The Fed appears unruffled by recent inflation readings

However, more months of warmer-than-expected data could change the tune

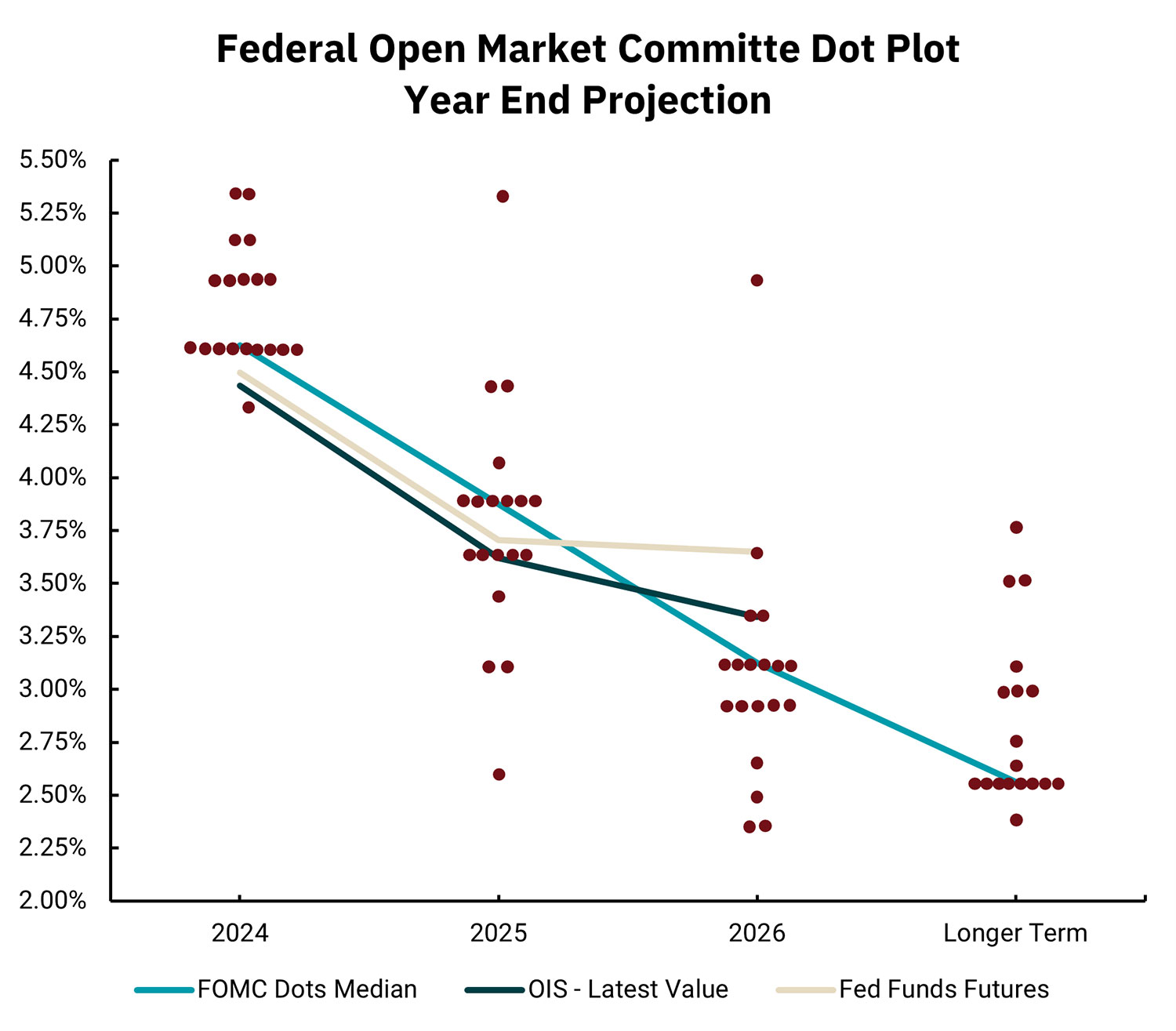

The Federal Reserve updates its Summary of Economic Projections (SEP) every three months. The March Federal Open Market Committee (FOMC) meeting provided the latest update. The update includes new economic growth (GDP) estimates, employment, and inflation. Additionally, we get an update on the Fed’s “dot plot .”The dots represent rate estimates from individual FOMC members, both voting and non-voting, over time. The integrity of the dot plot in forecasting future policy is questionable; some might say it’s useless, but it can provide a glimpse into the consensus of the committee members and an idea of the overall direction of rates.

As compared to the December dot plot, the variations within the outlook for 2024 have narrowed. However, looking at 2025 and 2026 shows how hard it is to make forecasts. Consider that these are all members of the FOMC. All are highly educated and possess the latest and best information. Yet the dispersion of estimates is very wide, ranging from virtually unchanged for one dot to a target of 2.5% for another in 2025. This reflects a big difference in the outlook for the economy and inflation amongst the committee members. Those with higher rate estimates might think inflation is a bit stickier and/or economic growth will to remain firm. At the same time, those with lower rate estimates might believe that the economy will weaken, allowing inflation to fall faster.

The dot plot may be most helpful as we consider 2024 and then the longer term. Why? While even short-term forecasting is hard, it is easier than 24-36 months out, and when we think about the longer term, we can remove the cyclicality of the economy and just think about a longer-term average. Based on the dots in 2024, the central tendency shows a consensus for three rate cuts, which matches the central tendency of the dots in the December 2023 SEP. However, The Fed’s forecast for growth in 2024 is a bit higher than in December, and the forecast for inflation is also a bit higher. This led some economists to wonder if the Fed might not be a bit more tolerant of inflation staying above their 2% target for longer. While Fed Chair Powell disagreed with this assessment during his post-meeting press conference, it seems the Fed feels they are currently restrictive enough not to worry about the slightly warmer inflation readings of the last month. More data could change that tune, but the Fed wants to begin lowering interest rates. Well-behaved inflation could warrant this, and the next rate move is lower, but one could find members of the FOMC who would say otherwise.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)