What’s your plan for your long-term care?

7 in 10 retirees will need it; cost of care expected to double by 2035

When the bill comes, many Americans are going to be shocked to find they didn't save enough for long-term care. Or they didn't plan far enough in advance, if at all.

Every day in America, more than 10,000 people turn 65, and by 2030, all Baby Boomers—those born from 1946 through 1964—will be at least that age.

United States Census figures for 2023 have the overall population at nearly 335 million, with 59.3 million (17.7%) 65 or older. The over-65 estimate for 2050 is 82 million.

Seven out of 10 of these people will need some kind of long-term care in their post-retirement years, according to the U.S. Department of Health and Human Services, but far fewer have set aside adequate funds to cover the cost, said Jimmy Harmon, insurance specialist with BOK Financial Advisors. In fact, only about 10% of those age 65 or older have long-term care (LTC) insurance.

Worse yet, many of those approaching retirement age aren't really even talking about it, he said. Instead, they should be having open and honest conversations with family members about the care they prefer and at what cost, and then get started by working with a financial advisor. According to Harmon, LTC insurance has undergone major changes recently and hybrid or linked-benefit policies now prevalent in the market should make such conversations easier to have.

Paying for it

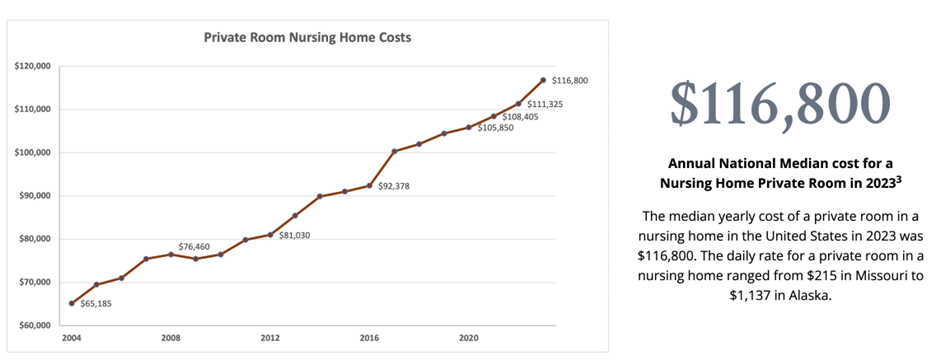

The price for long-term care is high and getting higher, Harmon stressed.

According to a 2023 Genworth Cost of Care study, the 2023 median annual cost nationally for a semi-private room at a nursing home is $104,028; $116,796 for a private room. By 2030, costs are estimated to be appreciably higher. Rates for alternative service levels such as in-home care and assisted living are rising similarly.

Cost based on 365 days of care as reported in

Median Cost of Nursing Home, Assisted Living, & Home Care | Genworth

A convenient cost calculator and description of the various service types can be found here.

It's a dramatic rise, and people need to be prepared, Harmon said.

With year-over-year private room rates up more than 7%, the threat to Medicare patients' savings—where $103,000 is the median amount saved—is only accelerating.

"Many people are under the impression that Medicare will pay for long-term care," said Harmon. "But that's not entirely accurate. In the best-case scenario, Medicare will only pay for up to 100 days of care."

The numbers are similarly challenging for those who can have in-home care—as many would prefer—with annualized homemaker and health aid-type care costing $68,000-$75,000.

When it comes to saving for long-term care, Harmon said people who haven't begun planning for long-term care tend to fall into four categories:

- In denial

- Aware, but procrastinating

- Wealthy enough to self-insure

- Assume a loved one or close friend can/will provide care

Where to start

Harmon said when it comes to long-term care planning, financial advisors ask three main questions:

- Where do you want to receive the care if needed? Maybe it's at home, an assisted living facility or a nursing home.

- Who do you want to provide that care? Is that a specific facility or maybe a certain relative?

- What is your family's skill level, comfort level and preference for caring for you if the need arises?

"More often than not, budget determines the care plan, not preference."- Jimmy Harmon, insurance specialist with BOK Financial Advisors

And the inability to plan can impact generations to come. "Statistics continue to show that women, on average, live longer than men," said Harmon. "With that, LTC premiums for women continue to outpace premiums for men of the same age and health status. Women also tend to purchase LTC policies more than men so they don't become a burden to living children or grandchildren if their spouse has pre-deceased them."

Long-term care should be a part of every client-advisor conversation concerning retirement planning, Harmon said. "The sooner, the better to prepare for long-term care, given that's when most people are healthier and can save more premium dollars over time. Today's policies can lock in rates at the most affordable prices."

Gender aside, he said the cycle applies to those in the so-called "sandwich generation" as well. "If you're paying for your parents' care and your children's education, unfortunately, you may not have the opportunity to be saving for your own long-term care—but you should," he said.

Start by talking to a financial advisor who will help you determine which type of long-term care insurance policy is the right fit considering age, health, wealth, care preferences and other variables.

Types of policies

Historically, "pay as you go" contracts have been the most common, where clients paid long-term care insurance premiums in regular, routine installments.

Estimates and coverages vary, but a healthy 55-year-old male might incur $45,000 in premiums by age 85 for policy benefits of $165,000. And it may never be used, depending on circumstances.

There are multiple policy types depending on your needs:

1. Single-deposit contracts. "This kind of policy multiplies the benefit of the dollar invested," he said. "So, a $25,000 deposit into a long-term care insurance policy could provide, depending on age, far more coverage than the initial $25,000 investment. Future cost increases can be offset by adding an inflation rider to a policy to help keep up with increasing costs."

2. Hybrid policies combine a life insurance with LTC coverage. They're not the "use it or lose it" type of years past, said Harmon. In many cases, the insured can either use the benefit to pay for LTC expenses (living benefit) or the policy fulfills as a life insurance policy and the benefit is paid out to the beneficiary.

3. Annuity LTC policies allow the insured to use the value of the policy to pay for LTC expenses and if the total value isn't exhausted, the beneficiaries receive any remaining value. There is generally a multiplier of value above the initial contribution. Also, with some carriers, a spouse can be added to give joint coverage for two people.

Lesser known are the positive benefits afforded treatment of annuities under the Pension Protection Act (PPA) of 2006. PPA allows you to exchange a non-qualified annuity with a long-term care insurance policy. The new PPA-compliant annuity must include a longer-term care rider. This rider would allow the annuity owner to use the annuity's death benefit to pay for long-term care expenses, tax-free, per the PPA.

Most financial advisors know the different types and can help find the best fit for you and your long-term care preferences, Harmon said. "Long-term care is personal and often emotional—with numerous factors to consider. Creating and acting on a plan early will help ease that burden and help you achieve the care of your choice without undue burden on loved ones."