What the ‘Misery Index’ is predicting for the election

Current reading supports incumbent party—but economic picture can change rapidly

The Presidential election is fast approaching, and it is becoming increasingly clear how closely divided the country is between Democrats and Republicans. Virtually every poll is within the range of error, meaning the outcome is highly uncertain, and as some election prognosticators say, a difference of as few as 50,000 votes might swing this year's presidential election.

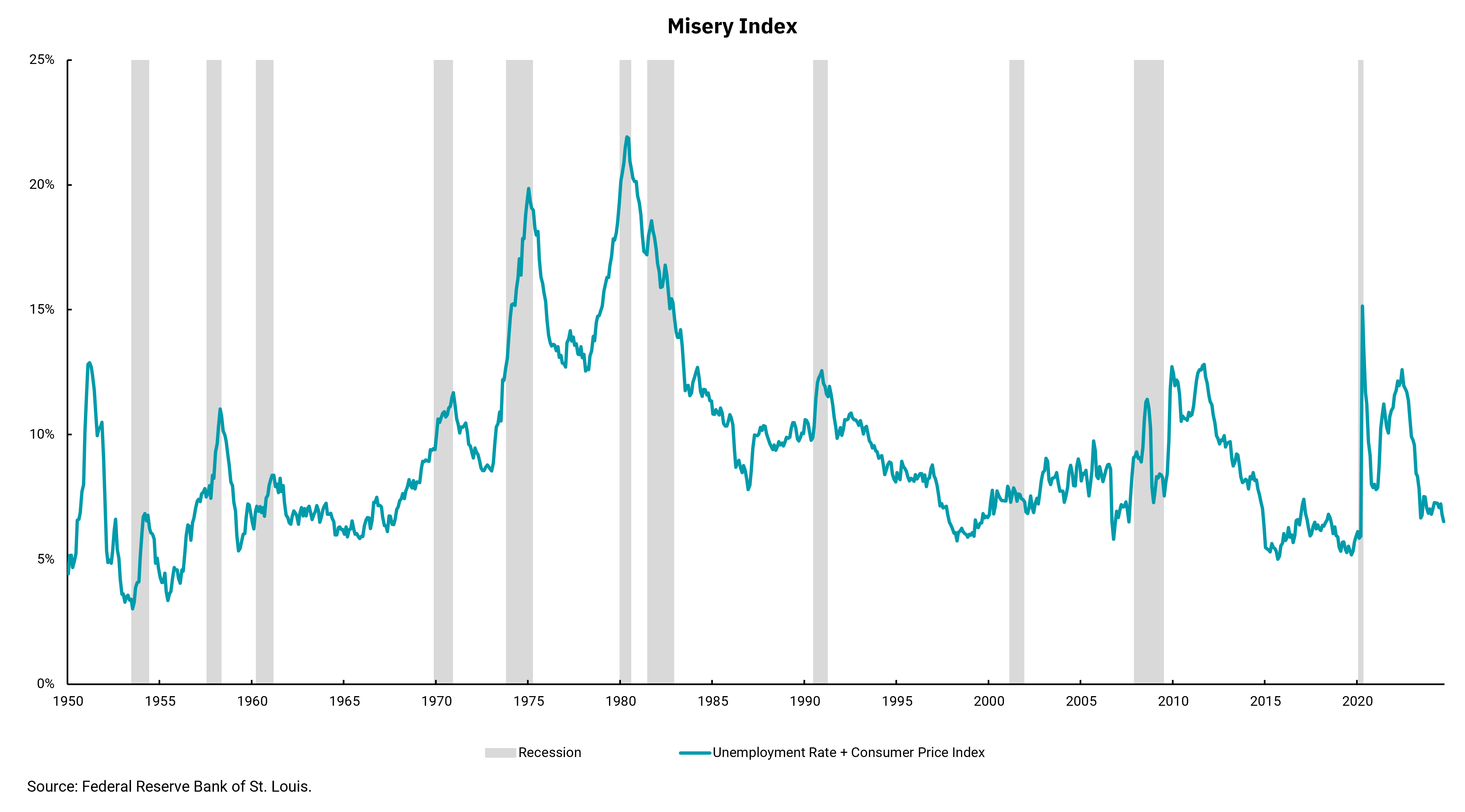

Within an environment like this, the potential impact of events in the weeks and days leading up to the election can be magnified. History shows that the economic factor with the single biggest impact on a president's approval rating is gasoline prices. However, an additional way to forecast the mood of voters is called the "misery index." This index is the combination of the headline Consumer Price Index (CPI) and the unemployment rate.

The higher this combination, the worse candidates seeking re-election perform. Historically, an index reading of above eight has been troublesome. The current reading on the index is below that level as unemployment remains low at 4.1% and headline CPI is now running below 3%. This means that this index is supportive of the incumbent party.

That said, little about this cycle is like anything we have seen before. The Democratic candidate was changed very late in the process, and the platform differences on issues like immigration, taxes, energy and regulation are very wide. In addition, the makeup of the Senate and the House of Representatives is a question mark and will go a long way in settling how much, if any, of the major platform issues can actually be implemented.

The overall inflation and employment picture can change rapidly; still, for now, the misery index is not indicating a change in the governing party.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)