More spending on possibly fewer holiday gifts

Holiday spending levels continue to rise while inflation confines how far money can go

We initially thought it might be a bit early to have a chart around the upcoming holiday sales season, but when we saw "Black Friday Sales" already occurring, we reconsidered. It could be a sign of the times to see the traditional holiday selling season extended. After all, competition is as fierce as ever, and the changing sales environment (online versus brick and mortar) is altering the traditional calendar.

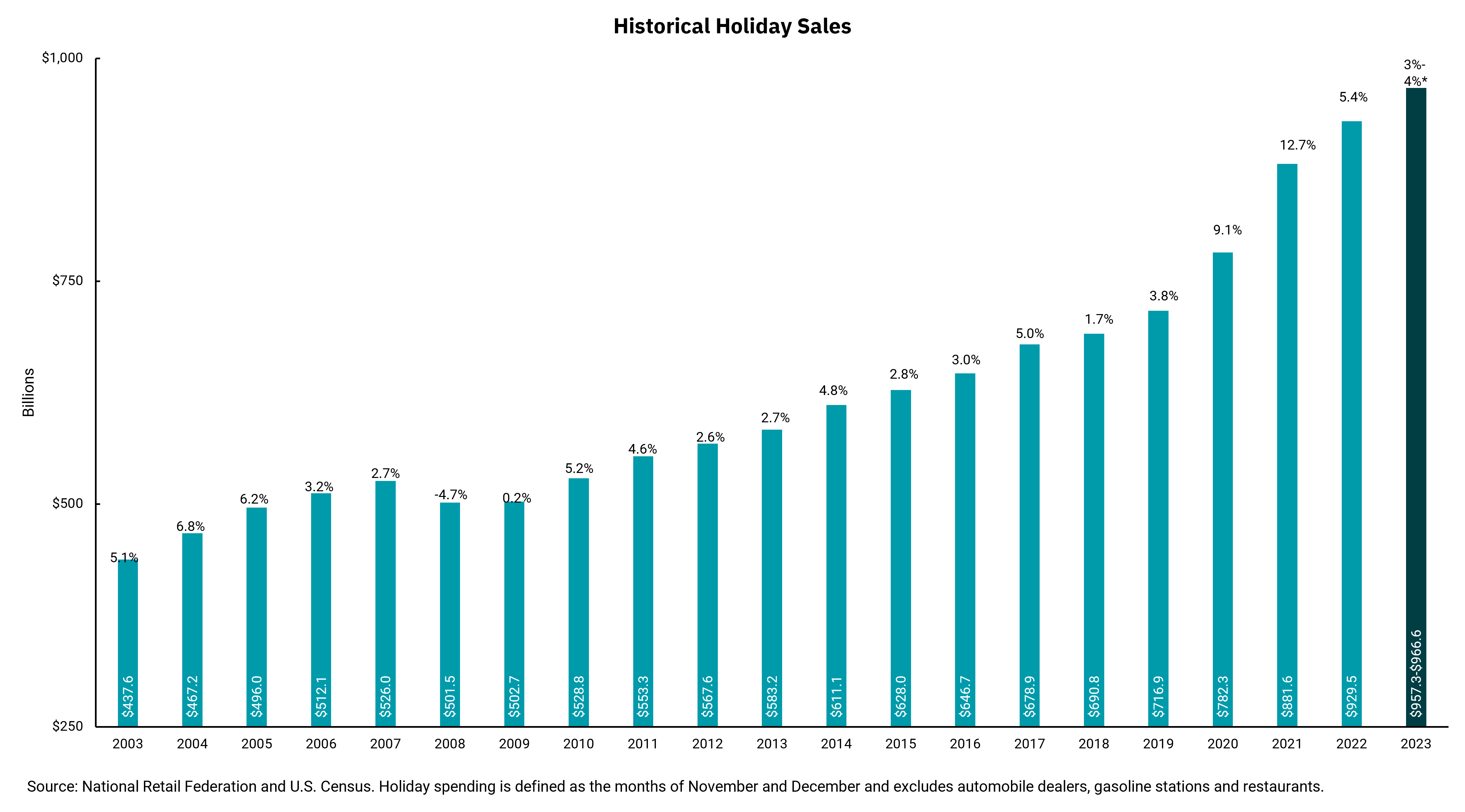

This week's chart shows the trend in holiday sales going back 20 years. We have seen a steady progression with only a minor interruption during the financial crisis in 2008 and 2009. Since 2020, this progression has accelerated, leading to nearly double holiday sales since 2003. One read of the chart is to expect higher holiday sales as the U.S. economy grows, and indeed, gross domestic product (GDP) is higher now than in 2003. Another read is that despite the environment, there is a tendency for domestic consumers to spend more. Debt levels are higher than in years past as overall income growth has supported a higher debt load, and after all, this is the holidays we are talking about; spend now, pay later is alive and well.

But what to make of the visible surge over the last three years, and what do we expect for this year? There are a couple of factors at work. First, in response to the onset of the pandemic in March 2020, we saw the Federal Reserve respond with lower rates. Still, the more significant factor was Congress's quick and material increase in fiscal support. Money was sent from Washington directly into the pocketbooks of Americans. And while it might have been harder to spend money as the economy struggled to re-open and snarled supply chains made deliveries of online purchases difficult, consumers did spend more. As this direct infusion of cash has slowed, inflation's effects can be seen. Retail sales are reported in nominal numbers, ignoring the impact of inflation. This means that consumers buying the same amount of goods but paying a higher price will result in a higher retail sales number.

For many, it will feel like we are spending more, but we are not getting more. The cumulative effect of overall price increases across our economy stretches consumer budgets. So, while nominal retail sales are higher, the number of presents shared may remain the same or even less. Fortunately, it is not just spending that makes the holidays so wonderful, and we wish you and yours a safe, joyous season.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)