Summertime—and the spending is easy

With inflation as sticky as the summer humidity, the search is on for affordable seasonal solutions

Though summertime can be carefree, it’s not a time to ignore your budget—especially with credit card balances and interest rates at or near all-time highs.

“When school’s out, families’ unstructured time multiplies, as does the temptation to spend,” said Josh Denton, manager of product strategy at BOK Financial®. “When you consider the cost to vacation, pay camp expenses or attend other in-town activities, summer can be financially challenging.”

As both a banker and the father of six daughters, he recommends rigorous planning and discipline to help manage budgets when summertime spending occurs quickly and often.

The big picture

As temperatures rise, so do the spending opportunities—whether they’re concerts, happy hours, sporting events or a quiet meal for two on a shady patio.

Compounding a household’s budget management challenge is the cost of credit cards. Between all that swiping and tapping, credit cards are easy to use but at a high cost, according to recent figures:

- Americans had a total of $1.115 trillion in credit card debt, as of early 2024. That’s down only slightly from $1.129 trillion in December 2023, the highest recorded by the New York Federal Reserve, which began tracking this figure in 1999.

- By state, the average credit card balance in late 2023 ranged from about $5,100 in Kentucky to nearly $9,000 in New Jersey.

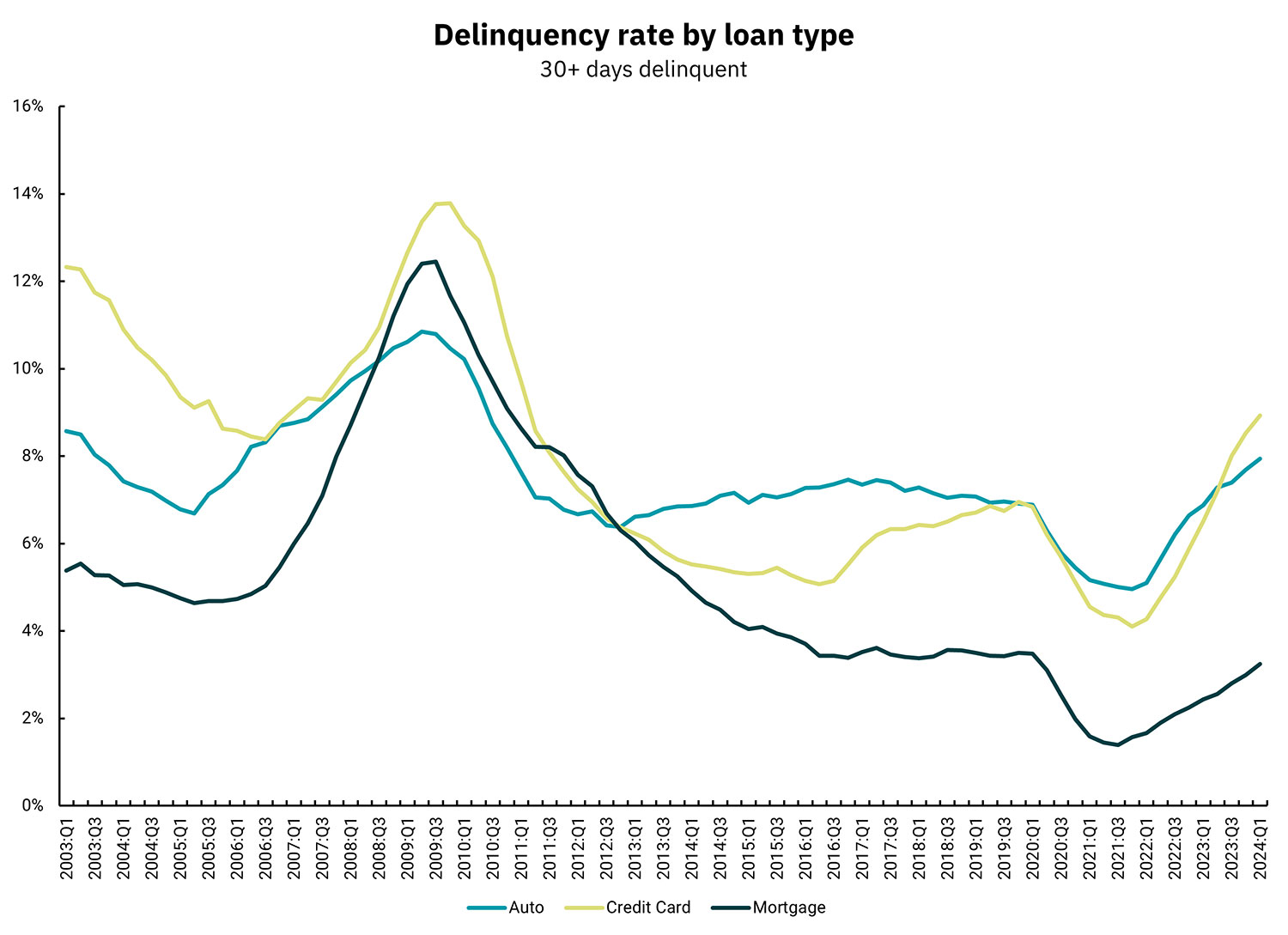

- More than 6% of credit card debt was “seriously delinquent” (90 days or more past due), as of the fourth quarter of 2023, compared to roughly 4% a year prior.

- Average annual percentage rates (APRs) for new credit cards are typically near 25% and near 22% for current card accounts.

Inflation also plays a role. “Although headlines indicate that inflation is slowing, everyone is still feeling the pinch from two years of elevated numbers. It just feels so much worse to many,” said Denton.

Meanwhile, another challenge has been the “medicine” for inflation—that is, the Federal Reserve’s strategy of keeping interest rates higher for longer to try to bring inflation down. “What was anticipated going into this year as up to seven rate cuts will likely be one or two at most this year by December,” Denton said.

A timely bright spot for consumers and families, though perhaps temporary, are recent reports that food service providers like McDonald’s, Burger King and Starbucks will reduce prices for popular combo meals or drinks. That may be welcome relief to a time-squeezed family with no choice but to spend an evening or weekend driving across town to baseball games, soccer fields or band camps, and otherwise may face a quick meal easily exceeding $50.

Controlling your situation

To manage or push back against these price obstacles, Denton recommends:

- Holding onto or allotting cash that came from springtime income tax refunds, bonuses or leftover holiday spending money. “Our data shows that account balances rise in March and April. That’s an opportune time to set aside savings for summer activities,” suggested Denton, adding that it may be too late this year, but something to strive for next year.

- Using a combination of credit cards, debit cards or cash judiciously to manage your spending or budget. “Paying mostly by credit card to acquire ‘bonus points’ is typically a losing proposition,” he said. “Many people underestimate the discipline needed to effectively charge now and be in a position to fully pay later.”

Instead, Denton suggested using credit cards for pre-budgeted big-ticket items like plane tickets and then cash or debit cards for discretionary meals, snacks and other smaller expenses. A different strategy is to hold onto responsibly accumulated points and apply them to big-ticket purchases when due. - Packing lunches in a cooler or buying meal-ready foods like sandwiches, chips or drinks from a nearby grocer when traveling or on the go, instead of frequenting quick-serve restaurants where food, taxes and tips can quickly add up.

- Staying on top of your credit and credit score by paying full balances when due or even partial balances twice monthly using the 15/3 method to manage your credit utilization. “Also, credit rating agencies and others like to see usage at less than 30% of available credit,” said Denton.

- Paying cash for appliances, TVs or other household items in exchange for a discount. Merchants often welcome cash to avoid credit card fees of up to 4%, and the “cash for a discount” trend has risen since 2015.

And with more than 33% of Americans surveyed planning to go into debt for travel this summer, vacationers and “staycationers” alike would do well to heed Denton’s advice:

“Work toward the credit card not being the default tool for summer expenses. Use cash or a set amount of spending for discretionary items to help establish boundaries.”- Josh Denton, manager of product strategy at BOK Financial