Inflation still a Scrooge this holiday season

Consumers’ inflation-adjusted spending remains below pre-pandemic levels

For many, it is hard to believe we are in the midst of the holiday season…Okay, maybe it's just me, but the all-important time of year for retailers is upon us. Obviously, the season is about way more than giving gifts. However, holiday spending is a material part of annual retail sales and can make or break many retailer's years.

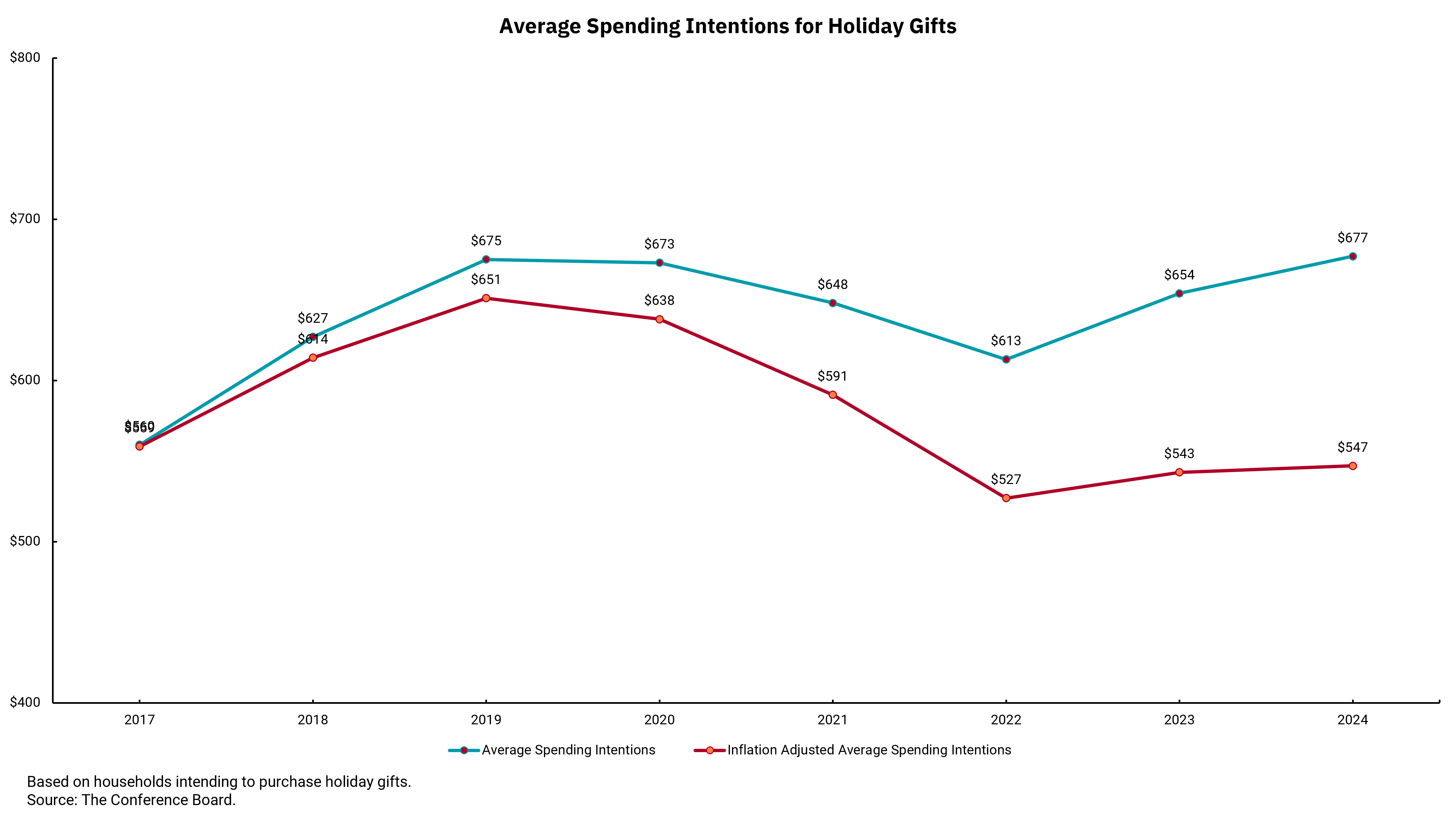

This week's chart shows average spending intentions, according to a survey by the Conference Board on a nominal and inflation-adjusted basis. The impact of the pandemic on spending is evident, as is the recovery as we worked our way through COVID-19 and supply chains healed, providing more access to goods for consumers. However, another factor is also evident in the chart: the impact of inflation. While nominal spending plans are back to pre-pandemic levels, real inflation-adjusted spending is lagging. Put another way, we are spending more but getting less, and the gap is widening. We can say the rate of inflation is slowing, but this only means that the price of goods and services is just going up more slowly than before.

In sum: this chart provides a stark visualization of the growing impact of aggregate inflation following the pandemic. Fed Chair Powell is not wrong when he states how important it is to get inflation back towards the Fed's 2% target and keep it there. In recent months, wage gains have begun to outpace the rate of inflation. Given enough time and stable prices, this will help close the gap that has opened up. This would be a welcome source of relief for consumers who have seen spending on non-discretionary items—like rent, insurance, transportation, energy and food—increase at an even faster rate than the overall rate of inflation reported by the government.

In our estimation, there are many reasons to be optimistic about the economy and markets as we move into 2025. That said, we know the last few years have not been kind from a cost-of-living standpoint. And so, a period of slowing price gains, which evolves into a more stable inflation environment, is vitally important. Here's hoping the incoming administration can find and implement the right mix of policies that improve growth while limiting inflation.

From our team, here's hoping you and yours have a safe and wonderful holiday season. And here's to 2025 being the best year ever.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)