflation back to its 2% target and stay there.

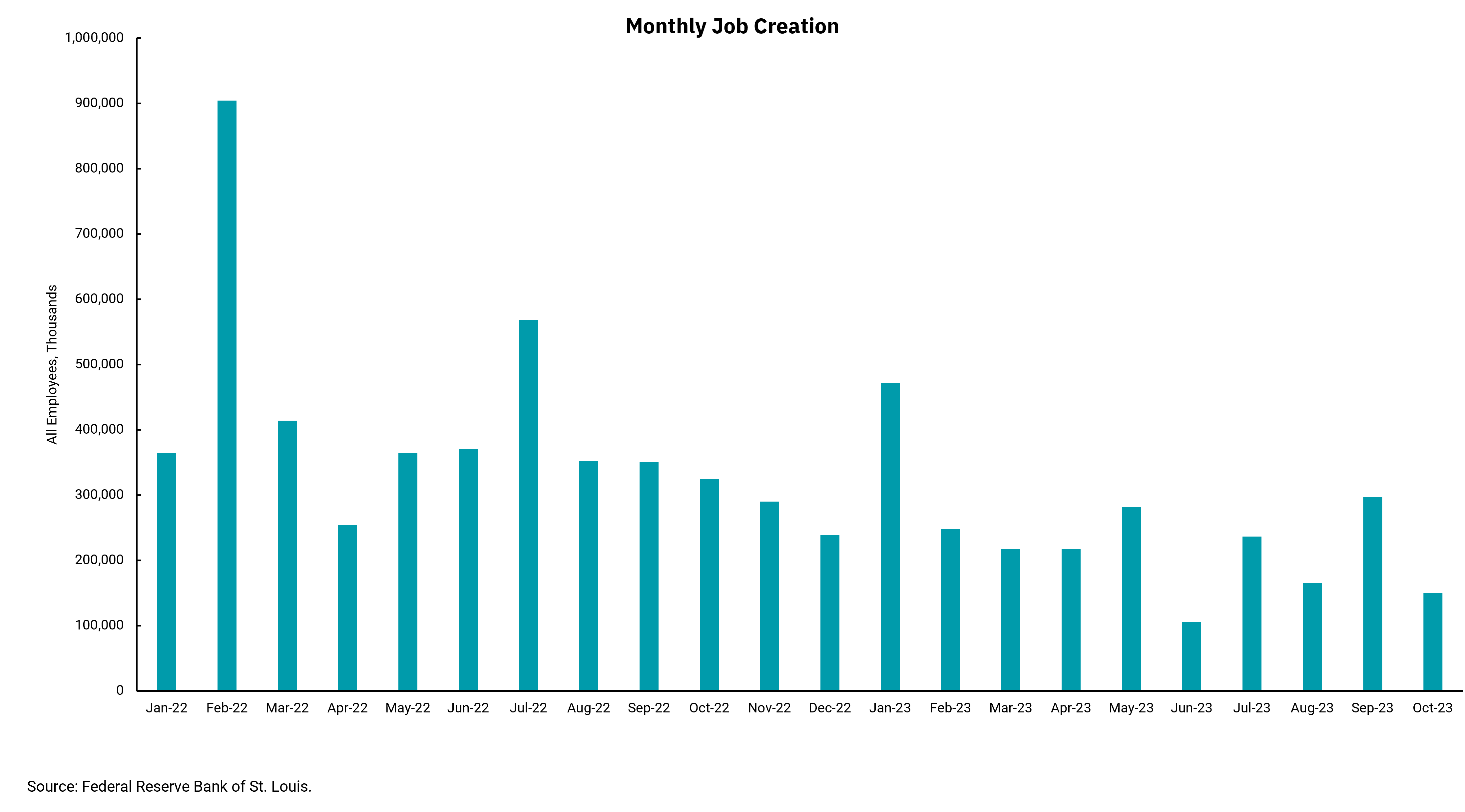

This week's chart shows the number of new jobs reported in the monthly employment report going back to January 2022. There have been variances, but the overall trend is slowing job growth. The September 2023 job growth number was higher than expected, raising concerns about the need for the Fed to raise rates even further. However, the most recent report has eased some concerns because job growth numbers slowed to 150,000, and we saw downward revisions to the previous two months’ reports. Within the report, we also saw a measure of wage gains slow to only 0.2%, which means wage growth over the last 12 months has slowed to 4.1%. That’s still above the Fed's inflation target but moving in the right direction. Both stock and bond markets are rallying after this report as "peak rates" get more support.

Nevertheless, there are still many issues to consider as we think about inflation, interest rates and the economy going forward. The monthly employment report is notorious for material revisions in future months. Still, it provides the most comprehensive look at the biggest driver of the most significant part of our economy—the U.S. consumer. Our sense is the bar to raise rates at future meetings is getting higher, yet the idea of rate cuts seems unlikely. Fiscal policy remains accommodative even as the Fed tries to be restrictive with monetary policy. We should continue to expect periods of economic and market volatility.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)