Unemployment creeping up—but labor market still strong

Strong job numbers may mean slower Fed rate cuts

The labor market's health is the number one factor in our outlook for economic growth. With around two-thirds of our GDP tied to consumer spending, a consumer with a job is vitally important.

The first week of the month is generally filled with employment data, which provides a glimpse into the job market. It starts with the release of the Job Opening and Labor Turnover Survey (JOLTS) which contains data on the number of open jobs and information on how many people are quitting and being hired. At the height of the pandemic, the labor market was a mess, with more than two open jobs for every unemployed person, leading to a significant level of turnovers and quits as employees were making job moves. Since then, the number of open jobs has declined, and turnover rates have slowed as the labor market has become more balanced. In addition, jobless claims are released weekly. These have remained very low for the size of our labor force. This might indicate that companies are reluctant to let people go as they remember how difficult hiring was during the pandemic.

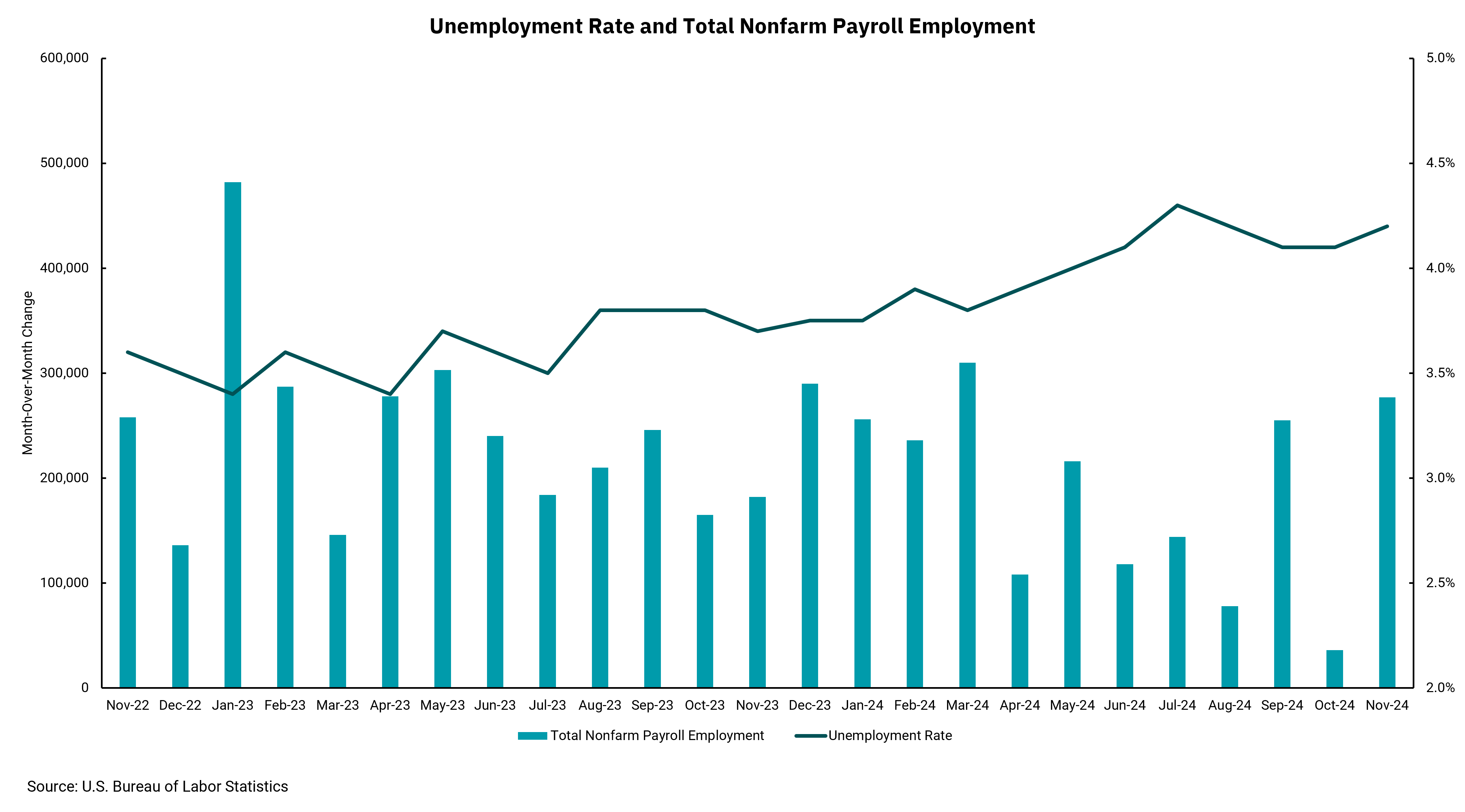

However, the most important data release is from the Department of Labor on the first Friday of the month. This week's chart shows the number of new jobs reported each month and a line representing the headline unemployment rate. In short, the labor market's performance in the face of a Federal Reserve that raised interest rates by 5% since March of 2022 has been impressive. The chart shows the trend of positive job growth every month with an average of more than 150,000 new jobs reported even as the jobless rate has crept up to a reading of 4.2% this month.

In a speech this week, Fed Chair Powell indicated the economy was stronger than they anticipated only a few months ago, which might lead to a slower rate of decline in interest rates. While the job growth number was a bit better than expectations, with some upward revisions to the previous month's gains, another part of the report that caught our eye was average hourly earnings, a measure of wage gains within the jobs data. Average hourly earnings were reported a bit hotter than expected for the fourth month in a row, up 0.4% in November. This annualizes to a 4% rate of wage growth and will make it harder for the Fed to attain its 2% target on inflation.

A vibrant economy with a strong labor market and above-trend economic output is very good for us all. If this means interest rates must stay a touch higher than expected, which will impact borrowers from homebuyers to corporations, it might not be a bad outcome for the overall economy. Having said that, we will need to watch how policies on immigration and tariffs are implemented, which in turn could impact inflation. At present, the market does not seem concerned about that outcome, and we remain optimistic as we move into 2025.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)