Job market not back to normal yet

Wages, a key factor in inflation, still too high

In an economy supported primarily by consumer spending, consumer health becomes paramount. A broad array of factors influence consumers, like inflation, but the primary influence is the job market. Consumers with jobs are much healthier, from an economic sense, than those without a job. And so, not surprisingly, data around employment plays a key role in our outlook.

There are multiple reports which provide insight into the job market. For example, every week, we get data on new jobless claims and continuing jobless claims. High-frequency data, such as these, can be important as we try to identify shifts in trends, but it can be volatile. Then, every month, we get reports on the Job Opening and Labor Turnover Survey (JOLTS), which gives us information on the number of new jobs and new hires, along with how many people are quitting their jobs. On the first Friday of each month, we get the Department of Labor’s (DOL) report, which gives us information on new hires, hours worked, labor force participation, and wages. The monthly DOL labor report is considered the most comprehensive look into the job market.

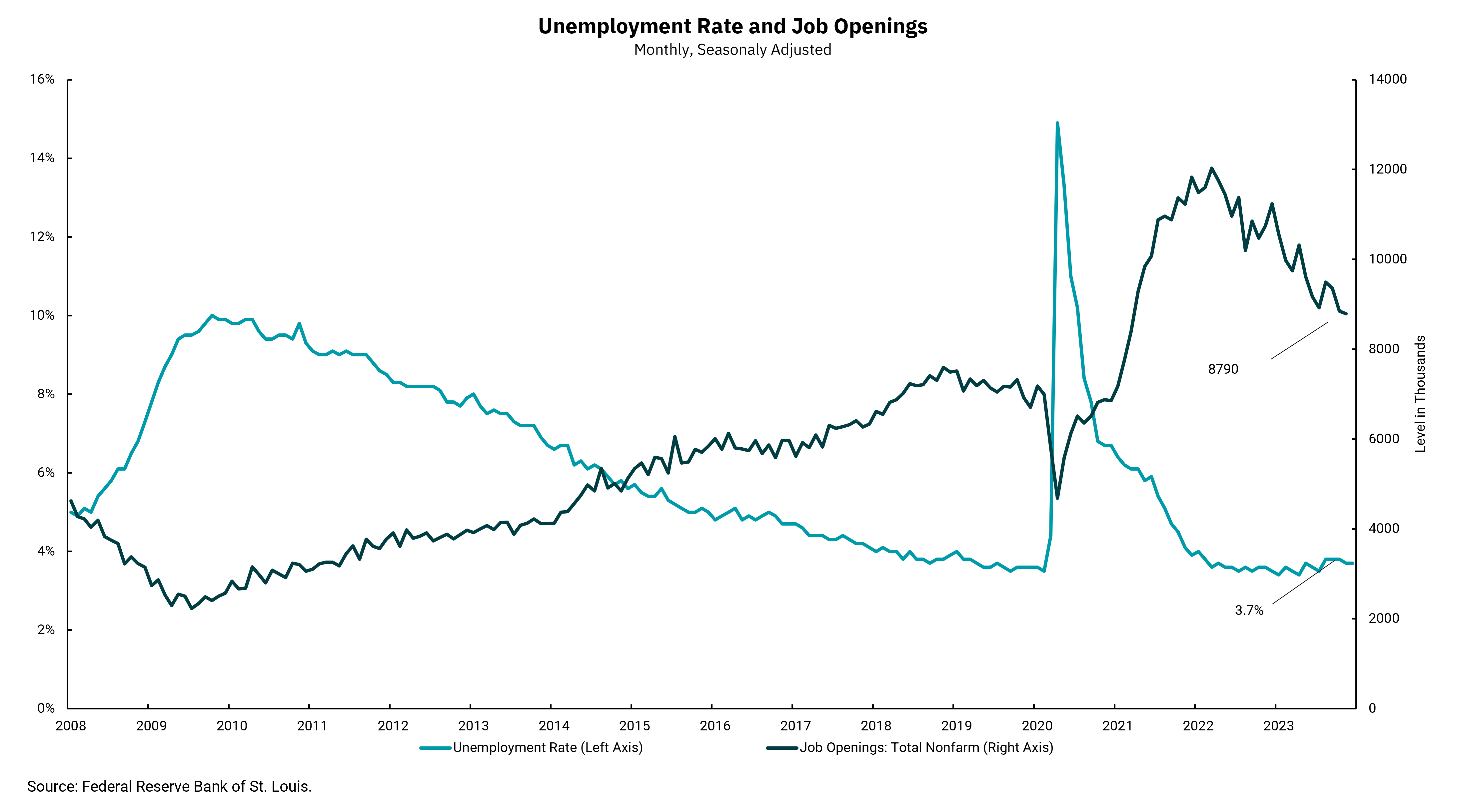

This week’s chart combines information from the JOLTS report and the DOL employment report released on January 5. A key part of our outlook for the economy is jobs. A key part of the inflation outlook is wages. Thinking about the balance of labor supply versus labor demand can give us an idea of what we might expect as we think about labor costs going forward. The dark line on the chart represents the number of open jobs in the JOLTS report, while the lighter line represents the headline unemployment rate in the monthly DOL report.

We can clearly see the impact of the pandemic and the rapid recovery from an unemployment rate that spiked to over 15%. As companies realized business would return, demand for workers spiked and job openings went above pre-pandemic levels. At one point, there were roughly two open jobs for every unemployed person in the U.S. This was an environment where demand for labor was so high it sparked significant wage gains. Competition for workers between companies was fierce, and inflation surged higher.

Of course, wages are not the only input to the inflation equation. Over the last few months, we have seen a welcome easing of inflationary pressures. Still, when thinking in the longer term, the Fed is paying attention to wages, and within this month’s DOL report, average hourly earnings were up a bit more than expected. We continue to expect inflation pressures to ease in the coming months. Nevertheless, before the Fed can claim “mission accomplished” on getting inflation back to its 2% target, we will want to see the labor market continue to normalize. If we can do this without seeing unemployment rise materially, it would be a huge win for the Fed, the economy and U.S. consumers.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)