Who’s keeping the U.S. economy afloat?

Large spending gap between highest and lowest earners

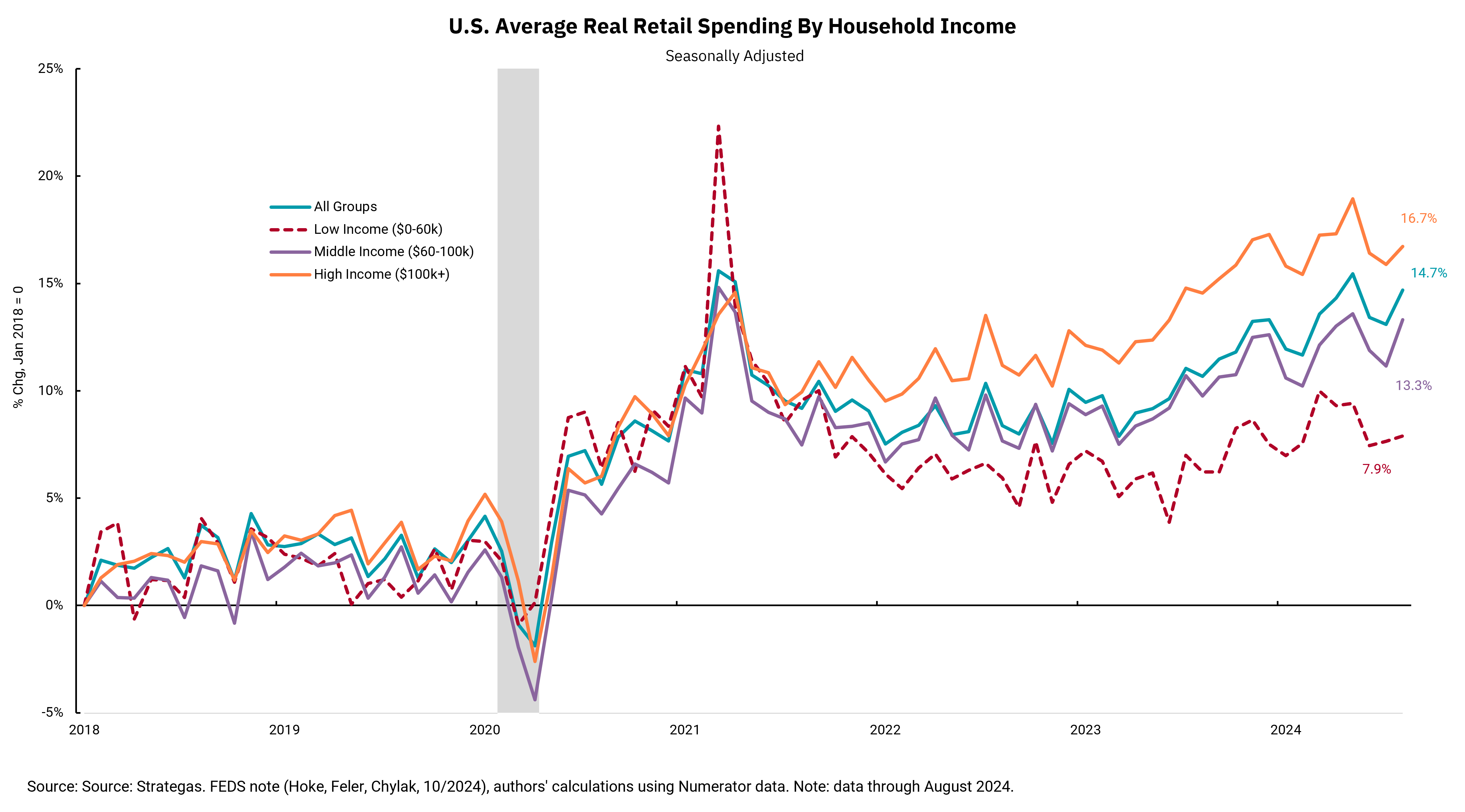

The consumer is king when it comes to the domestic economy, so investors watch U.S. consumer spending very closely. Spending from the highest earners is particularly important for the overall economy, as this group has the most financial resources of all consumers. With this in mind, this week's chart shows the average growth of inflation adjusted retail spending in the U.S. from 2018 onward, separated into low-, middle- and high-income households.

During the Covid era, significant stimulus measures were passed to support the economy as the country faced lockdowns and a severe reduction in economic activity. Due to the influx of stimulus funds, many lower income consumers had more spending power than they did pre-pandemic. Many of these households did not hesitate in putting those dollars to work in the economy. The dotted red line in the graph, representing lower-income consumers, peaked in early 2021 at over 20%. Spending growth for low-income households then troughed in mid-2023 and is currently showing a meager 7.9% growth rate since 2018.

On the other hand, spending from upper-income consumers has risen relatively steadily since 2018. Their inflation-adjusted retail spending grew by 16.7% over the same period, more than double the growth rate for low-income households. Essentially, wealthier Americans continue to drive the U.S. economy forward, while the temporary high in spending from Covid-era stimulus was just not able to last for lower-income households.

Wealthier U.S. households have the means to keep U.S. economic growth on stable footing. Absent an external shock to the economy or a significant downturn in the labor market, this trend seems likely to continue for now. The first look at third-quarter gross domestic product (GDP) will be released on Wednesday, where expectations are for over 3% growth. While we would like to see lower-income households be able to keep a better pace, there is enough spending from higher-income households to keep the economy afloat.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)