As inflation drops, consumers continue to spend

After declining in October, retail sales up last two months

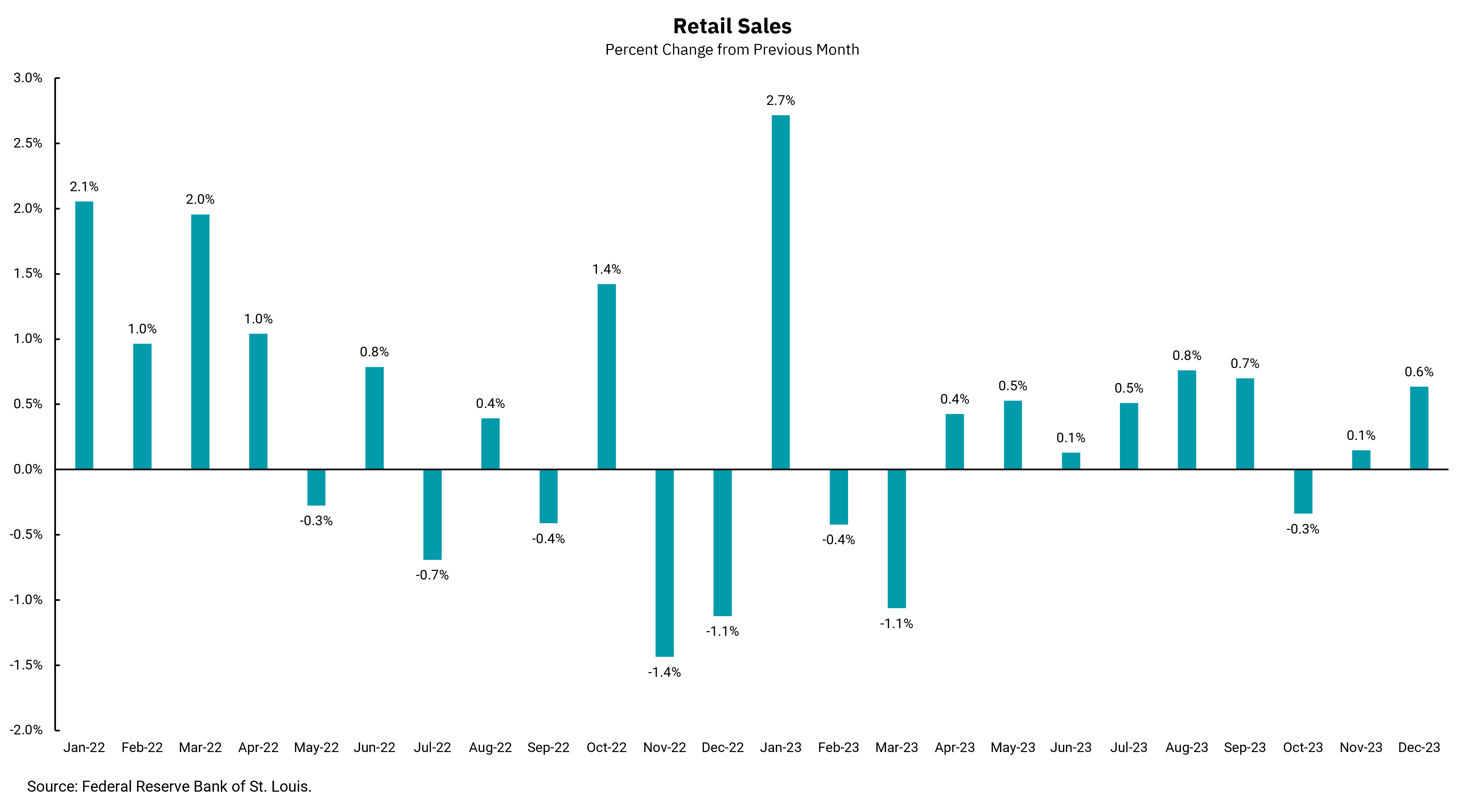

After a solid run of increasing retail sales for most of 2023, a decline in October raised some questions about the U.S. consumer’s ability to continue to spend. Consumer spending is the most significant component of gross domestic product (GDP), so this heightened anxiety was understandable, especially at the beginning of the all-important holiday shopping season.

The concern seems unfounded now, however, as data released this week showed a better-than-expected 0.6% increase in retail sales in December. In addition, inflation has been falling, meaning most of this increase was in real terms. It is understandable to be cautious as we think about how far the Federal Reserve has moved interest rates and the ongoing shrinking of its balance sheet. Still, to date, the employment market remains firm, acting as a strong support for consumers. The weekly reading on jobless claims showed initial claims falling to only 187,000, near a multi-decade low and reflective of an outlook for continued low unemployment rates.

Our outlook from here is that the Fed's next move will be toward lowering rates. This view is primarily driven by an expectation for inflation to continue to moderate, which should allow the Fed to lower overnight interest rates. Lower energy prices are helping overall inflation declines, and an increased supply of multi-family units should allow rents to soften over the coming months. Changes to the global economy, multiple armed conflicts and the stillstrong labor market will be potential headwinds to the Fed accomplishing its goal of getting inflation to 2% and keeping it there. Hence, it is too early for the Fed to consider inflation a past problem.

Somewhat lower rates would be a welcome development for potential home buyers, but we should not expect a return to the ultra-low mortgage rates borrowers enjoyed during the pandemic. On the flip side, this also means savers should not have to bear the brunt of near-zero interest rates on shorter savings and deposits.

We expect economic growth to slow from levels we saw in the back half of 2023 yet remain positive, inflation to continue its recent decline and corporate profitability to support equity valuations. A recession remains a possibility but is not our base case.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)