Is consumer overspending a ticking time bomb?

Use of revolving credit and delayed repayment options could impact 2024 growth

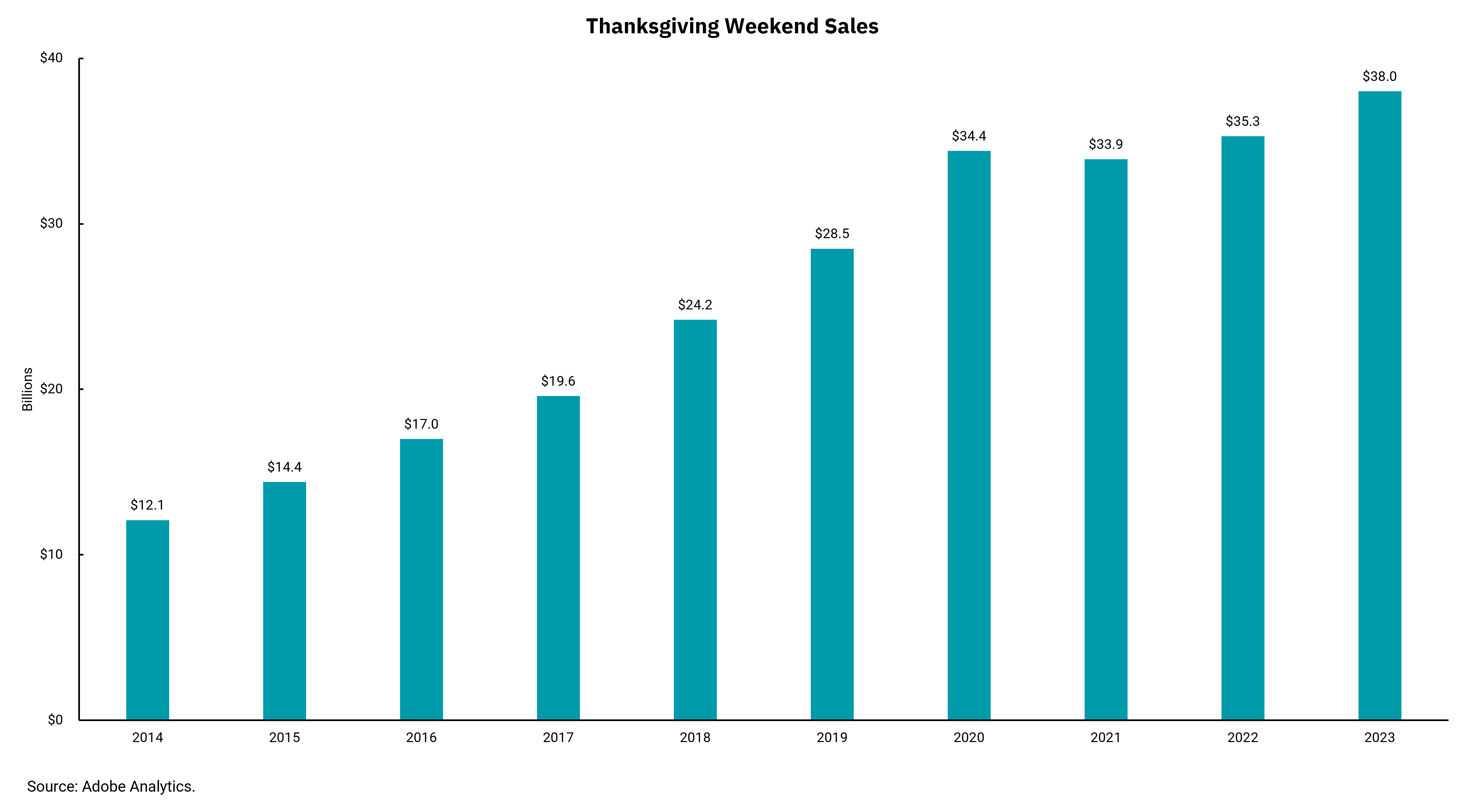

As we recently discussed, the definition of "Black Friday" seems to be changing as sale prices now begin showing up before Thanksgiving. However, the few days after the holiday, including "cyber Monday,” remain important as a marker for consumer spending. On that front, this year's post-Thanksgiving spending indicates the U.S. consumer is still supporting economic growth.

Overall, our outlook is for an increase in holiday spending this year. Some of that is due to inflation, as retail sales are reported nominally without subtracting inflation. This means that higher holiday sales might not mean a higher volume of goods purchased. Instead, we are spending more to get the same, or even less, in goods and services due to inflation.

There were a couple of other interesting trends within the overall sales data. First, the ratio of online sales continues to increase. It seems some consumers would rather not fight the crowds at stores to try and snag a limited number of "hot sale" items (the author of this commentary might be amongst that group). Second, we are seeing a material increase, some 30% above last year, in "buy-now-pay-later" (BNPL) sales. This trend could be because more and more merchants are offering this option, which can provide some cost savings versus using high-interest rate credit cards. Still, it could also be another sign of the increasing level of stress on the average consumer. Credit card balances recently crossed $1 trillion, and overall consumer debt levels are elevated. The strong job market continues to support consumers, while wage gains have slowed, inflation rates have eased, and some prices, like gasoline, are lower. Still, the aggregate level of inflation over the last three years exceeds the average wage gain, and consumers have pulled down savings to maintain spending levels.

A recent article by CNBC highlighted a trend they called "Doom Spending.“ The article notes a survey by Intuit Credit Karma, which indicated 96% of Americans are concerned about the current state of the economy, and the fact that over a quarter of respondents continue to spend despite economic and geopolitical concerns. Indeed, the level of spending sets U.S. consumers apart from those in many other economies, but the use of revolving credit or delayed repayment options could be a limiting factor on spending as we enter 2024. If it is, economic growth next year may suffer from the current spending spree.

However, we should acknowledge that economists have been calling for the death of the U.S. consumer for years. As long as the job market remains firm and inflation continues to ease, the outlook for positive growth in 2024 remains intact.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)