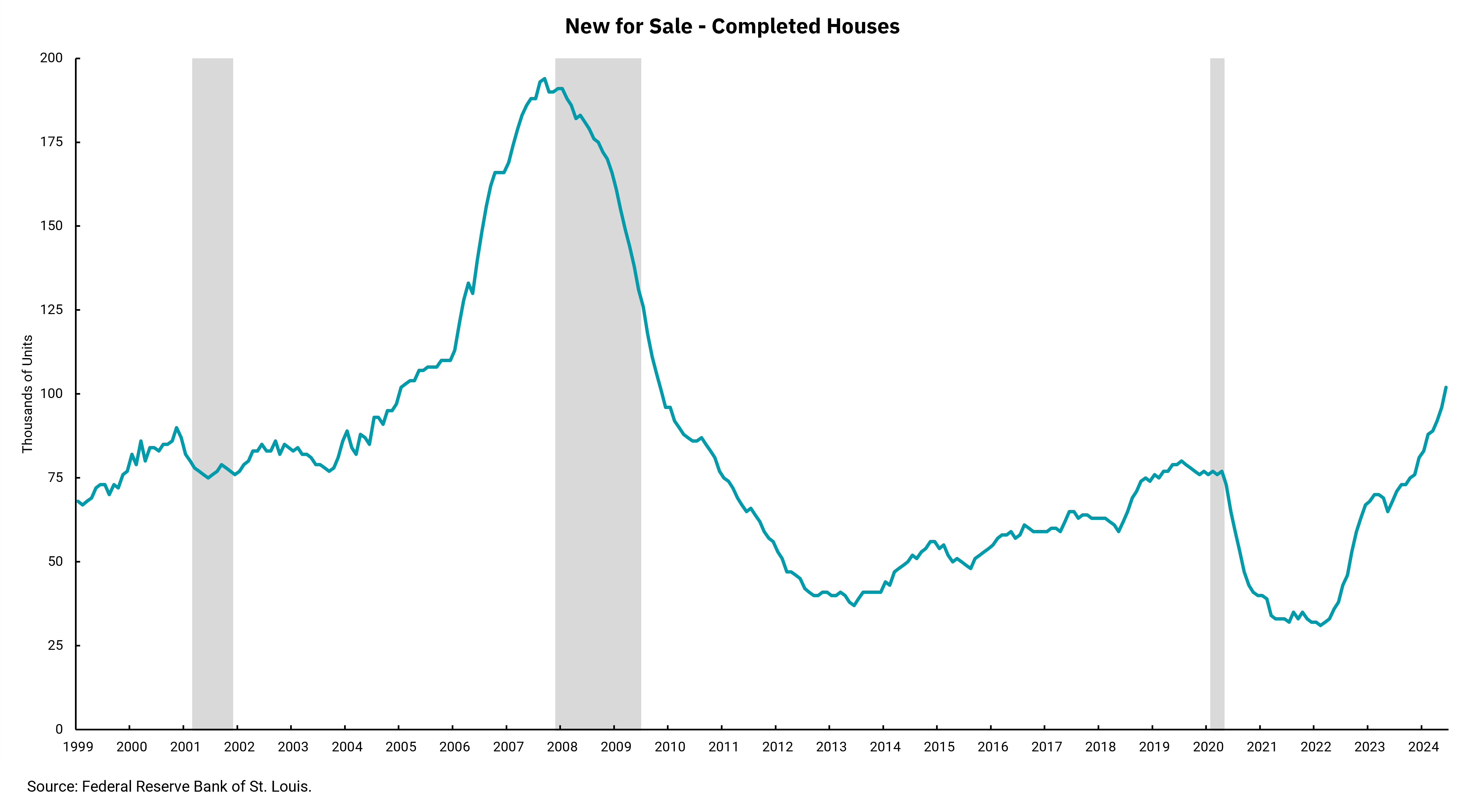

More new homes for sale—but still short of demand

Investment in housing still recovering from the Financial Crisis

We have commented before on the bi-furcated nature of our economy and the varying impacts of inflation and rates. While the job market remains on stable footing, we know inflation’s negative impact on lower-income households is growing as delinquencies on credit cards and autos are increasing. Meanwhile, in the corporate world, the impact of higher rates is materially different between larger and smaller companies. Even with the rotation from large-cap to small-cap equities over the last month, year-to date performance still reflects the larger impact higher rates have had on small companies.

The housing market is no different. If you already have a home with a low fixed-rate mortgage or no mortgage at all, the housing market may seem fine. This applies to most homeowners right now, as more than 90% of mortgages are at rates below the current level. For those in this group, higher rates are not increasing their interest expense. Meanwhile, home prices continue to rise, so they’re building more equity.

However, the housing market is a mess if you are trying to buy a home. The large number of low-rate mortgages means that existing homeowners have little incentive to sell, reducing the supply of homes for sale overall and helping keep prices firm. This leaves new homes as the primary source of available housing. However, that, too, is in short supply. Our chart this week shows the impact of the Financial Crisis when the investment in housing fell off a cliff and stayed below replacement levels for the better part of the last decade. This overall dearth of supply is why the impact of higher rates has been muted on the housing market.

Recent data, however, shows a shift might be underway. New homes for sale have been rising and are now above levels we saw going into the pandemic. Prices, overall, remain high, but as supply rises, we may begin to see the trend toward price cuts expand. If we look a bit more granular by region, we can see the biggest increase in new homes for sale is in the South, where we are back to pre-Financial Crisis levels. The West, Midwest and Northeast are still well below those levels—but back to, or slightly above, pre-pandemic levels.

The Fed’s expected adjustment in monetary policy could bring some rate relief. Still, underlying demand remains at levels that likely will prevent significant price decline or a material improvement in affordability. The fact is: despite the recent increase in new homes for sale, we remain in a supply-constrained housing environment.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)