What’s ahead for the U.S. dollar?

Stronger dollar could be headwind for U.S. companies exporting goods

From time to time, concerns arise about the potential for the downfall of the dollar. On one hand, the dollar as a percentage of global currency reserves has fallen slightly in recent years. On the other hand, its standing as a bedrock of the global financial system is unrivaled. And so, put simply, the dollar reigns supreme and there is no real substitute. It’s closest competitor, the euro, is just not close. This global dependence on the dollar provides many benefits to the U.S. that most other countries would like to possess.

In the wake of Tuesday’s election, there is a sense of optimism surrounding economic growth that has translated to the performance of the dollar. From an economic perspective, if tax cuts are extended and there is less regulation, then, all else equal, in the short-run it’s positive for growth. There are arguments about the long-run effects of these policies, but these policies will be additive to the current economic environment, bearing in mind that there could be additional stimulative measures as well.

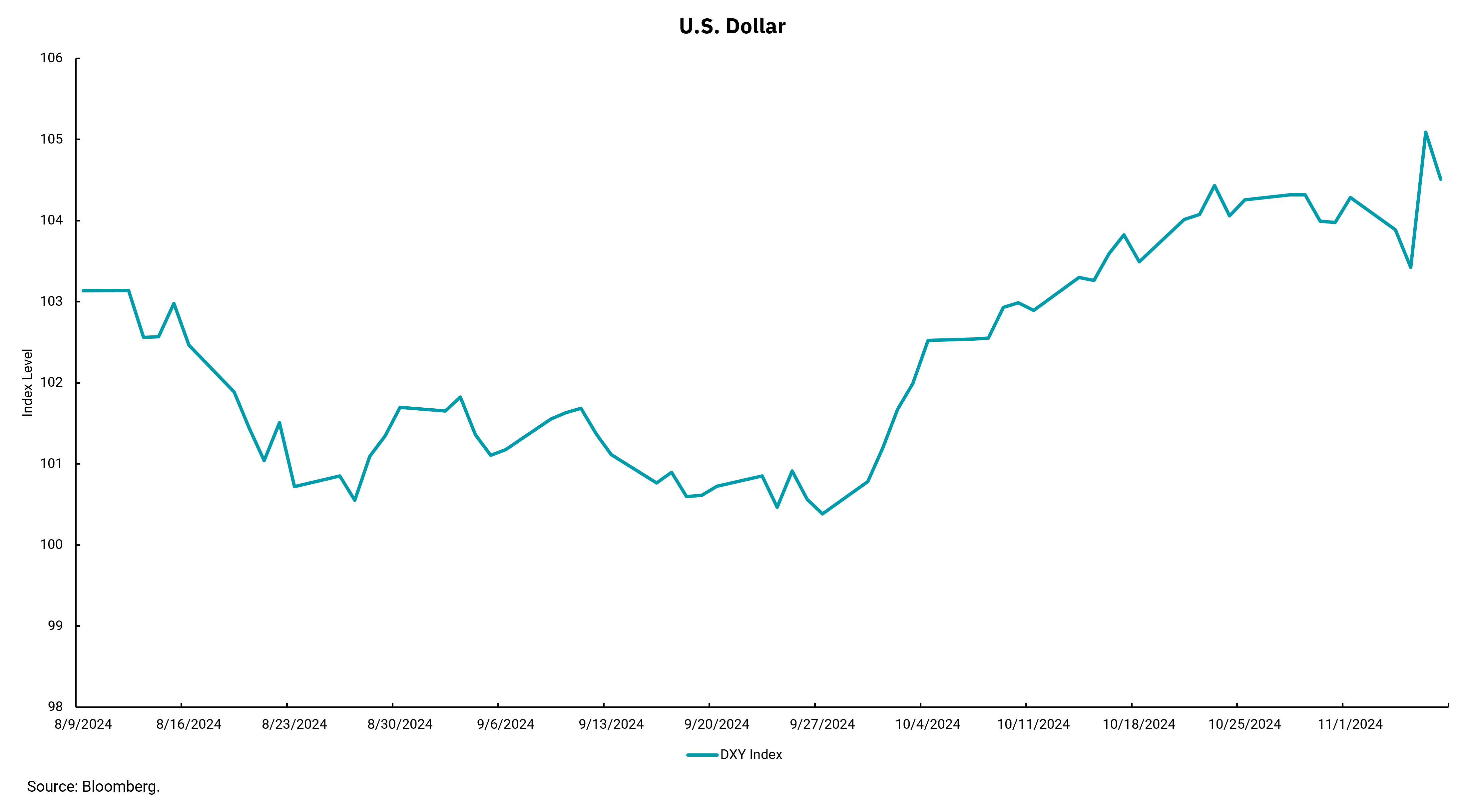

Leading up to the election, the dollar rose significantly, possibly sensing a higher probability of a Trump victory, culminating in a spike the day following the election. The dollar has taken a bit back from its initial post-election move up but remains elevated looking back on the past three months.

However, currency markets are fickle, and while the dollar index (DXY) is well off its 2022 closing high of approximately 113, the recent movement upward bears observing. Does it mean that the inflationary effects of upcoming policies won’t be as bad as some are suggesting but instead more growth inducing? It’s certainly possible that we will have a relatively strong economic growth backdrop without a corresponding strong move in inflation. Still, that does not take away from the fact that the U.S. should address its fiscal position at some point down the road.

Other implications from a stronger dollar include potential headwinds for internationally-focused U.S. companies as our exports become more expensive on a relative basis. However, looking at the larger context of relatively stronger economic growth, the potentially positive effect on the equities market looks promising. In the long term, all these developments are of course, up for debate.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)