Should you ‘sell in May and go away’?

Despite the Wall Street axiom, this summer may be warm for equity markets

Many investors are familiar with the old Wall Street axiom “sell in May and go away.” It essentially suggests investors should reduce equity exposure during the six months from May to October. And so, is there any truth to this axiom? Well, on one hand, research has found that May through October is the weakest six-month return window for the S&P 500 going back to 1950. On the other hand, although this data from May through October appears poor, a different story emerges by cutting the data in half and looking at the historical S&P 500 performance data for just the period from April 30 to July 31.

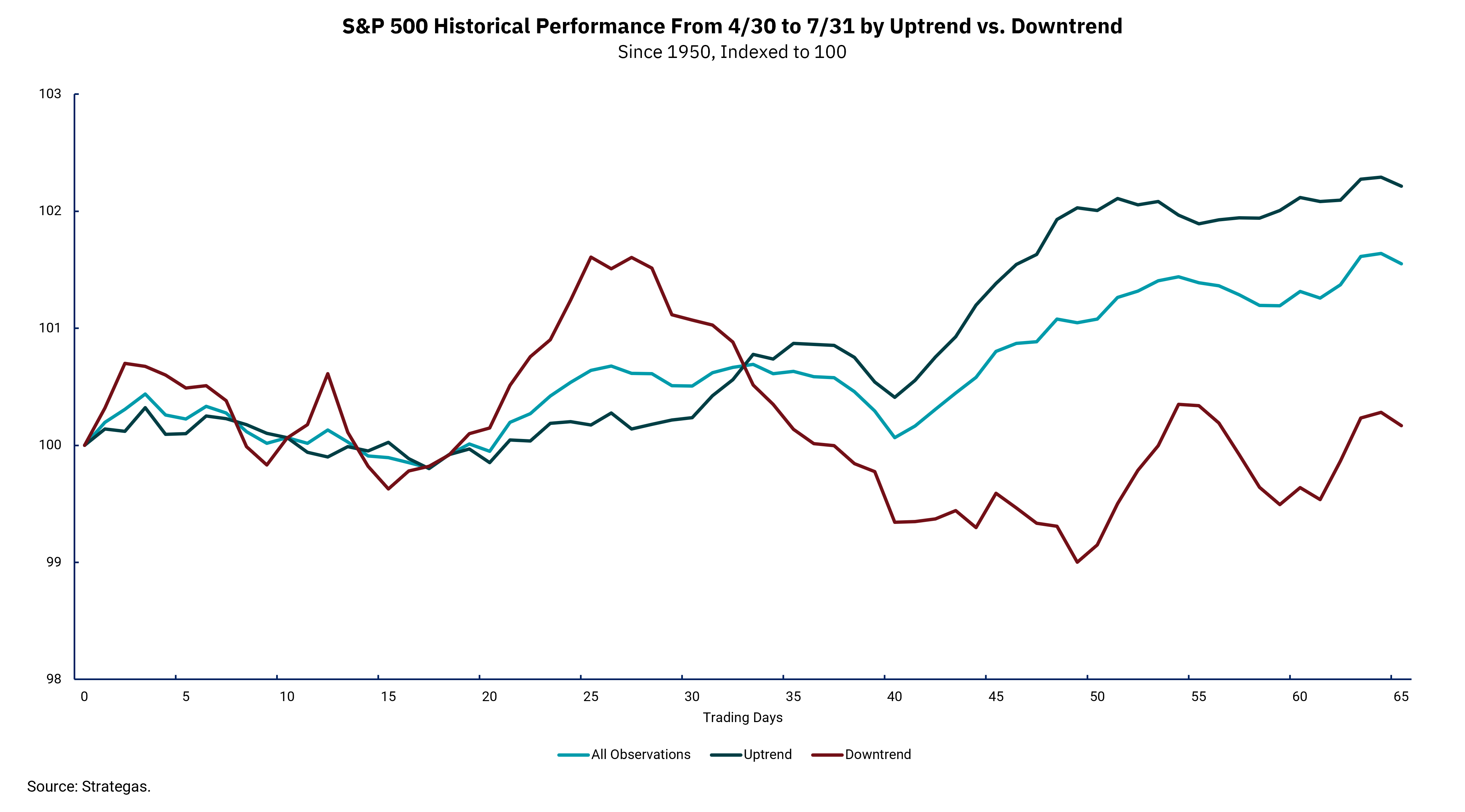

Our chart this week shows just that: the performance of the S&P 500 in trading days from April 30 to July 31 since 1950. It’s separated into three data sets: performance for all years, performance during an upward-trending market environment and performance during a downward-trending market environment. Looking across all observations (the light blue line), the period between April 30 and July 31 delivered a positive return of 1.6%. During the years coinciding with an upward-trending market environment (the dark blue line), the period between the same period delivered a return of 2.2%. During the years coinciding with a downward-trending market environment (the red line), the S&P 500 returned 0.2%. In other words, in all scenarios, the performance was positive, though to differing degrees.

Today, the S&P 500 is in an upward-trending market environment. The best period of performance in an upward-trending market environment does not start until late May, according to the data. And so, our evaluation of historical performance suggests that there may still be room for the S&P 500 to appreciate in the coming months, meaning that the axiom likely doesn’t hold true right now.

Still, it bears considering: what is the obstacle most likely to stand in the way of the equity markets continuing to perform well? The most visible near-term risk surrounds inflation, interest rates and the Federal Reserve. If investors receive hotter-than-expected inflation readings (or inflation-related data), this could cause an increase in interest rates and bring back fear of a more hawkish Federal Reserve—a Federal Reserve that is more likely to adhere to a higher-for-longer policy approach to interest rates. There are certainly other potential risks lurking in the markets out there, including geopolitical events. Still, if history is any guide, investors may be looking at a relatively warm summer—in the equity markets, at least.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)