Calls for the Fed to consider March rate cuts are increasing

U.S. economy hit “near-ideal” condition of higher growth, lower inflation in 4Q

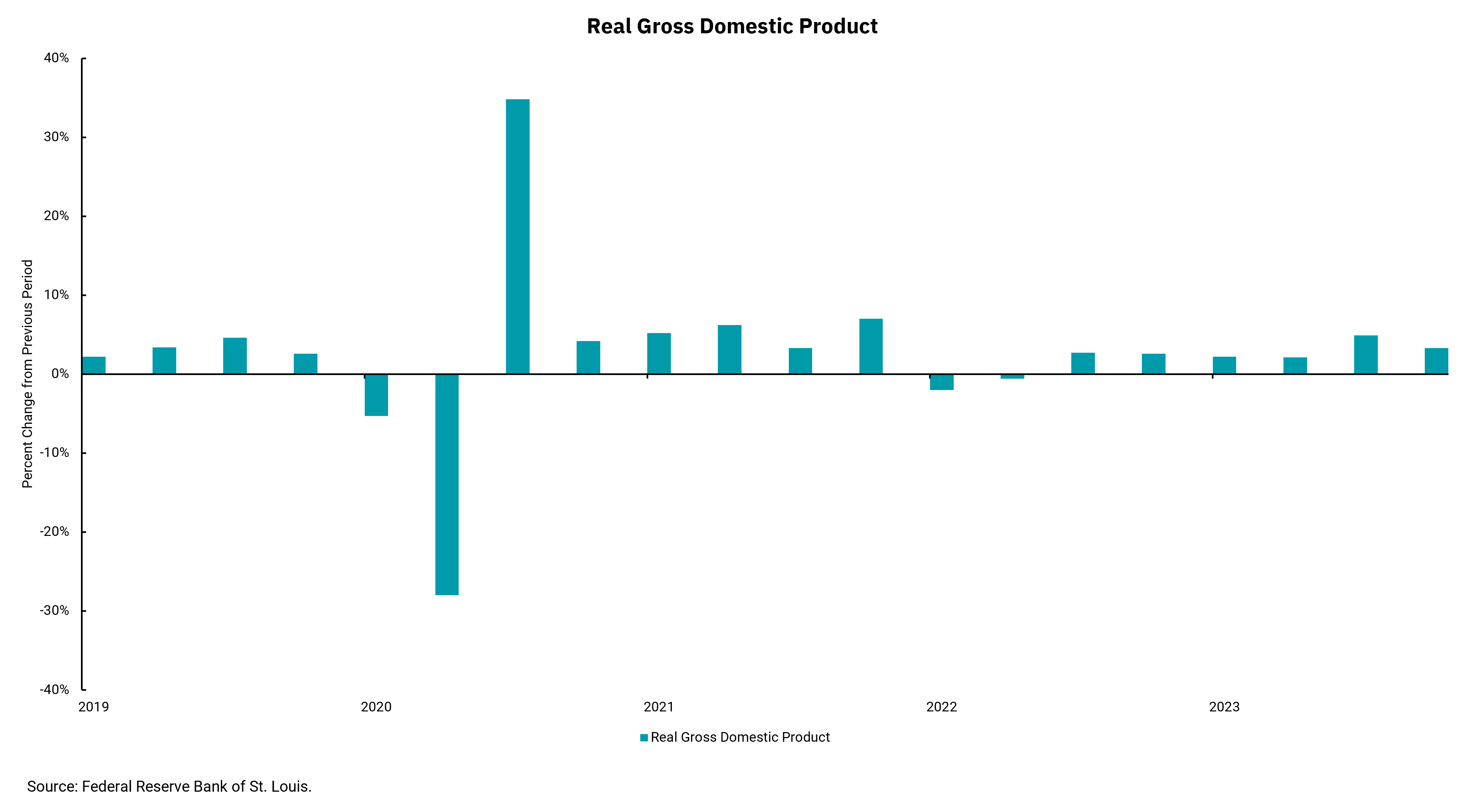

The U.S. economy was expected to slow in the fourth quarter, after growing by an inflation-adjusted rate of 4.9% in the third quarter of 2023. And while growth did slow, it was still quite a bit higher than expected, with inflation-adjusted growth totaling 3.3% (compared to an anticipated 2%). In addition, the rate of inflation embedded within the number, the “GDP deflator”, was lower than expected, which helped produce a near-ideal condition—higher real growth with lower inflation.

After starting the year slowly, the overall expectation for growth in 2023 was around 1.9%. However, this third and fourth-quarter growth means the rate will be closer to 2.5%. I say “closer” because the fourth quarter GDP number will be revised over the next couple of months, which could impact the final score on growth. Suffice it to say, though, that 2023 was a year where the economy's resilience surprised many to the upside. Despite higher rates, which now appear to have peaked in July of 2023 at 5.25-5.5%, the employment market remained firm. In fact, since the Federal Reserve began one of the most aggressive tightening cycles in history in March 2022, the unemployment rate has only moved from 3.6% to 3.7%. The robust nature of the job market has served as a huge support for an economy based primarily on consumer spending.

Looking forward, we think the impact of higher rates will continue to be revealed over the next few months as higher borrowing costs start to bite. Still, the economy has significant momentum as we enter an election year where we expect fiscal spending to remain a tailwind for growth.

Meanwhile, the lower-than-expected GDP deflator figure adds to the overall picture of slowing inflation, as measured by the Consumer Price Index (CPI), Producer Price Index (PPI) and the Fed's preferred measure of inflation—the Personal Consumption Expenditures Price Index (PCE). The fact that inflation is slowing should provide the Fed room to begin to lower rates as we move through 2024. The Fed has its first meeting of the year next week, and while there is a very low chance of any rate action, the spread between inflation and the overnight Fed Funds rate is widening. Looking at core PCE over the last three to six months, inflation is annualizing at or very near the Fed's 2% target. The year-over-year number is still elevated at 3.2%, down from a peak of 5.1%, but the direction of inflation is lower and calls for the Fed to consider a March cut are rising.

There is much for the Fed to consider when implementing monetary policy, but they are in an advantageous position now as economic growth is positive and unemployment remains low. Operating in a non-crisis environment also is an advantage. They should try to make sure their action, or inaction, doesn't cause one.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)