Making things happen

Kimberly Bridges uses personal experience and passion to educate women on financial decision making

Doing something “to the max” is a concept that Kimberly Bridges knows well.

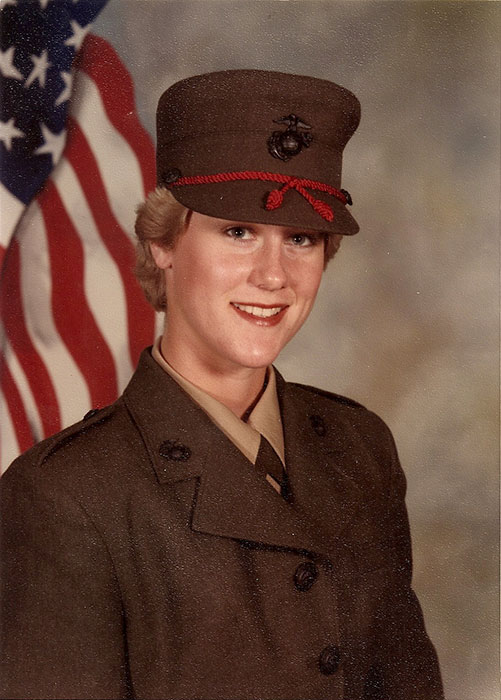

When she decided to join the military, she joined arguably the most physically demanding branch: the Marines.

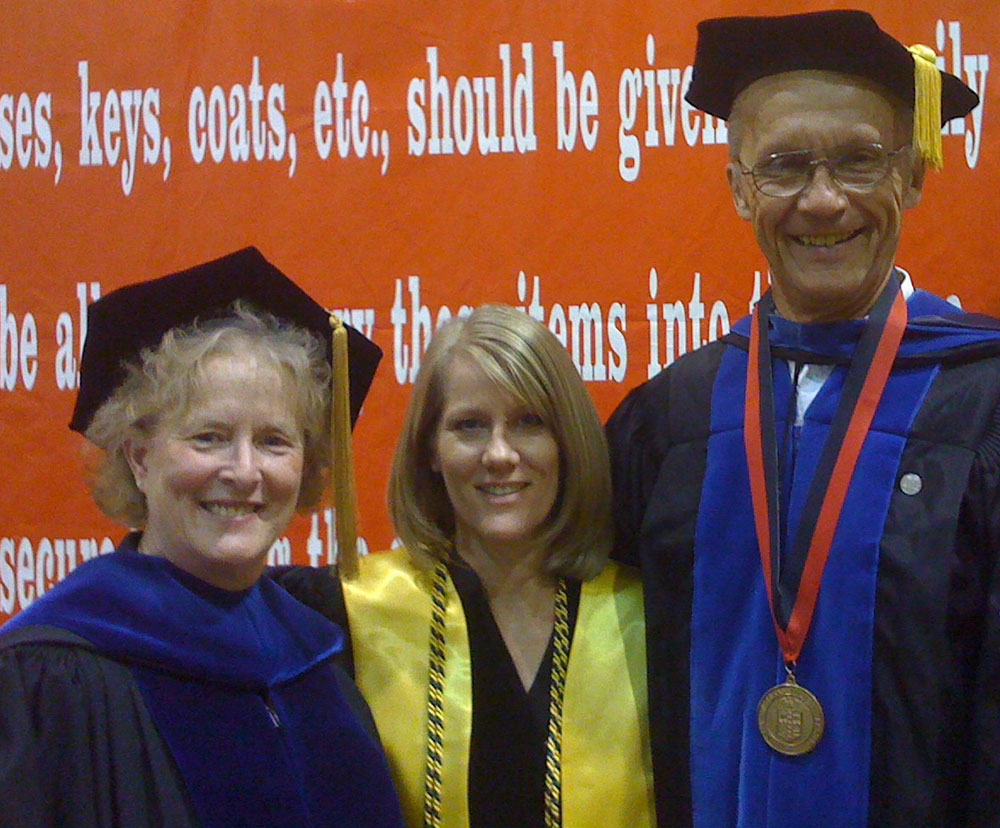

When she decided to pursue her college education on a non-traditional timeline, she didn’t stop at a bachelor’s degree. She went on to earn a Ph.D.

Now director of financial planning at BOK Financial®, Bridges is responsible for developing and deploying the company’s comprehensive financial planning strategy.

But years before, she was in a position familiar to many women starting a new phase of life. After serving as a Marine, she started a family, relocated numerous times, started college again—and realized that her financial education as a young woman had fallen short.

“My mom taught me about cash flow management: how to balance a checkbook, to pay bills on time and the basics of money management,” Bridges said. “But when I took a personal finance course in college—well into my 30s—I became aware of how little I really knew about planning for the future.”

Bridges’ next adventure: financial guru

Coming out of the course, Bridges felt angry about the lack of preparation she had for her own financial future and the missed opportunities to build her financial security early on.

“I always thought I was good with money, but this class made me realize how much I didn’t know about topics like using credit wisely, building savings, compound earnings and investing for the future,” she recalled.

Self-described as a “doer,” Bridges decided then and there that personal finance would be her next pursuit. Motivated by her personal experiences, she set out to learn as much as she could about how to make smart financial decisions and then help as many people as she could.

“I had a poster on my wall as a teen that said: People can be divided into three groups: those who make things happen, those who watch things happen, and those who wonder what happened. I knew I wanted to be in the first group.”- Kimberly Bridges, director of financial planning

The best laid plans

However, even though Bridges always knew she wanted to “make things happen,” she didn’t always know what those "things” would be. For example, coming out of high school, her original plan included college, but she realized after a semester that she wasn’t sure what she wanted to do which led to a pivot to the Marines.

“Joining the Marine Corps set me on a completely different path,” she said. For the next six years, Bridges served her country, which she said was a good fit for her personality. “I like structure, so the military fit well with my style.”

While serving in the military, Bridges met and married a fellow Marine. This eventually led to a shift in roles from active-duty Marine to full-time military spouse and mom. “I calculated that we moved 18 times, including 10 major relocations during our 20 years of military life,” she said. “I think that’s one of the reasons why I’m an adaptable person today.”

A commitment to education

During her family’s numerous moves, Bridges never lost sight of her education, taking classes at various colleges and universities as opportunity allowed. By the time her then-husband’s career in the military ended, Bridges was able to transfer 100 credit hours from seven different colleges and universities to Kansas State University.

It was during this time that Bridges took a personal finance course to complete a general education requirement—the one that made her realize how little she knew…and how much she wanted to know.

“From that point, I dedicated myself to learning as much as possible so I could help myself and others make smart financial decisions,” she said. Once she was on this path, she never looked back, quickly following undergrad with a master’s degree and a Ph.D. in personal financial planning.

Luke Dean, one of her classmates in the Ph.D. program at Texas Tech, recalls Bridges’ work ethic during graduate school where she always volunteered to teach the toughest subjects.

“When I asked her why she was doing this—and questioned her sanity—her response was that she really wanted to learn those things at a deeper level and that the pressure of teaching in front of a classroom would require her to prepare herself in a way that she would truly learn,” said Dean, who is now CFP® program director and professor of financial planning at Utah Valley University’s Woodbury School of Business.

“Kim was making an investment in herself that also paid off for the students and professionals she was preparing for the future,” he added.

Teaching clients in the real world

During the final stretch of her doctoral program, Kim was recruited by a wealth management firm in Scottsdale, Ariz. for a financial planner role. She had always felt that the best teachers were the ones who had real-life experience working with clients, so she accepted the position, but never lost sight of her commitment to financial education.

“I quickly realized that when you’re working with clients, you’re teaching all the time,” she said. Bridges had a special passion for educating women. “Too often women are making decisions that have a financial impact with incomplete information.”

“In one of my early personal finance classes, I came to realize women who exited the workforce are at a significant disadvantage when it comes to building their financial security,” she explained. They are not just missing out on current earnings, but also on retirement savings, Social Security benefits and disability insurance protection. She started calling this a “homemaker disadvantage” and marked up the margins of her textbooks with those words.

“Sadly, most women aren’t aware of the trade-offs they are making when they exit the workforce. I certainly wasn’t.”- Kimberly Bridges, director of financial planning

Homemaker disadvantages are compounded if divorce ensues, with mothers who have spent considerable time out of the workforce experiencing the greatest declines in economic well-being following divorce. After their Ph.D. program, Dean and Bridges worked together on a research project to examine the unique outcomes that women face after a divorce—an interest that Bridges continued to pursue later when she became a Certified Divorce Financial Analyst®.

“It was really great to see Kim’s focus, dedication and drive to examine and research what variables helped insulate women from potential negative outcomes following a divorce,” Dean said.

“It was evident that Kim has a passion for helping women not just in wealth management but in all aspects of life.”- Luke Dean, professor of financial planning at Utah Valley University’s Woodbury School of Business

Paying it forward

Bridges’ focus on financial education for women has landed her on stages across the country to present to audiences of women and the advisors who serve them.

“I’ve watched her speak directly to women about the journey she’s been on and why it’s important, as a woman, to understand finances and options, and why you have to play an active role in those decisions with your partner,” said Mindy Mahaney, chief risk officer at BOK Financial and Bridges’ former supervisor. “She believes in making it a priority for women to raise their hand and have a seat at the table around which financial decisions are being made.”

Bridges works alongside Sascha Fincham, financial planning manager at BOK Financial, in leading the financial planning team, and they’ve also worked together on Women and Wealth, an initiative designed to promote financial empowerment for women.

“I attribute the success of this initiative to Kim because she’s so passionate about fostering a community of shared information and learning for women,” Fincham said.

For Bridges, the best success is watching other women take steps to own their financial future.

“I want to empower women so they can take charge of their finances and live the life they want,” she said.

“There is nothing more empowering for me than watching women lean in and educate themselves on financial matters, then use that education to make better financial decisions for themselves and their loved ones.”- Kimberly Bridges

Hero image: Kimberly spoke at a recent Women & Wealth client event in San Antonio.