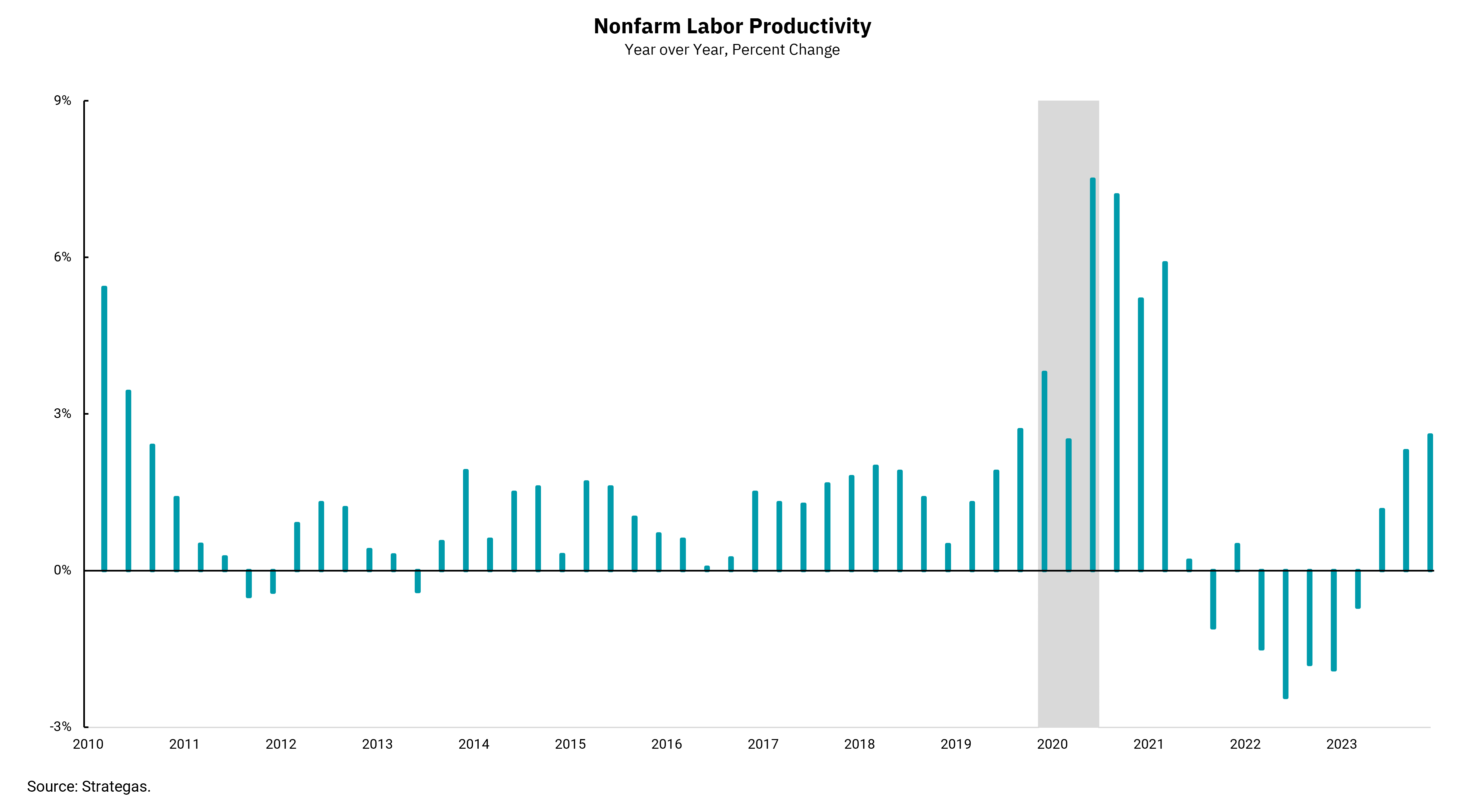

U.S. worker productivity resurging

Strong March jobs report setting the right tone for rate cuts

As we think about economic growth and inflation going forward, productivity will be a key variable—a factor that we should consider as we view each month’s jobs report. The March jobs report reflects a job market that remains robust. Growth in nonfarm payrolls far exceeded expectations and grew by 303,000. The headline unemployment rate fell to 3.8% and the labor force participation rate rose. Average hourly earnings increased by 0.3%, which put the year-over-year growth rate at 4.1%, versus last month's 4.3%. Overall, it was hard to find any bad news in this report, unless one was hoping for a report that might lead the Fed to consider cutting rates.

It is almost unbelievable that the economy continues to show above-trend growth, and unemployment remains below 4% for the 26th consecutive month (the longest such streak since the 1960s), after the Fed raised rates by a full 5%. "Big fiscal" is certainly playing a part as the federal government continues to pursue deficit spending—with more on the way, as we implement the programs that are part of the Infrastructure and Jobs Act, the CHIPS and Science Act and the Inflation Reduction Act. Also, the labor force has been positively impacted by immigration, as some 2 million jobs have been allocated to non-U.S.-born individuals over the last couple of years. This has allowed economic output to expand, while reducing the inflationary aspect on wages.

There is a reasonable question about the sustainability of both tailwinds going forward, which will bring the idea of productivity to the forefront of the discussion. A rough estimate of gross domestic product (GDP) can be attained by looking at workforce population growth and adding productivity. Our chart this week shows that productivity is variable but, overall, a positive force. Although short-term changes in the workforce and output can distort the picture, in the longer term, the increasing use of technology along with business-friendly policies have allowed the U.S. economy to outperform many foreign economies. The negative productivity we saw during the pandemic reflected high wage growth due to demand for workers during a period when output growth was limited. As wage pressures have declined, the economy's recent performance has allowed productivity growth to resume. This is a positive for the Fed as they think about bringing inflation back to their longer-term target of 2% and should provide an environment where rates can be lowered.

However, it is important to note that the Fed will be lowering rates for a different reason than many of us are accustomed to. Rather than lowering rates to stimulate demand, the Fed will be lowering rates to maintain a steady level of restrictiveness to policy. In fact, the risk of spurring additional demand is causing the Fed to hesitate and state a need for "more confidence" in inflation declining before acting. Continued growth in productivity can be part of the "confidence" the Fed needs to begin to lower rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)