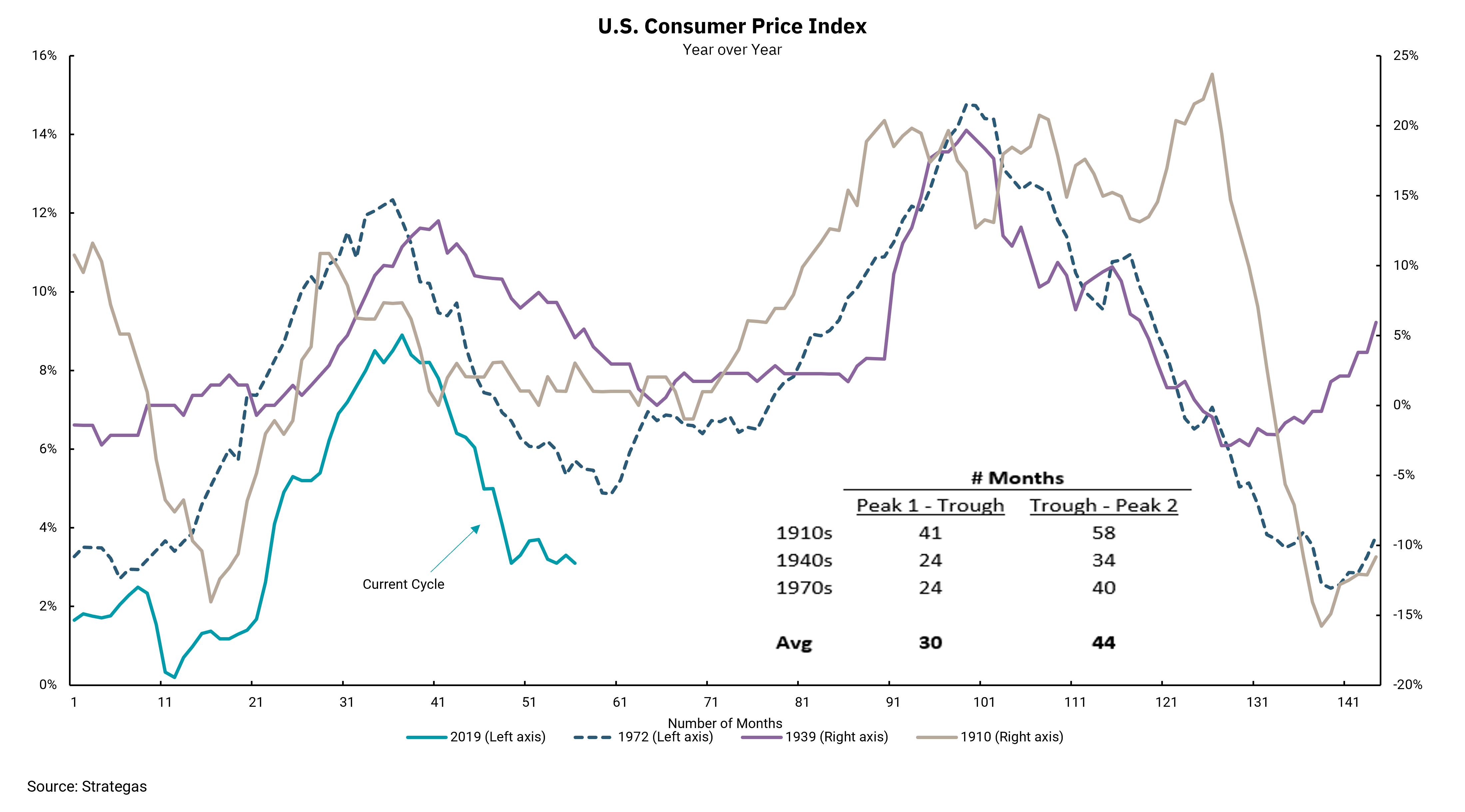

Can the U.S. avoid a second wave of inflation?

Fed is hoping that postponing rate cuts can keep inflation down

The Federal Reserve has a tough job. It is extraordinarily hard to accurately forecast the direction of the incredibly complex U.S. economy during "normal" times. It is even more complicated now as the economy unwinds from the massive monetary and fiscal policy response to the global pandemic. As the U.S. shut down its economy in response to the outbreak of COVID-19, the Fed quickly lowered rates to zero, supported parts of the capital markets to maintain the flow of credit and directly invested in markets as it quickly grew its balance sheet. It was a similar response, but of even greater magnitude, to the Financial Crisis in 2008-09. However, unlike their lack of action during the Financial Crisis, Congress responded actively to the pandemic and began a series of fiscal policy supports, which eventually totaled between five and six trillion dollars.

As the economy re-opened, we saw a spike in inflation as demand began to exceed the output capacity of an economy still hobbled by pandemic policies. In response, the Fed raised interest rates and started shrinking the size of its balance sheet. These actions led many economists, us included, to anticipate a weaker economy with the risk of higher unemployment. However, the federal government did not pull back on spending. While we have not had additional fiscal stimulus "plans" since early in President Biden's term, the federal budget deficit has widened over the last couple of years to some $1.7 trillion in the 2023 fiscal year. According to the Congressional Budget Office (CBO), the forecast is for continued trillion-dollar-plus deficits going forward. Meanwhile, the economy continues to grow, and unemployment remains below 4%.

Despite the ongoing fiscal spending, we have seen inflation decline rapidly over the last 12 months—enough so that we are now expecting the Fed's next move to lower rates. Some economists and politicians are even asking why they haven't already begun lowering rates. After all, high rates are painful for personal and business borrowers. Meanwhile, the current Federal Funds rate target range is well above recent readings on inflation—from the Consumer Price Index (CPI) to the Producer Price Index (PPI) to the Fed’s favored inflation gauge, the Personal Consumption Expenditures Price Index (PCE). Those calling for lower rates are, rightfully, pointing out that a stable Fed means real rates are going higher, which could increase the chances of slowing the economy too much over the next few months. So why is the Fed hesitating?

This week's chart is a long-term look at previous bouts of inflation along with the progress of our current inflation episode. History shows inflation tends to come in waves—flaring and then slowing as markets adjust but reigniting and moving to levels above the initial peak. This wave of inflation topped out at just over 9%, and the Fed would like to avoid a secondary wave of inflation if possible. Studies of past inflation episodes have concluded that lowering rates too soon contributed to a second wave beginning, causing the Fed to raise rates even higher to slow the more stubborn second round of inflation. And so, while the current Fed’s patience may seem unnecessary from a short-term perspective, we should note that the right side of the chart covers a much longer period than what we have been through so far.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)