Exploring the deeper effects of more tariffs

Potentially more US production but higher prices and less global cooperation expected

Going into 2024, the question on many people’s minds was how soon the U.S. Federal Reserve and other central banks would start cutting rates and whether they would move in lockstep. Now, going into 2025, a significant focus is on the nature and magnitude of proposed U.S. tariffs and how the U.S. economy—and the world—will react.

Of course, many of the details surrounding the tariffs remain undecided and will remain that way until after President-elect Donald Trump takes office in January and new tariffs are announced. However, even so, experts say history—and economics—can help sketch what the path ahead may look like.

Will tariffs cause inflation to rise again? What about growth?

Overall, it’s not the use of tariffs in general that has some economists concerned, but rather how broad or large the tariffs might be. During his campaign, Trump’s proposals included imposing a blanket tariff of 10% to 20% on all imports, with additional tariffs of 60% to 100% on goods imported from China, and a 25% to 100% tariff on goods from Mexico—if the Mexican government doesn’t tighten the U.S.-Mexico border. However, in late November, he proposed a 25% tariff on goods imported from Mexico and Canada and a 10% tariff on imports from China.

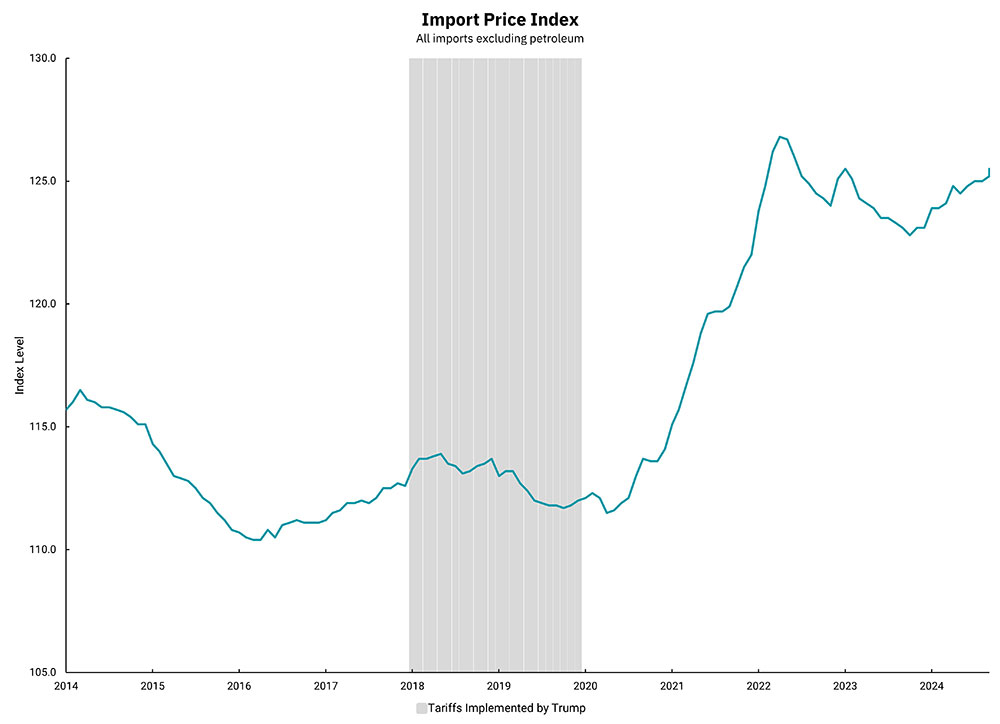

Caption: Former President Trump's previous tariffs had less of an impact on import prices than the Covid pandemic.

As BOK Financial® Chief Investment Strategist Steve Wyett explained, "Targeted tariffs can help keep China from dumping steel on the global market, for example, or something of that nature, but the broad use of tariffs probably causes as much economic damage as it helps.

"If you're using tariffs to protect domestic producers, inevitably, what you're saying is, ‘I'm going to raise the price of this foreign good that can be imported cheaper, so it can be made here.' However, that means consumers are now going to be asked to pay a higher price for the good either by paying the tariff on what's imported or by paying a little bit higher price for a domestic producer to produce the good. The domestic producer is going to price it as close to the tariff price as possible," he explained.

And so, broad tariffs tend to be inflationary from a price standpoint, right up to the point that it destroys demand, Wyett continued. "Then, all of the sudden, you just have lower economic growth."

At the same time, proponents of broad tariffs argue the opposite. For instance, the Washington International Trade Association (WITA)—a non-profit, non-partisan organization that includes the president and CEO of the American Apparel & Footwear Association as president of its board—publicized a trade model that predicts broad tariffs would benefit U.S. consumers and businesses in multiple ways.

Specifically, the 2022 model looks at the impact of a 15% revenue tariff increase on all imported goods, and a 35% tariff increase on some imports that are significant for economic reasons or for "national resilience," such as imports from Non-Free Trade Agreement (NFTA) countries. With those in place, the model predicted a 7% boost to the U.S. economy,10 million new jobs, a 10% in inflation-adjusted household income and $603 billion generated in federal revenue.

However, the model uses tariff figures that differ significantly from the ones Trump suggested during his campaign. To put all of these numbers into perspective, you have to go back nearly 200 years to 1830 when the highest tariff in U.S. history, a near-62% tax on all dutiable imports, was imposed and received strong political opposition within the U.S. The second-highest tariff was the 1930 Smoot-Hawley Tariff Act, which raised around 900 import tariffs by an average of 40% to 60%. As Wyett pointed out, this act is believed to have been a driver of the Great Depression, "but I don't think we're in the same position now," he added.

How will other countries react?

One reason why the Smoot-Hawley Tariff Act is believed to have helped trigger the Great Depression is because of its significant reduction in global trade. In response to the act, around two dozen countries enacted high tariffs of their own within two years of its passage, causing a 65% drop in international trade between 1929 and 1934.

Already, President-elect Trump has indicated that he could propose tariffs on China and Mexico, which could have serious implications for the economies of those two countries.

As for China: "If Trump does come in and put those tariffs into place, then that's obviously going to have a detrimental effect on its economy," said Peter Tibbles, senior vice president of foreign exchange trading for BOK Financial.

"The Chinese economy has struggled all year despite numerous rounds of stimulus from the authorities to help jump start growth," he explained. "As the middle class developed and millions of workers sought new manufacturing jobs, the Chinese property conglomerates built massive megacities to serve as hubs for new factories and industries. As the real estate market became saturated, many of these megacities remained uninhabited and this has proven to be a drag on the economy and the companies which own the apartment complexes which were supposed to house millions of workers."

In turn, China's reaction to high U.S. tariffs could also impact the energy market, said Dennis Kissler, senior vice president of trading at BOK Financial. "In retaliation, they could come against U.S. crude imports into their country. It also would weaken their economy. Remember that they're the largest crude importer, so if we weaken their economy, it would likely lower Chinese demand for crude—and that's going to be a problem."

However, until we learn about more details concerning the Trump tariff policy it will be hard to ascertain the effect these tariffs will have on the economies impacted and indeed if any countries retaliate with tariffs of their own. "Obviously, it's going to affect trade, but how it affects trade can be very different, depending on the specific policies," Tibbles said.

2025 Outlook

A new year is often associated with transformation. Even so, the degree of change ahead in 2025 looks unusually large for the U.S., with potential shifts in trade policy, immigration, regulation and more. BOK Financial's investment management team has prepared its 2025 market outlook as a downloadable report, supplemental articles and a recorded webinar.