Consumer sentiment rising—but still below pre-pandemic levels

Lower-income consumers feeling drag of inflation, high rates the most

As often discussed, the U.S. consumer is vital to the domestic economy, with household spending contributing to roughly two-thirds of economic activity. While growth for the first few months of the year has been positive, consumers continue to face rising property and auto insurance costs, stubbornly elevated home prices and high interest rates on mortgages and credit cards.

Recent retail sales reporting for April appears to point to consumers slowing down their spending habits. Retail sales came in flat month-over-month, compared to an expected 0.4% increase. While this may indicate that consumers are reevaluating how much they are spending, other factors, such as the strong labor market and rising incomes, should provide continued support.

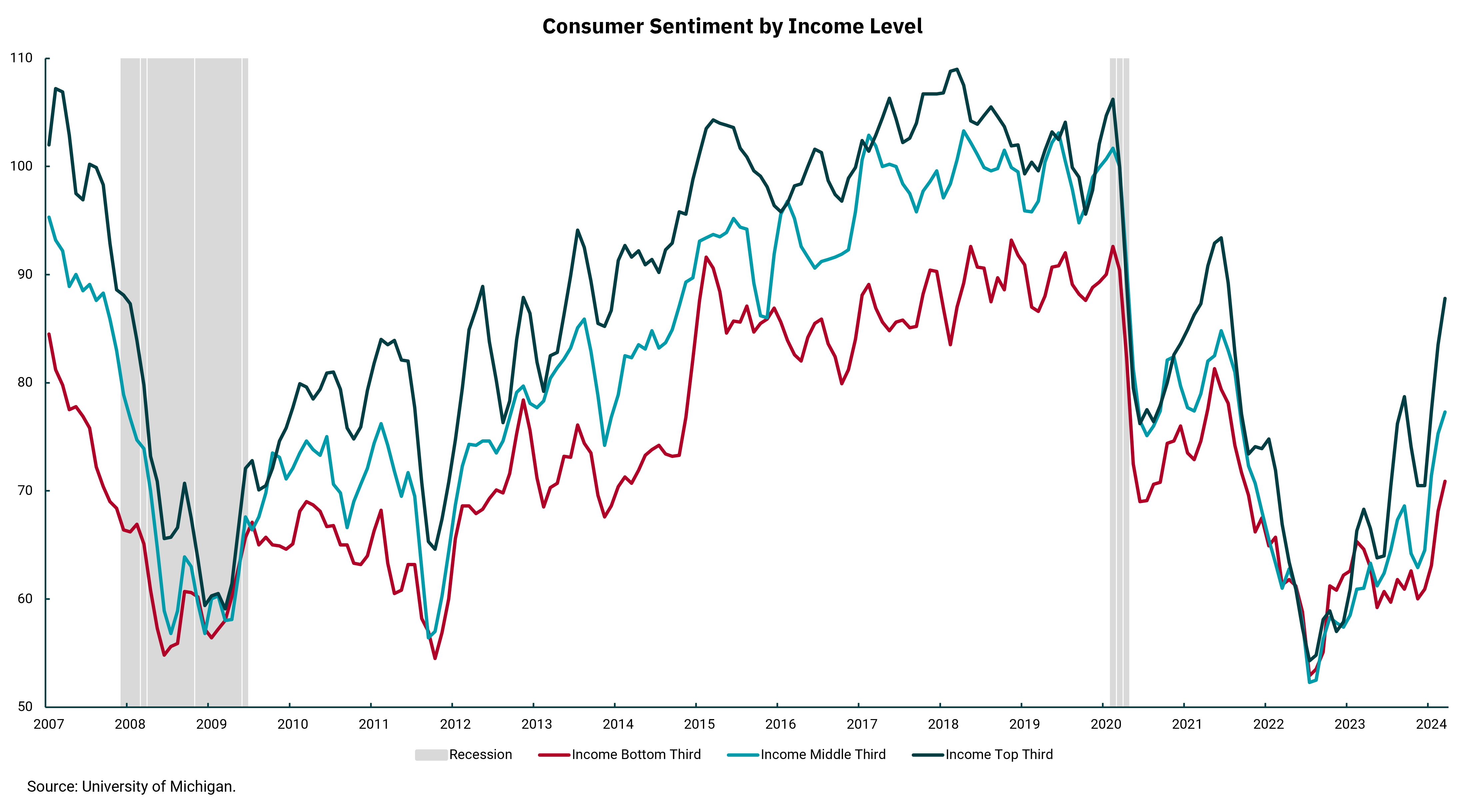

However, retail sales doesn’t tell the story of how consumers feel about their financial futures. For that, we turn to the University of Michigan's Consumer Sentiment Survey. This week's chart takes a more targeted look at consumer sentiment, categorizing the survey findings by income level. Notably, the sentiment of the bottom third of income earners (red line) continues to trail behind that of higher-income earners. This disparity could reflect consumers’ attitudes toward their overall financial health, but the effects of aggregate inflation and persistently high interest rates often carry more weight.

Although the Federal Reserve has made significant progress in its fight against inflation, current inflation levels do not represent the full effects of inflation from the years coming out of the pandemic. While it’s true that real (inflation adjusted) wages have grown significantly coming out of the pandemic, this figure does not incorporate how consumers truly feel about their economic circumstances, and this appears particularly true at the lower end of the economic spectrum. It may be easy to look at the data and see all of the progress made to bring inflation down from its 9% high, but the everyday consumer recalls the prices they used to pay and the aggregate inflation they have endured over the past three years.

Today’s chart accentuates the variable impact of inflation which hurts those who can least afford it the most. If we can accomplish the goal of reducing inflation to 2% without a material increase in unemployment, it would be a huge win for all of us.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)