Other central banks lowering rates, but Fed likely to wait

High wages call into question if U.S inflation sustainably is headed to 2%

The European Central Bank (ECB) voted to lower interest rates at its meeting on June 6 as global inflation trends continue to moderate. Other central banks are considering similar actions, but in the U.S., the Federal Reserve's language and actions have been more reserved.

The labor market plays a key role in shaping the Fed's view about the path of inflation going forward, and recent data has shown that it is becoming a bit more balanced between labor supply and demand. The May Job Opening and Labor Turnover Survey (JOLTS) registered a decline in open jobs, with approximately 8 million openings versus a high of 12 million in 2022, resulting in a ratio of open jobs to unemployed persons of about 1.2. JOLTS Data on the number of people quitting their jobs, which provides insight into the level of turnover, reveals an environment where lower competition for workers can lower pressure on wages.

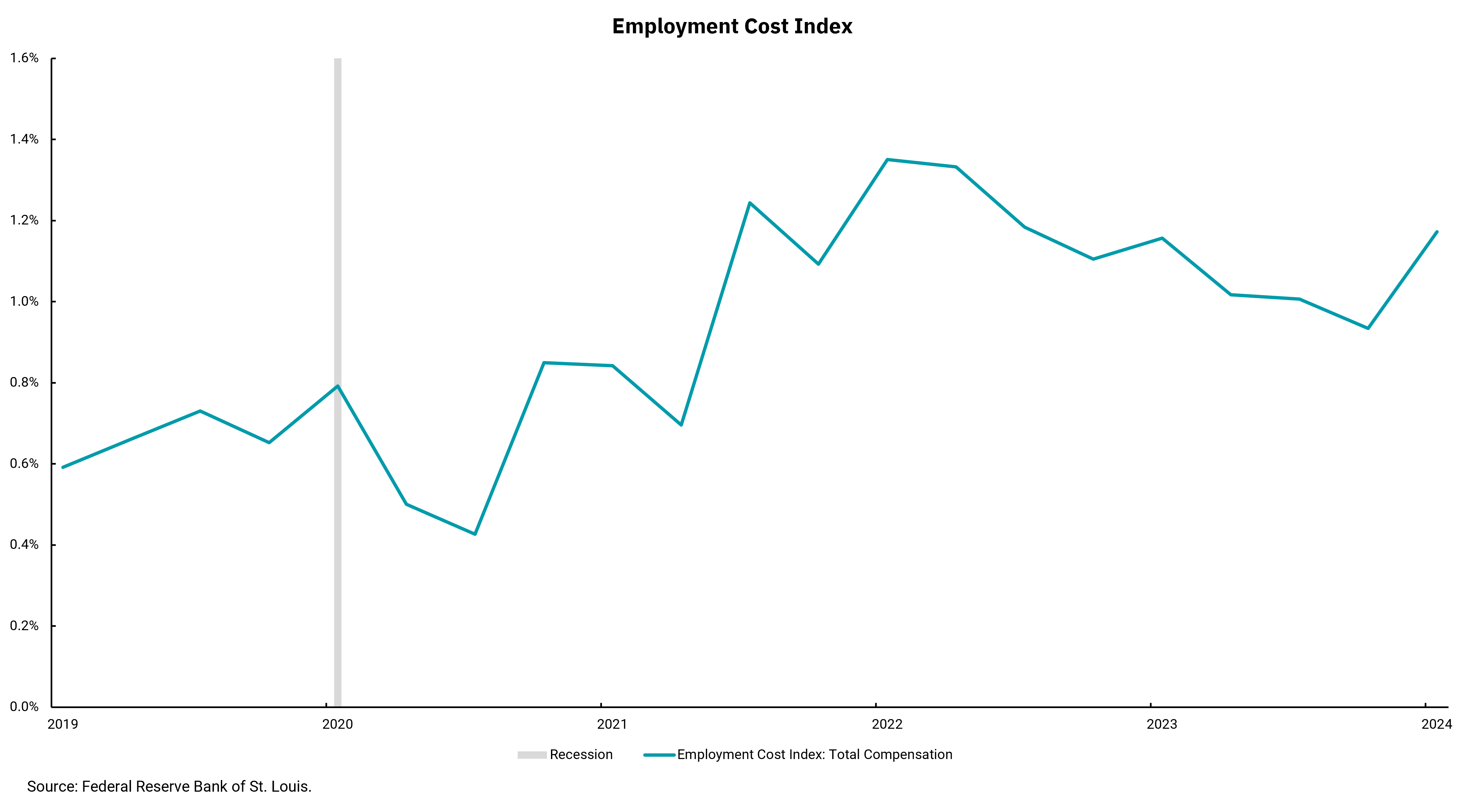

We see wage data within the Department of Labor's (DOL) monthly unemployment report, as well as the quarterly report from the Bureau of Labor Statistics (BLS) called the Employment Cost Index (ECI). Unlike the monthly data from the DOL, which measures wages amongst employed persons, the quarterly BLS report includes wages, salaries and benefits. This week's chart shows the ECI for civilian workers through the first quarter of 2024.

We can see that the most recent ECI is lower than its peak in 2022, but our last report also showed an increase in the first quarter of 2024 compared to the end of 2023. Wage data within the monthly employment report has not increased like the ECI, but wages have remained stuck at levels that call into question the ability for inflation to move "sustainably" to the Fed's 2% target. We sense that an increase in unemployment would lead the Fed to begin lowering rates sooner. Still, when unemployment is stable and below 4%, wage data provides a reason why our Fed might be moving a bit more slowly to lower rates than our international counterparts.

In addition, the European fiscal response to the pandemic was significantly less than ours. As a result of the U.S. fiscal response and our dynamic economy, domestic growth has rebounded faster and more strongly than in Europe. However, our ongoing level of deficit spending might be a factor in keeping our inflation a bit higher for a bit longer. If so, we might see an ongoing difference between global central bank actions and our Fed.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)