Timely opportunities abound for win-win charitable giving

Year-end traditions, gratitude and gifting go hand-in-hand

Two straight years of strong stock market returns and the scheduled 2025 reduction of the estate tax exemption may have you thinking more charitably than usual as year-end gift giving fast approaches.

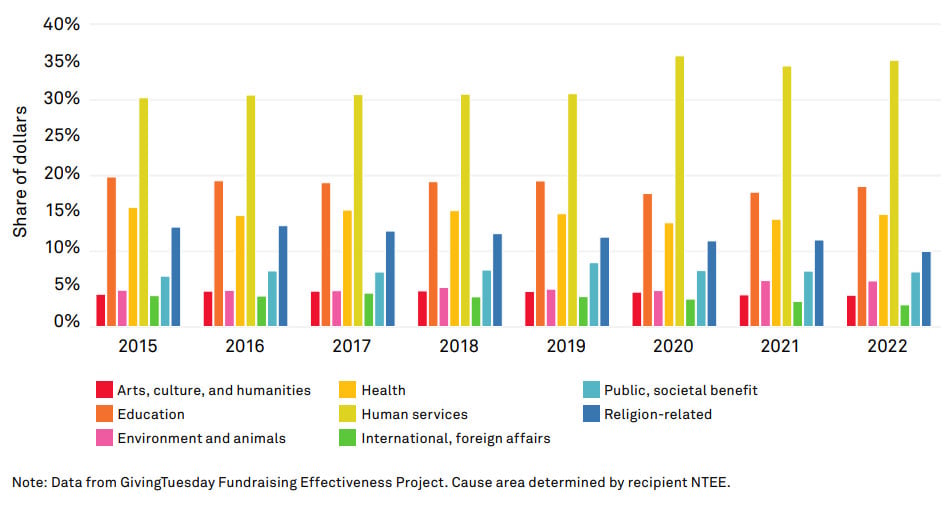

Fortunately, a variety of tax-advantaged giving tactics are available to meet traditional needs compounded this year by Hurricanes Helene and Milton. Human services, education and health-related causes typically rank 1-2-3 for giving by individuals, with the three combining for about 65% of the take for the top eight causes.

Share of individual giving by cause area and year

Though it’s often quick and convenient to give online in the rush of the season, larger donations made via qualified distributions, foundations and gift annuities are more methodically made within an overall financial plan that includes tax and gifting strategies, according to experts.

“As you’re evaluating your many options for charitable giving this holiday season, consider the tax implications. Certain giving strategies could help you maximize the amount that goes to charity and minimize your tax bill,” said Kimberly Bridges, director of financial planning for BOK Financial®.

The first step is to know your current marginal tax bracket (the rate you will pay on your last dollar of income) and compare it to your expectations for next year. If your marginal tax rate is higher this year than is expected next year, you may want to front-load some or all of next year’s contributions before 2024 ends in a process known as “bunching."

“In other words, instead of simply pledging, go ahead and make your 2025 gifts before year-end to maximize the tax benefit for the 2024 tax year,” said Bridges.

Charitable giving options

Bridges suggests considering these seven tax-wise ways to give:

1. Direct cash donations. Charities will gladly accept cash through websites and fundraisers. Donors who itemize on their income tax returns can claim a deduction, reducing their taxable income and overall tax liability. For 2024, the standard deduction is $14,600 and $29,600 for individual and joint filers, respectively. But keep in mind that other strategies—such as giving appreciated assets—may provide additional tax benefits, leaving cash donations as a less effective option. Standard deductions will rise to $15,000 and $30,000, respectively, for 2025.

2. Donor-advised funds (DAFs). Commonly established at financial institutions and community foundations, DAFs allow you to realize a tax deduction in the year of the gift, with the ultimate recipient—a cause or organization of your choosing—to be decided later. DAFs are especially helpful in years of higher-than-expected income from capital gains, a Roth conversion, bonus or inheritance. Assets in a DAF can also grow tax-free, potentially increasing the overall amount available for charitable giving later.

On the flip side, younger donors may be well-suited for giving through a DAF, although awareness of this mechanism is relatively low among this cohort of donors. Giving through a DAF involves a lower barrier to entry than more complex charitable vehicles, and the ease of use can inspire not only giving, but also help reinforce or perpetuate these newer donors’ attitudes around giving.

3. A foundation. You could consider donating to a charitable foundation aligned with your values. Charitable foundations are legal entities established to provide financial support to other charitable organizations. Examples include the local or regional United Way and local community foundations.

4. A charitable gift annuity (CGA). This giving method involves contracting with a charity to give them a lump sum, but you get a portion back from it every year for the rest of your life to have a long-term income stream. Any donated money remaining when you pass away goes to the charitable organization. Tax benefits include a deduction for the value of the gift the year the CGA is created. A portion of the yearly payments to you may be considered a tax-free return on principal and have the potential to reduce capital gains taxes on the appreciated assets.

5. Gifts of appreciated assets. You could consider donating stocks, bonds, real estate, artwork or collectibles that have appreciated in value directly to your favorite nonprofit organization. You’ll benefit by deducting the total value of the asset and the charity will receive the total value, not reduced by taxes. Additionally, you’ll avoid incurring a tax liability on the gain. Note: Not all charities can accept all types of assets, so check with them in advance, and you should start the process well before year-end to ensure the transaction is completed before December 31.

6. Charitable trusts. This is a legal arrangement in which assets are put into an irrevocable trust to benefit a charity for a set number of years or the life of the donor. When the time is up, the remaining assets go to the donor or assigned beneficiary. There are two types: Charitable Remainder Trusts (CRT) and Charitable Lead Trust (CLT), each with its own features and tax advantages.

7. Qualified Charitable Distributions (QCDs). If you are over 70½, you can make a QCD from your IRA directly to a qualified public charity and it can count towards your required minimum distribution (RMD), if applicable. Limits for 2024 are $105,000 for individuals and $230,000 for married couples. This year, you may elect to use part of this QCD limit to make a one-time gift of up to $53,000 to fund a charitable remainder annuity trust, charitable remainder unitrust or a charitable gift annuity. You do not need to itemize deductions to benefit from the exclusion. Still, the amount must be sent directly from the custodian of your IRA account to the charity without passing through your hands.

Please note: If you are planning to do a QCD from an IRA, you should not make post-70 ½ contributions to the same IRA (assuming you are eligible to make contributions after 70 ½) to avoid causing the QCDs to be disqualified and create a record-keeping headache.

Be mindful of year-end deadlines

Remember, some of these options take time to create with an estate lawyer and your financial advisor, so they aren’t all last-minute, end-of-year decisions. However, if you have an existing charitable trust that allows additional contributions, you may be able to make additional gifts before year-end.

“Don’t forget that to receive a charitable deduction for this year, the gift must be made by December 31,” Bridges said. “That means it has been delivered to the charity, and you have relinquished control.”

A check must be mailed or handed over to the charity—and it’s okay if they don’t cash it until 2025. In the case of securities, the gift is not complete until ownership is changed in either the corporation or broker’s records. So, make sure you check ahead for their cut-off dates.

Leave a lasting legacy

Bridges says charitable giving is a great way to align your money with your values and leave a lasting legacy. Some families choose to start a Donor Advised Fund and include their children and grandchildren in determining grantee organizations. Others take legacy giving to the next level by starting their own family charitable foundation with its related benefits and requirements.

Consult with your financial advisor on which options serve your needs for tax advantages, creating passive income streams and legacy planning—and the timing needed to secure the tax benefits you want.

However you celebrate this holiday season, charitable giving is always in style.