Should we worry about the job market?

Jobless claims rising but headline unemployment still relatively low

As the Federal Reserve considers the future path of interest rates, the labor market will loom large in the discussion. Of course, full employment is one of their two mandates, with price stability being the other. In some ways, the labor market cuts across both mandates as an economy with a healthy labor market is a growing economy. However, at the same time, an economy with a hot labor market is probably dealing with increasing price pressures, as wages play a key role in longer-term inflation expectations.

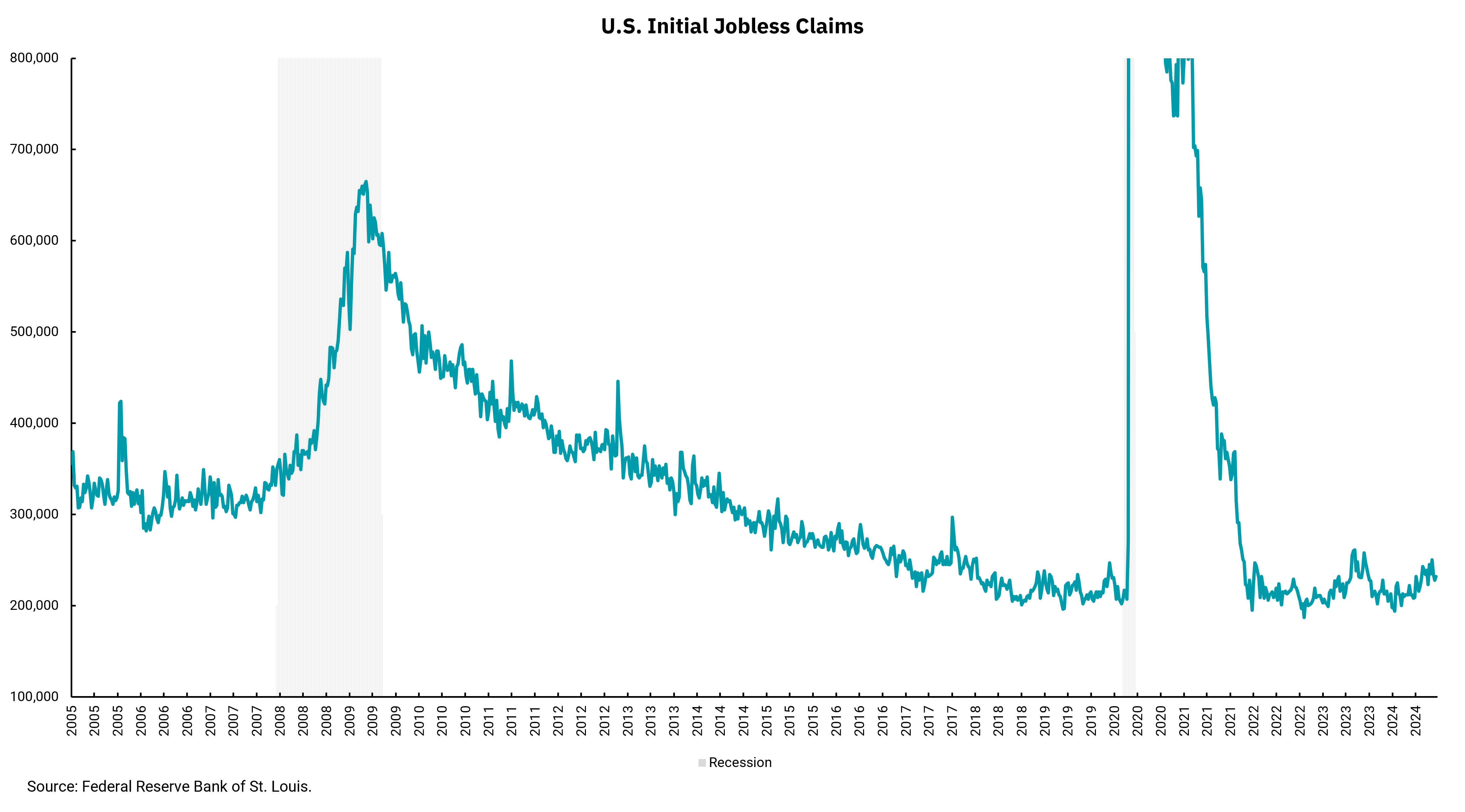

The weekly jobless claims report is the timeliest measure of the labor market's health. Although there is the risk of week-to-week variability from issues like strikes or even weather, such a frequent view can reveal trends as they develop, giving us clues about what to expect in the all-important monthly labor report from the Department of Labor (DOL).

Much as in the DOL report, our periods of risk are when the weekly jobless claims begin to trend higher, slowly at first but then at an accelerating rate. This is the environment in which we may find ourselves now. Looking at the right side of this week’s chart, we can see that the trend of initial jobless claims is moving higher. This is occurring as the headline unemployment rate is increasing to 4.3%, according to the DOL labor report. Yet we can also see that weekly jobless claims increased last year but then receded as economic growth improved in the third and fourth quarters of 2023. And so, we would not want to sound alarm bells just yet.

This data all will put Fed Chair Powell's recent comments at the Jackson Hole Wyoming Economic Conference under the microscope, as it appears that the Fed is setting the table for a September rate cut. This move is understandable, as inflation is declining (although not at the Fed’s 2% target) and the labor market is becoming more balanced as open jobs decline and quit rates subside. Altogether, this should provide the level of confidence that the Fed needs to begin recalibrating policy.

Thankfully, economic growth, in aggregate, remains positive. However, there are enough signs of consumer stress and labor market changes to give the Fed room to lower rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)