Still feeling the pinch from higher prices?

“Real” wages no longer freefalling—but consumers may still be aching from the past

As I travel and get the opportunity to interact with individual investors, company employees and owners, there is one economic topic on which everyone has an opinion—inflation. And why not? It impacts everyone, which means we all have a perspective on its impacts and opinions on what to do about it. Meanwhile, inflation is also an area where the disconnect, as the language of economists or politicians and the meaning to actual participants in the real economy can vary widely.

As a prime example, the common economic and political message today is that inflation is declining. Is it really? It depends on the definition of “declining.” For economists and politicians, the definition of “declining” is that, if inflation was at 9% and is now at 3%, then inflation is declining. However, for most real-economy participants, the definition of “declining” is outright price declines, not prices still going up but at a slower pace. Well, we have a word for outright price declines: deflation.

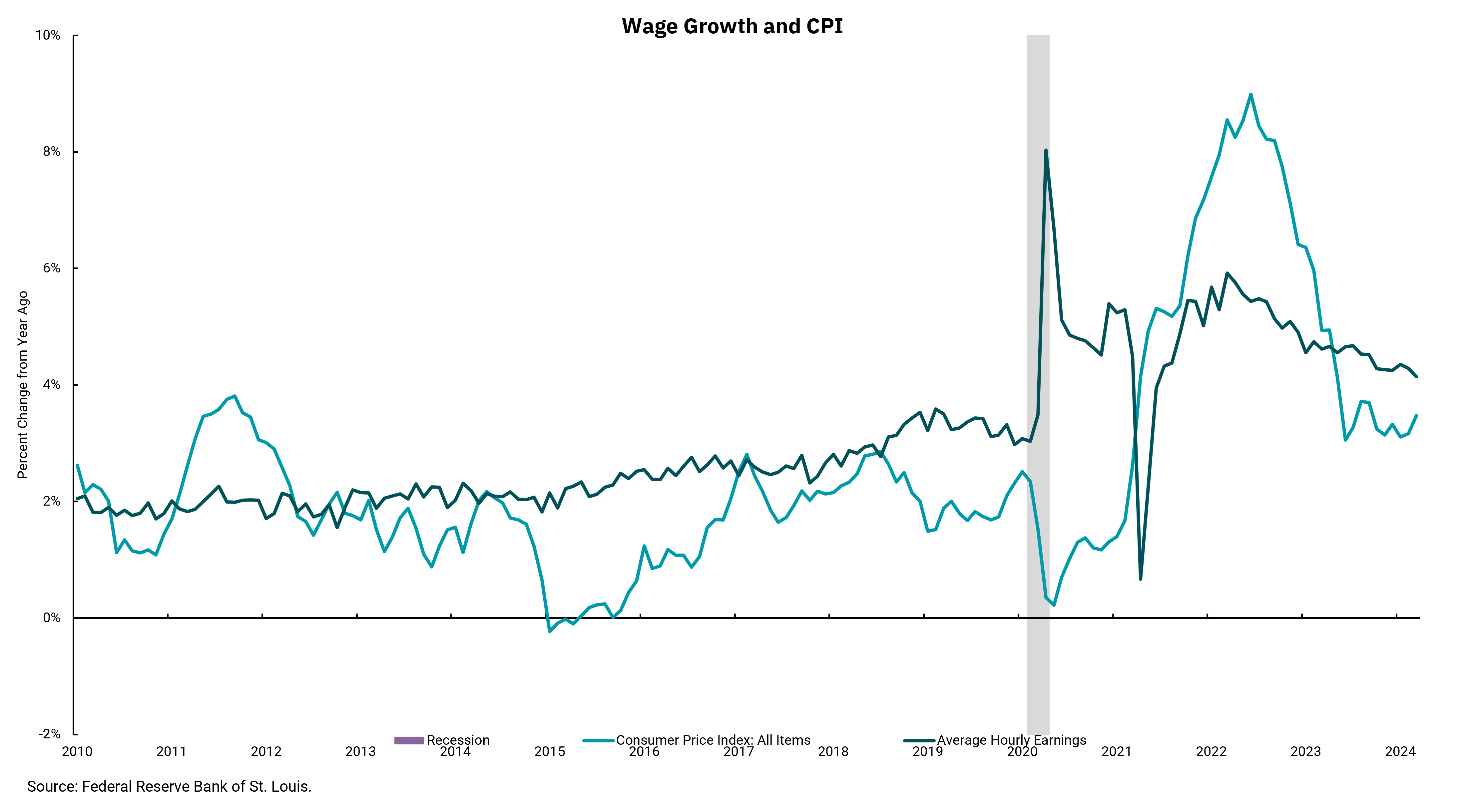

Still, for many, an economist or politician talking about declining inflation is like hitting your thumb with a hammer, and then hitting your thumb again but not as hard and being told the second hit is better than the first. As an aside, we see the same thing when politicians talk about cutting spending but, in fact, they are only slowing the growth rate of spending. They are still spending more—just not as much as they were going to spend before. This brings us to this week’s chart, which shows a longer-term view of wage growth versus the headline Consumer Price Index (CPI), which is one measure of inflation. We know the Fed thinks about “core” inflation when it comes to monetary policy, but as consumers, we live in a “headline” CPI world.

We can see a few things looking at the data. First, things were much more stable before the pandemic and, for the most part, real incomes were rising as wage growth exceeded headline inflation. This was a period marked by improving consumer sentiment. Second, the pandemic clearly upset the stability we had been seeing. The spike in real wages occurred as inflation fell and Congress showered the economy and consumers with stimulus payments. As stimulus slowed and inflation ramped higher, real wages fell until wage growth rebounded. Yet wages did not rebound fully enough to make up for the increase in inflation, resulting in a multi-month period of negative real wage growth. Not surprisingly, this period was accompanied by a decline in consumer sentiment. More recently, as inflation has been falling from its peak, wage growth, while declining, is back at levels that produce real wage gains for consumers.

However, the message of wage earners doing better is lost when considering the aggregate impact of the period when inflation was far outstripping wage gains. That is, over the total period from 2021 forward, inflation has outpaced wage gains. If recent trends hold, we expect consumers to begin to feel better. As it is, however, our collective “thumbs” still ache from the period of inflation reducing our overall standard of living, and while one definition of inflation is getting better, prices are still moving up.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)