Inflation volatile—but still trending lower

Recent data was a mixed bag, but Fed rate cuts still expected this year

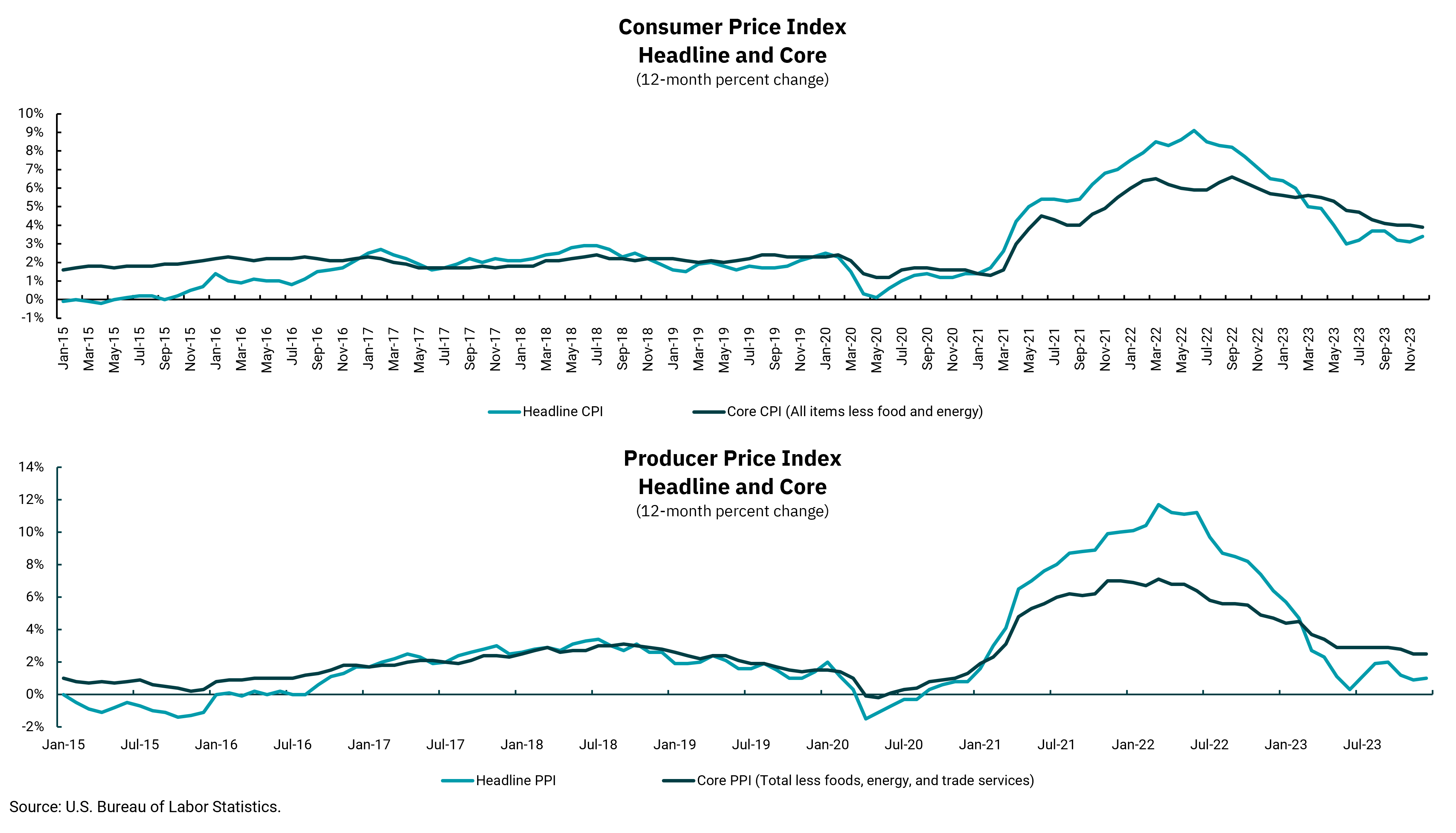

There has been a mix of inflation data recently. After the most recent Consumer Price Index (CPI) report showed a bit higher inflation at the retail level than expected, the following day, the Producer Price Index (PPI) report showed a bit lower inflation at the wholesale level than expected. The timing for the first Federal Reserve rate cut was pushed out following the CPI report, only to be brought back to March following the PPI report.

Such volatility can be hard to follow and shows the difficulty in forecasting the future of monetary policy. The good news is that both series, as shown in the graphs below, are moving in a similar direction: lower. The headline inflation rate for the CPI is at an annual rate of 3.4%, while the core rate, which strips out food and energy, is 3.9%. This is a welcome development after both measures peaked in the summer of 2022 at 9.1% and 7.1%, respectively. The PPI report showed headline inflation at an annual rate of 1% while the core rate advanced 2.5% annually. The PPI peaked at even higher levels than the CPI in 2022.

The CPI is more important to the Fed from a monetary policy standpoint between these two measures. Still, with PPI lower than CPI, this could indicate even less inflation pressure in the pipeline going forward. That said, while it is good news that the inflation rate is falling, this does not mean prices are declining overall. Instead, it means the pace of price increases is slowing. Consumers are still feeling the aggregate increase in price levels since the beginning of the pandemic, with the aggregate increase in the CPI index since January 2020 approaching 20%.

As we think about what this might mean from an interest rate standpoint, the Fed has forecast rates to be lower throughout 2024. This would not be a classic “easing” of monetary policy where the Fed lowers rates to spur demand. Instead, this would merely be a rate reduction to avoid increasing the restrictive nature of interest rates. If the Fed has rates at 5% and inflation at 4%, their “real rate” is 1%. If inflation falls to 3% and the Fed takes no action, their real rate increases to 2%. This now higher real rate may act to slow economic growth more than desired, so to avoid this, the Fed could lower rates to 4% and keep the real rate at 1%.

The difficulty lies in the volatile nature of inflation, and the Fed prefers to avoid making quick changes to interest rates. At the same time, they know inaction might lead to lower economic activity and higher unemployment than they want. We will closely watch the inflation and labor market indicators as we move through 2024. Here’s hoping inflation continues its decline while economic growth stays positive and the Fed can reduce rates slowly.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)