Will unemployment have to rise for inflation to fall enough?

Labor market strong despite nearly two years of rate hikes

Our outlook for U.S. economic growth largely hinges on the job market, which makes sense from the standpoint that most of our economy is driven by consumer spending. In the third quarter of 2023, consumers were responsible for 68% of the positive 5.2% growth we saw. The labor market is also a key part of what drives the outlook for Federal monetary policy, as the unemployment rate, particularly wages, plays a vital role in the outlook for longer-term inflation. Hence, the monthly report from the Department of Labor (DOL) is, at present, the most important economic data point for the capital markets.

When the Federal Reserve began raising rates in response to inflation in March 2022, Fed Chair Jay Powell indicated the Fed's actions would eventually cause some level of "pain." The "pain" he spoke was the expectation for higher unemployment, as higher rates would increase the cost of borrowing, which would slow consumer spending and eventually corporate revenues, leading to companies announcing layoffs. Higher unemployment, in turn, reduces consumer demand and leads to lower inflation. Historically, that is how higher rates lead to lower inflation.

The uncomfortable part of that equation is that, in effect, the Fed's policies are designed to put people out of work. Based on the size of the U.S. workforce, every 1% increase in unemployment means 1.6 million jobs lost.

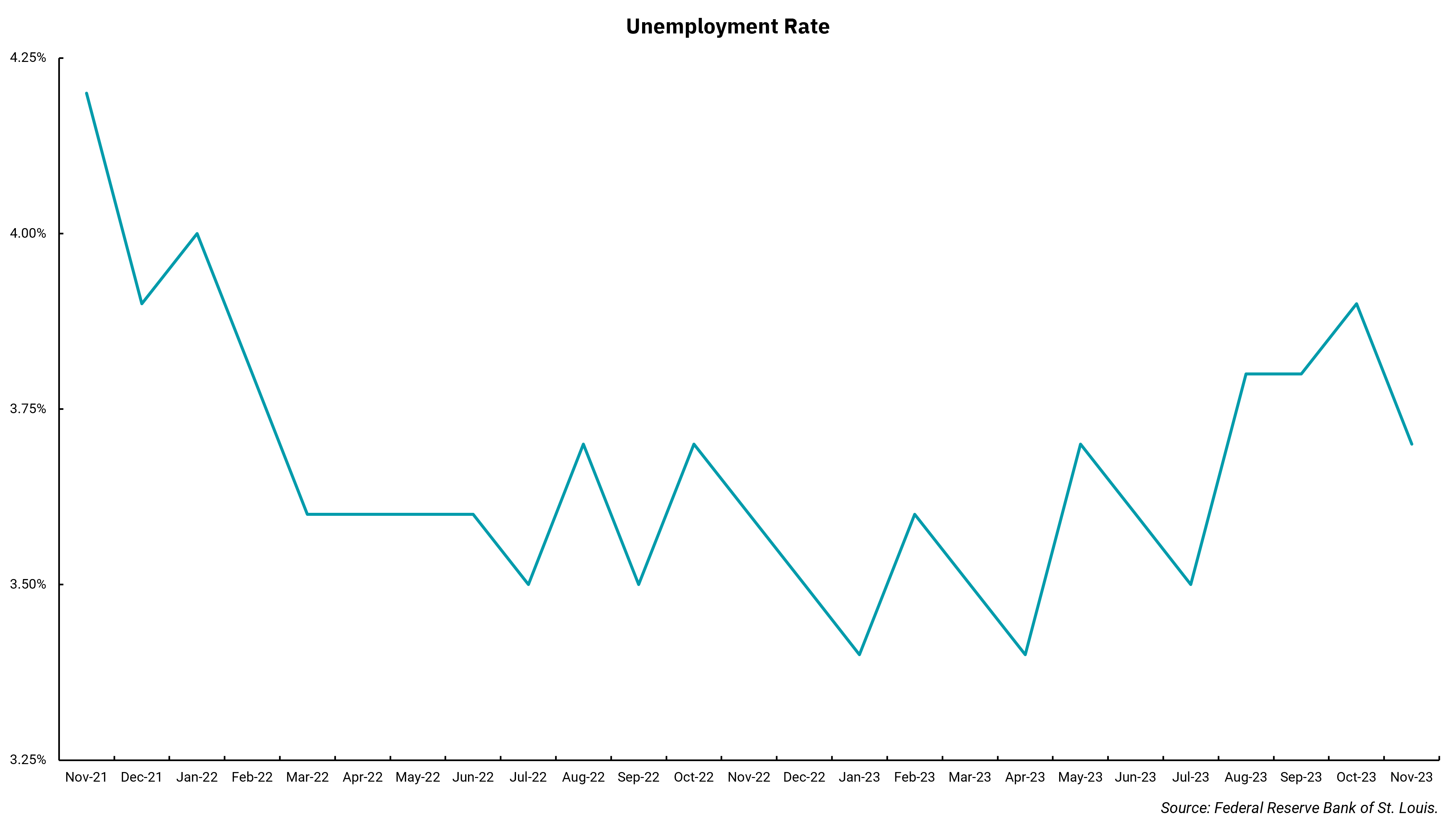

The good news is that the Fed's interest rate increases have NOT led to a material increase in the unemployment rate. In March 2022, when the Fed began raising rates, the headline unemployment rate was 3.6%. It fell to as low as 3.4% before rising to 3.9% in October of this year. Based on the November report released Dec. 8, it is back to 3.7%. That is a mere 0.1% increase since the start of the rate-hiking cycle, despite rates being 5% higher now. Within the data, wage growth, a measure of the imbalance between the demand and supply of labor, fell to a 4% year-over-year rate. That’s still above the Fed's 2% target but the lowest year-over-year rate since June 2021.

Meanwhile, inflation is moving in the right direction, even as the labor market continues to help support the U.S. consumer and provide the basis for positive economic growth into 2024. The Fed insists on getting inflation back to 2%. Having it stay there means we may still see unemployment increase. We expect the Fed to be slow to lower rates, but in their Dec. 13 announcement, we expect them to keep rates the same as they update their economic and rate outlook for 2024.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)