Spring is in the air, boosting some retail sales

Spending on building and gardening materials is up, while furniture sales are down

The U.S. consumer is the workhorse of the domestic economy, as roughly two-thirds of economic activity is based on household spending. Within total household spending, retail sales are an important component. Recognizing all this, Congress provided numerous—and material— fiscal stimulus plans to put money in the hands of consumers. As a result, there was a period of increased savings and reduced indebtedness. However, it didn’t take long for consumers to revert to their habit of spending money if they had it—and they had a lot of it.

Consumers also changed how they spent money, and this increased demand caused inflation to rise because we were in a supply-constrained economy. As we move forward from this pandemic surge in consumption, we should expect consumer spending—and data like retail sales—to revert back to lower numbers.

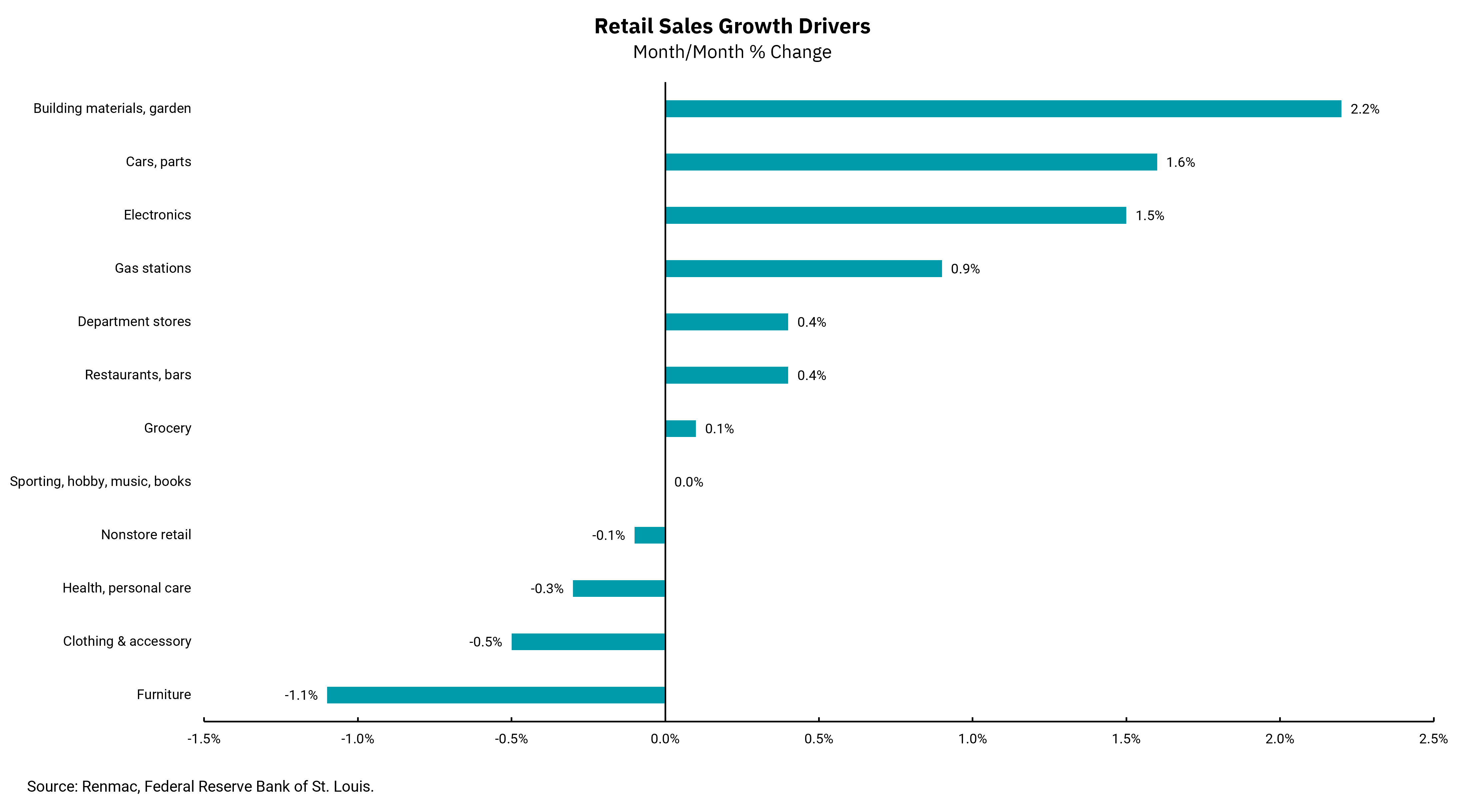

Although month-over-month data can be lumpy, we are seeing retail sales that are slow but remain in a longer-term uptrend. In addition, we have seen how consumers spend their money on return to pre-pandemic sectors. For example, during the pandemic, we could not travel or eat out often, so spending on goods exploded higher than spending on things like going to restaurants and bars. More recently, there have been outright declines in spending on some goods, like furniture and clothing; overall, retail sales were positive in the most recent report.

Another area that saw huge increases during the pandemic was “e-sales,” or non- “brick-and-mortar” store sales. Today, internet commerce is still a large part of sales, but it seems the consumer is back to thinking shopping is about the experience, not just the purchase. Consequently, department store sales have been increasing. Last month, we saw a big jump in building materials and garden supplies. Spring is in the air.

Looking forward, we are entering the tax refund season, which could provide a boost as we see March and April retail sales. At its base, the consumer continues to be supported by a robust job market, low unemployment and real wage gains. The cumulative effect of inflation remains a problem, but as inflation has declined, we have seen some relief for consumers and their pocketbooks.

Shifts in interest rates and economic growth can and will impact consumer spending going forward. Still, in the long run, the consumer is expected to be a major driving force for economic growth.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)