Jobless claims low—but trending higher since January

Some economic data showing slowdown while fiscal spending buoys growth

There are multiple measures we watch when considering the health of the labor market. Of these, the monthly report from the Department of Labor is at the top of the list in terms of importance. However, the timeliest measure we get is the weekly measure of jobless claims reported every Thursday morning.

As with many frequent reports, the weekly number can be subject to periods of volatility based on possible delays or assumptions from reporting states. We watch trends in the data, like the four-week moving average, to help smooth out vagrancies. The most recent report provides an example of this volatility. The previous week, a huge surge from California led to an increase in jobless claims. The then most recent report saw a large decline in claims from California. The point is not to lessen the report's validity, but rather to highlight why single data points might be a bit misleading.

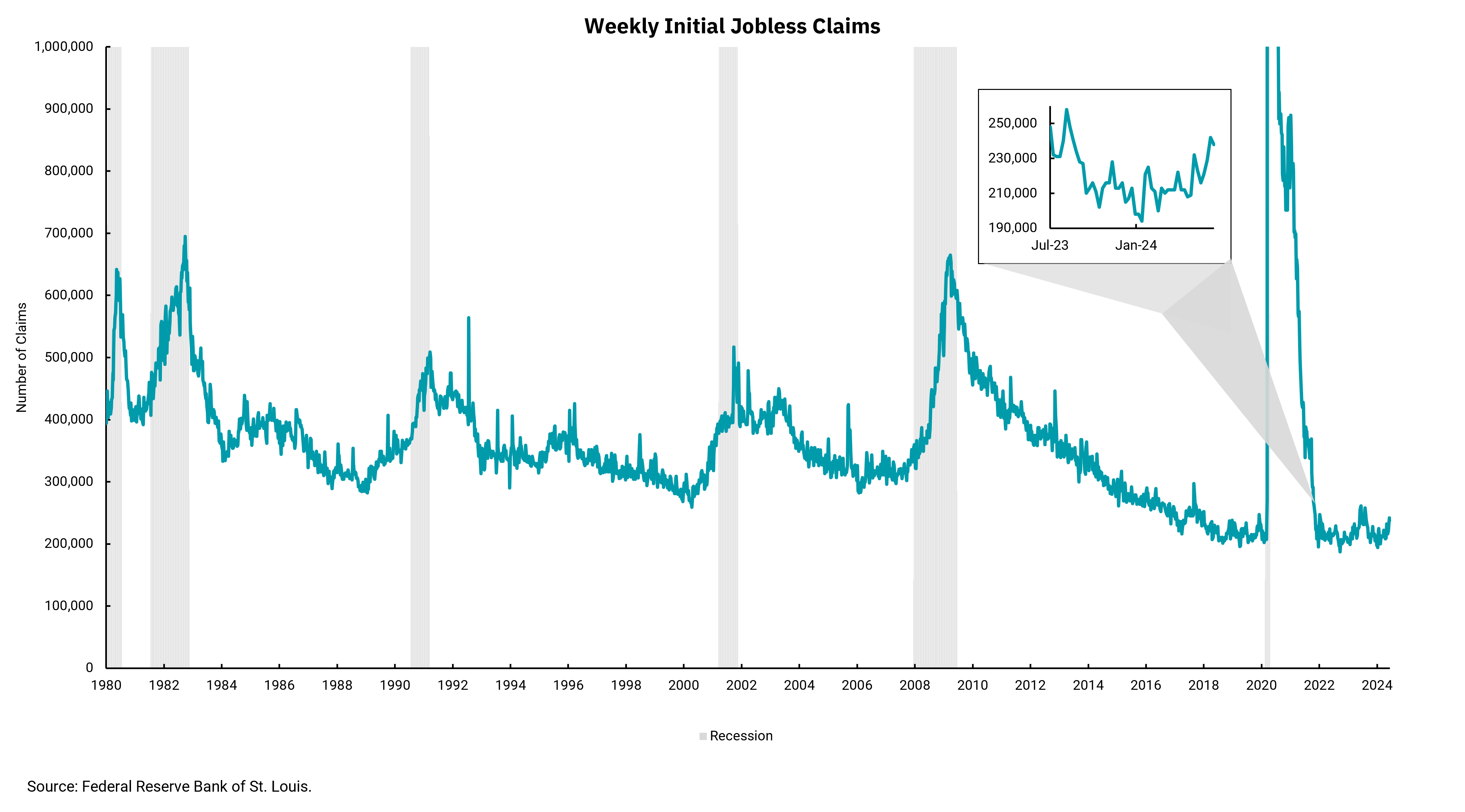

We take a longer-term view of jobless claims in this week’s chart to provide some context on just how remarkable the performance of the labor market has been. Looking back to 1980, when the labor market was much smaller than today, weekly claims averaged higher than now, even during periods of economic expansion. We can also see a clear correlation between increasing jobless claims and recessionary periods (represented by the gray bars in the chart). Yes, there is a gray bar in early 2020, as jobless claims soared to record levels and then recovered very quickly. This correlation helps explain why the labor market plays such a large part in our outlook for the economy.

The most recent trend can be hard to discern in the longer-term data, so the insert window provides a better view of what we are seeing now. The absolute level of jobless claims remains low, but the trend has been higher since January. We should note that we saw jobless claims above current levels as recently as last year, and we did not go into a recession, so the recent move should not necessarily be viewed as a recession indicator. Still, taken as part of an overall view where the most recent housing data is worse than expected, consumer sentiment is declining and measures of stress in credit card and auto loan delinquencies are rising, meaning we need to be vigilant. The historical view also shows that once jobless claims begin to move higher, they can accelerate upward quickly.

Meanwhile, there is still a lot of fiscal support coming from Washington. A recent report indicated that the deficit for this fiscal year will be some $400 billion more than expected, putting it on track to reach near $2 trillion. Some of this was from lower tax revenues, but a bigger part was from unexpectedly high spending. In the short run, we should view this as additive to growth prospects and as lessening the chances of a recession. However, we have not erased the concept of a business cycle from our economy, and we will be watching trends in the labor market very closely.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)