Will the days of full Social Security benefits come to an end?

Long considered stable and untouchable, the benchmark retirement-age program may soon be unable to pay retirees full benefits

Social Security is under pressure from an aging population and a rapidly growing number of recipients—with nearly one million added annually—many of whom are highly dependent on their monthly benefits to pay everyday living expenses. Additionally, fewer workers are paying into what was formally known as the Old-Age and Survivors Trust Fund and the Disability Insurance Trust Fund.

If Social Security benefits ultimately are reduced or do come to an end, it would affect women more than men, noted Jessica Jones, a senior financial advisor at BOK Financial Advisors. More than 40% of women and 37% of men count on Social Security for 50% or more of their income in retirement, and 15% of women and 12% of men are 90% dependent on it, she explained.

“My clients are asking, ‘What can I do? I can’t depend on Social Security like my parents did,’” Jones said. She counsels them to save more through their employer-sponsored retirement plans or other means—and not plan on Social Security.

Many prospective retirees know that waiting to start Social Security can bring an 8% annual benefits bump, but some may be wondering how long is too long to wait, and for how long they can expect to receive 100% of their scheduled benefits.

Here’s why they’re concerned.

The state of Social Security

When Social Security began in 1935, it was intended to provide supplemental—not primary—income to retirees. However, as time has gone on, more and more people have depended on Social Security to get them through retirement.

Meanwhile, an increasing number of people are drawing on Social Security, thanks to the post-World War II population swell known as the Baby Boomer generation. Now that more than 11,000 Baby Boomers are reaching retirement age every day, the system that served fewer than 26 million beneficiaries in 1970 is challenged to maintain its output.

And the challenge will only get worse. This year, more than 71 million Americans will receive Social Security benefits.

What may be ahead

Under current law, by 2033, Social Security and Disability Income reserves that now pay 100% of scheduled benefits are projected to deplete, and then pay ongoing income at 77%, according to the Center for Retirement Research at Boston College. That’s two years sooner than the 2035 depletion date projected in 2022 and 17 years sooner than the 2050 depletion date projected in 1984.

Though the system’s long-term viability is threatened, hope rests with the time and willingness needed to make systemic changes. By modifying decades-old rules that now carry then-unforeseen costs, today’s scheduled benefit levels may be preserved, said Jones.

Why are retirees depending so heavily on Social Security?

According to Jones, who recently earned her Retirement Income Certified Professional (RICP) designation, economic factors and career or lifestyle choices have retirees increasingly concerned about bridging the gap between retirement expenses and income.

Inflation, market volatility, vanishing pensions, early retirements, insufficient savings and even a sense of entitlement to “the good life” all factor in, she said. Population growth slowdowns (about half the 1990s rate in the 2010s) and life expectancies also contribute to the uncertainty.

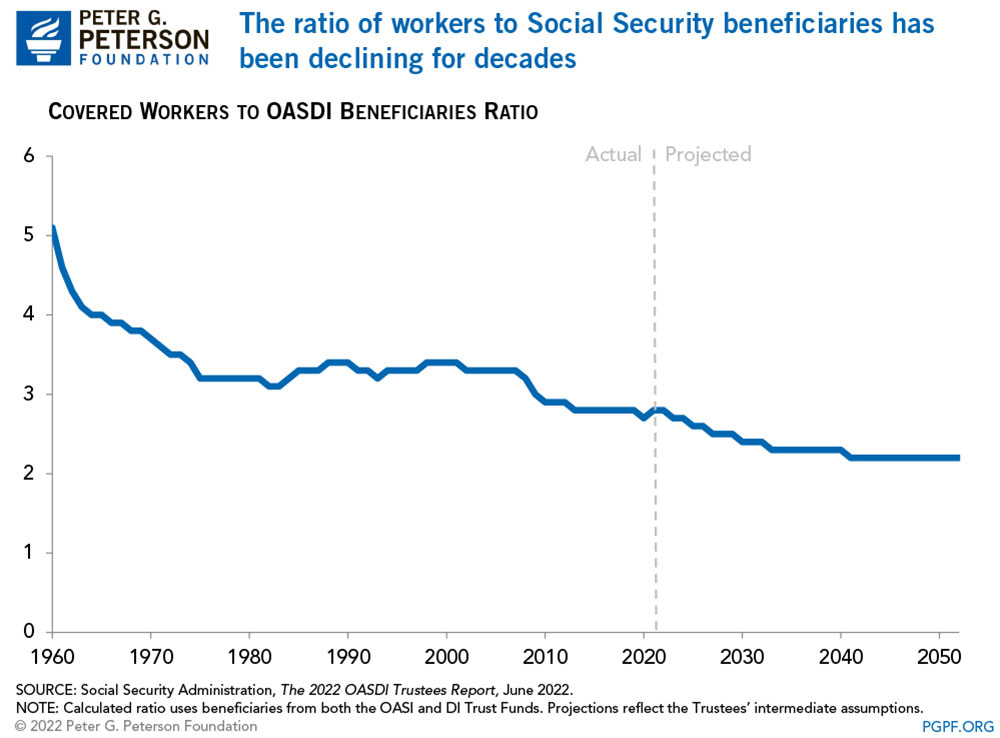

Among younger aspiring retirees, those in their 30s and 40s, there’s significant doubt about Social Security’s future availability. That’s due in part to a steadily declining ratio of contributors to beneficiaries. That figure was 5:1 near 1960, about 3:1 near 2020 and projected to be just over 2:1 by 2050.

Meanwhile, Social Security program coffers have been compromised by operational inefficiencies and benefit miscalculations. The agency recently announced attempts to reclaim or “claw back” more than $20 billion in overpayments. Other drains on the system, according to Jones, are longer lives (up to 20% longer in 2000 compared to 1940) and higher divorce rates, which often create two beneficiaries instead of one from single-income households. The U.S. divorce-to-marriage ratio for 2021 was about 35%, roughly 700,000 divorces to two million marriages.

Though not offering specific recommendations that would delay depletion of Social Security’s reserves, the SSA’s 2023 Annual Reports cite a need for “substantial changes” to address the financial challenges, and that projected shortfalls should be addressed sooner than later to allow for a gradual phase-in of changes and corrective behaviors.

Opportunities for beneficiaries

Although no one can predict just how much or how little Social Security benefits future retirees will have, it’s important to plan ahead for the worst-case scenario, experts caution.

“Now more than ever, prospective retirees need to financially plan for their later years without presumed help from Social Security,”- Jessica Jones, BOK Financial Advisors

Here’s how to get started:

- Access your personal Social Security statement at SSA.gov to understand your scheduled benefits.

- Become more empowered and prepared by using online calculators to account for Social Security’s share of your retirement income.

- Change your reliance mindset around Social Security to less, not more.

- Advocate for the reform of outdated policies that could not have foreseen the full impacts of early or extended retirements, dual-income households and survivor’s benefits.

By taking a proactive approach—and the sooner, the better according to experts—Social Security can resist depletion, and instead fully benefit retirees into the program’s next hundred years.