Fed has best shot at soft landing in over 20 years

Horizon bright for stocks when rates fall without a recession

Most of the time when the Federal Reserve has cut interest rates in the past, it's surrounding deteriorating economic conditions that culminate in a recession. In the current cycle, the Fed has, so far, evaded such a recession. That’s not to say that there haven’t been any economic downturns in recent years. For instance, there was a recession due to the self-imposed lockdowns associated with the height of the COVID-19 pandemic. There were, also two negative consecutive quarters of gross domestic product (GDP) back in 2022, which preceded a bear market in stocks, but there was no official recession call. Nevertheless, while the Fed was late to the party in its realization that inflation was more than fleeting, it has managed an economic landing very well.

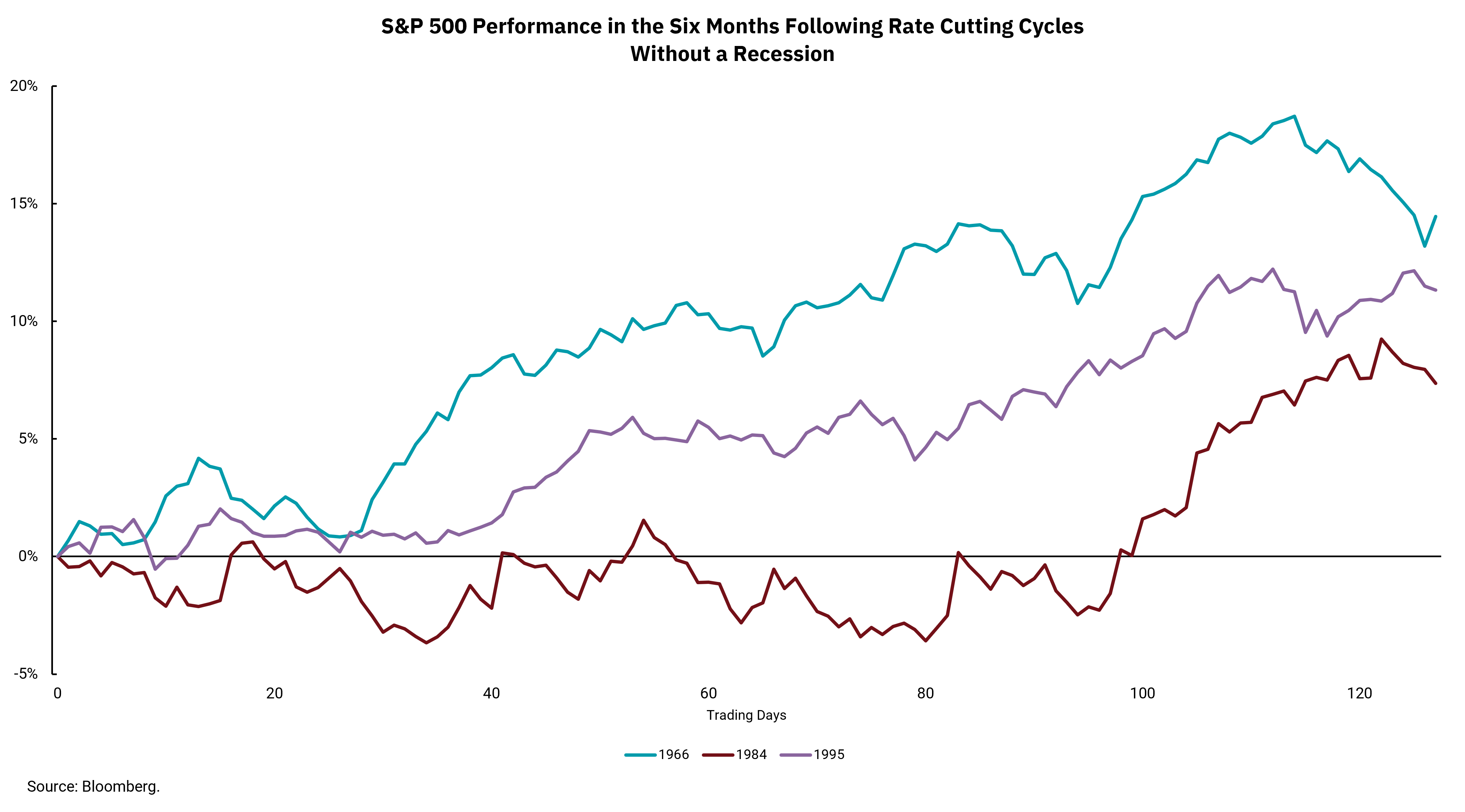

The history of recessions and their association with interest rate cuts by the Fed is well known, but what do we know about rate cuts that were not accompanied by a recession? There have only been three such cycles in the past sixty years (excluding a very brief and shallow rate cutting cycle in 1998). This week's chart shows the six-month performance of the S&P 500 in the wake of these rate-cutting cycles.

As you can see, the returns are all positive. Although the lack of a recession in the data will naturally lead to somewhat of an upside skew in the return level, it still tells a pretty good story. In fact, returns for the S&P 500 six months after the initial rate cut average 11%. And so, intuition tells us that stocks can potentially have a relatively significant upside once markets overcome the initial fear of a rate-cut environment.

So, what does all this say about the current environment in which investors find themselves? Well, this is the best shot the Federal Reserve has had at a soft landing in over 20 years. Assuming the evidence of such a soft landing continues to build, investors will want exposure to stocks. Of course, the Federal Reserve just began implementing rate cuts on Sep. 18, and all good things take time. Although there are still risks, including an election season here in the U.S. and geopolitical issues, the horizon looks relatively bright right now.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)