Fed likely to cut rates by 0.25% in November

Most recent jobs data calms concerns—for now

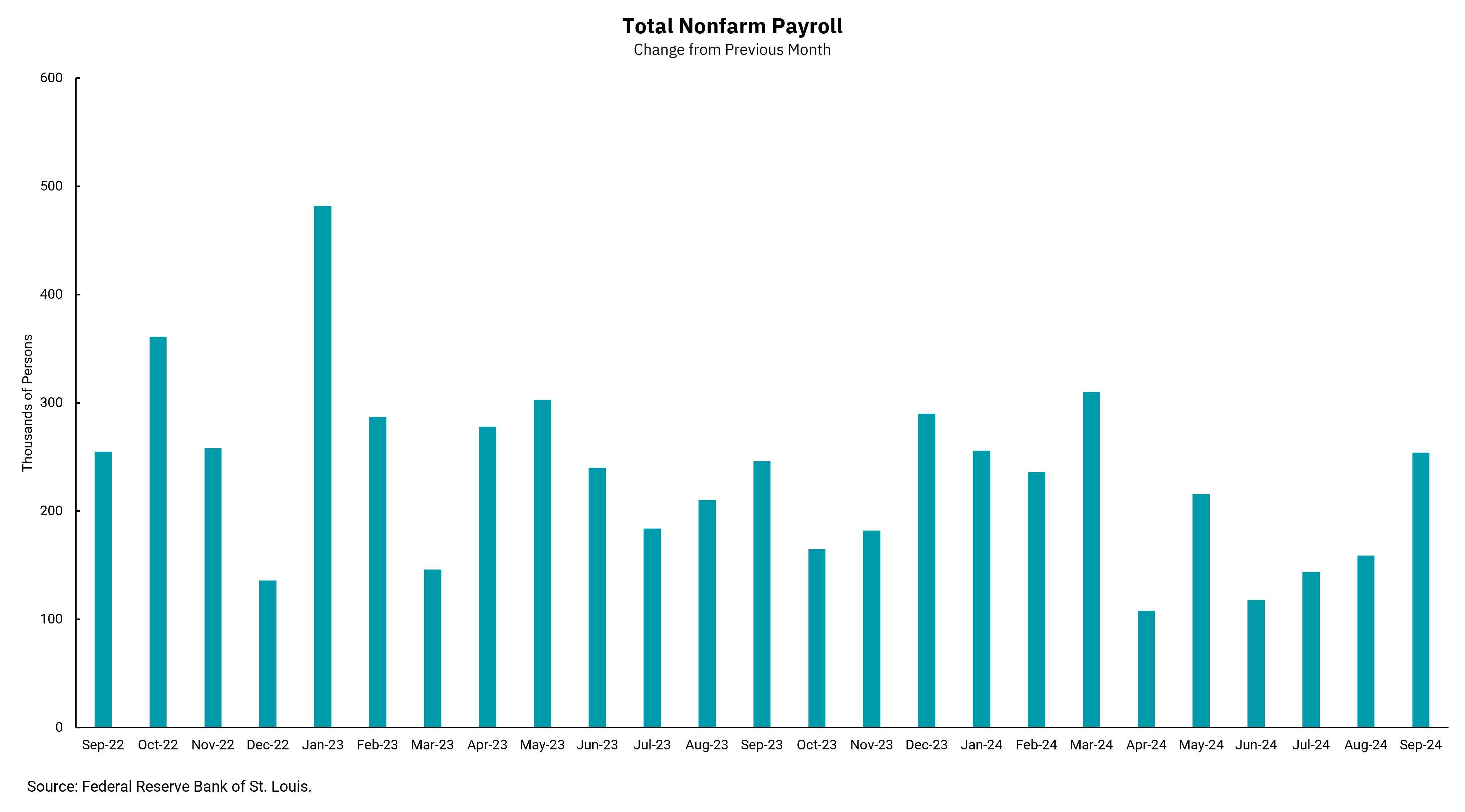

The highly anticipated September jobs report did not disappoint. Expectations going into the report were for job gains of 150,000, and the headline number handily beat expectations, adding 254,000 jobs to the U.S. economy in September, showing a labor market that continues to support the consumer. July and August jobs growth were also revised significantly higher, with an additional 17,000 jobs added for August and 55,000 additional jobs added to July’s total. It wasn’t very long ago that many investors were very concerned about the labor market. The strength seen in this report should put those concerns to rest for now.

The September jobs report also revealed that the unemployment rate fell from 4.2% to 4.1%. After the Sahm rule was recently triggered, many analysts feared the worst regarding the unemployment rate. So far, those concerns remain unfounded.

Average hourly earnings, however, came in a bit warmer than estimates at 0.4% versus 0.3% expected on a monthly basis. This serves as a reminder that inflation may still be an issue and means the Federal Reserve is more likely to cut by 0.25% than 0.50% in November. However, if the economic data continues to remain this strong, then a 0.25% cut should be warranted instead of a 0.50% cut. This collective data should be considered with the view that the domestic economy remains on solid footing.

We view a soft landing as the base case scenario as the Federal Reserve has managed a very difficult task to date. Remarkably, with unemployment remaining below 5%, the Fed has brought inflation down almost to target while maintaining a healthy labor market. In fact, if you remove the effects of shelter inflation from overall inflation, the Federal Reserve is below its 2% target.

Looking to the markets, the S&P 500 is supported by a healthy economy and a Federal Reserve amid a rate-cutting cycle. Geopolitics remains a challenge, but the market fundamentals are showing strength.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)