Path to 2% inflation may not be a straight line—nor a certainty

Potential for ‘echo wave’ of inflation still exists

We talk about inflation a lot. However, that emphasis is understandable: inflation and employment influence virtually every spectrum of the economy. Consumers and businesses feel the effects of inflation every day, and its impacts on their actions and sentiments are material.

And so, the good news over the last few months has been the significant decline in inflation, even as we have seen economic growth remain positive and unemployment remain low. As the Fed began raising rates in March 2022, there was broad agreement that higher rates would slow the economy, leading companies to react by reducing costs, resulting in higher unemployment. However, the headline unemployment rate, which was at 3.6% in March of 2022, has only risen by 0.1% to its latest reading of 3.7%. This outcome is surprising and a huge win for the economy, consumers and the Fed. Unemployment has now been below 4% for 26 straight months, the first time this has happened in the U.S. since the mid-1960s.

As inflation has declined, markets and the Fed have anticipated rate cuts. After all, the short-term Fed Funds target of 5.25-5.5% is above the current inflation rate. Further declines in inflation would mean the Fed is becoming even more restrictive and risking a bigger slowdown in economic activity and higher unemployment than necessary. Still, the issue for the Fed is that the current inflation rate remains above their 2% target, and they consequently have indicated a need to have “greater confidence” that the path of inflation is heading towards 2% on a “sustainable” basis.

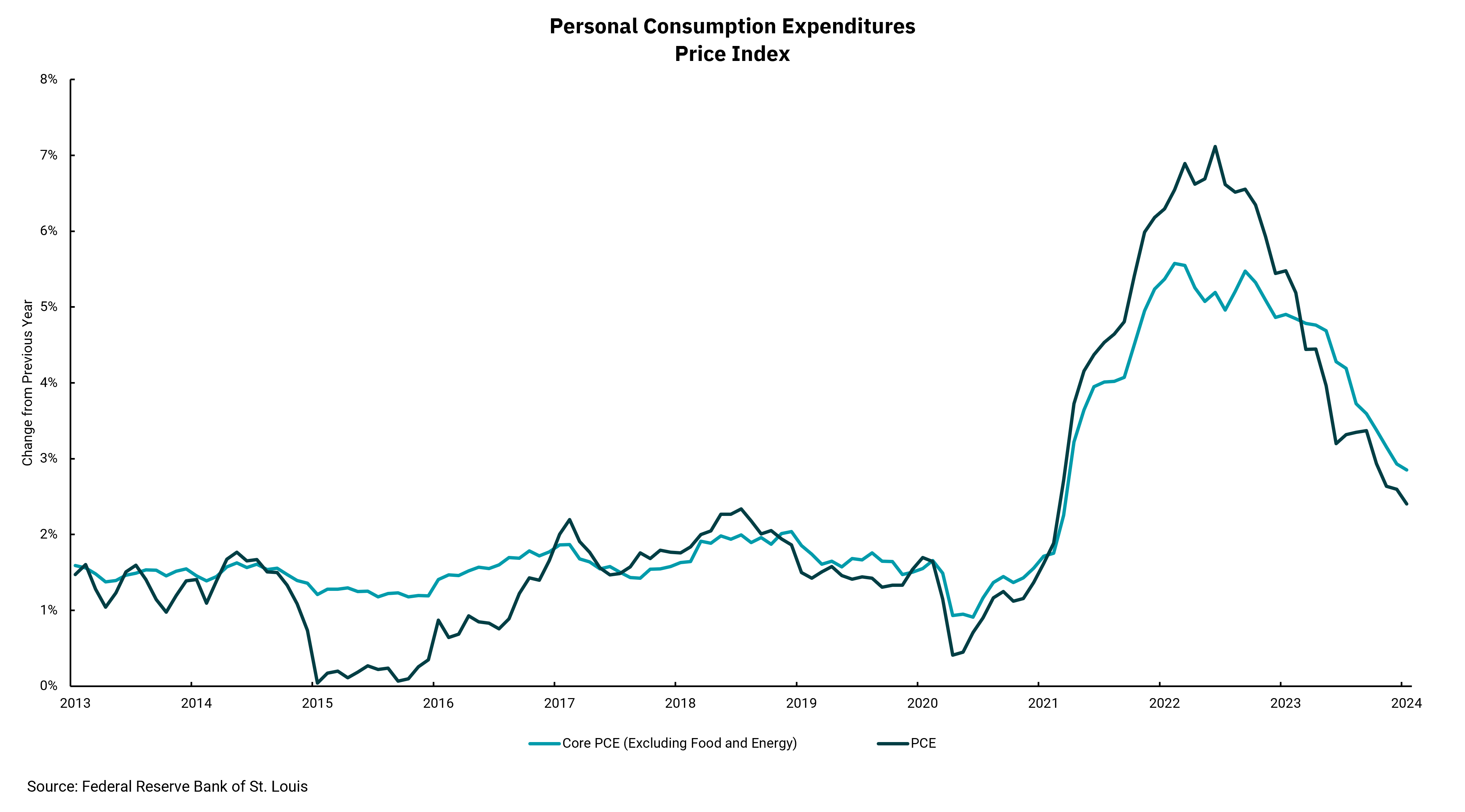

For many, this Fed is responding too slowly, as high rates impact individuals and companies whose borrowing costs have risen. In past commentaries, we have shown charts illustrating the tendency for inflation to come in “waves” where an initial move higher, as we saw in 2021 and 2022, is followed by a decline only to be set up for an echo wave of inflation at an even greater magnitude. Yet, the Fed’s “patience” seemed to be warranted after recent inflation readings on the consumer price index (CPI) and producer price index (PPI) both came in hotter than expected, putting a lot of focus on the Fed’s preferred measure of inflation, the personal consumption expenditures (PCE).

Unlike the CPI and PPI readings, the most recent PCE came in as expected, which limited the market impact. However, core inflation, which includes the less cyclical parts of inflation like wages and rents, is declining more slowly and remains above headline inflation. In fact, within the CPI data, there were some adjustments within the rent component, which is the largest part of the CPI data set, leading to an increase in those measures and putting upward pressure on the overall inflation reading. As a result, we do not think the recent readings signal a shift in the “trend” of inflation. This is a reminder that the path to 2% inflation will not be a straight line nor a certainty. However, our outlook for the Fed to begin reducing rates at their June meeting remains in place. They likely will not be easing traditionally to spur economic activity but rather recalibrating policy.

And now one final aside on inflation after a week on the road in Texas, visiting with numerous clients and prospects in San Antonio, Austin and Houston: people and businesses are feeling inflation at different levels than the government data indicates. Almost universally, the impact is greater than government statistics. They are not wrong. Depending on what part of the economy you operate in, one’s “personal inflation rate” can differ materially.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)