Fed’s next move—when it makes one—likely a rate cut

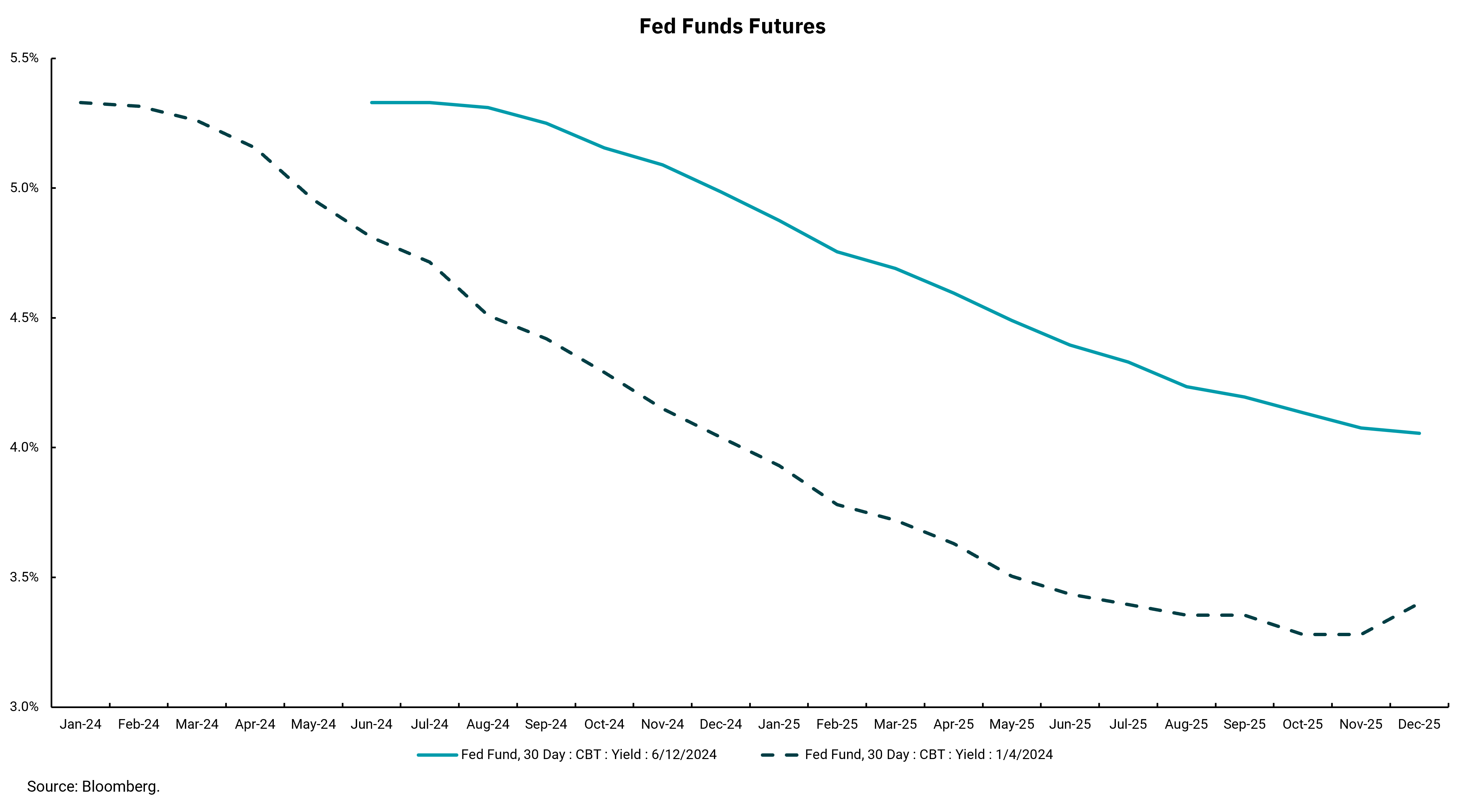

Market expectations for extent of rate cuts have leveled off

What a difference a few months can make. Using Fed Funds futures as the basis, this week's chart shows how the market’s expectations for rate cuts changed from Jan. 4 of this year through June 12. Not only has the beginning of rate cuts been pushed out, but the expectation for the total number of rate cuts is now significantly lower. However, we still believe the Fed’s next move will be to lower rates—that is, when it does make a move.

The outlook was further refined as the Federal Open Market Committee (FOMC) met for its June meeting to discuss rates and update their economic projections. During the same week, the consumer price index (CPI) report showed inflation at lower rates than expected.

Overall, the performance of the economy, markets and inflation has been impressive. Economic growth has slowed a bit from the fast pace of 2023 but remains solidly positive. While the employment market is becoming more balanced as job openings are falling, it still shows headline unemployment at 4% as we continue a streak of low unemployment not seen since the 1960s. Stock markets have powered to new highs as corporate profitability remains strong despite over 5% in interest rate increases from the Fed. And the rate of inflation is declining. The pace of declines has slowed and become a bit more uneven, but the ability of the economy to grow while still seeing reduced inflation pressures has been a huge win for the Fed and U.S. consumers.

That's not to say the Fed can let its guard down. There are signs of consumer stress as credit card and auto loan delinquencies rise. While the rate of inflation is slowing, the aggregate level of prices continues to increase, impacting those least able to afford it the hardest. At the same time, the economy is becoming more bifurcated, as those with financial and real assets, like stocks and homes, have seen incomes and net worth expand rapidly. In contrast, individuals who own fewer financial assets and are renting have seen their budgets hit hard with no corresponding increase in net worth.

It is important for the Fed to reduce inflation sustainably towards their 2% goal. Yet, in many ways, the "medicine" of higher rates hurts those most negatively impacted by inflation the hardest, too. Access to credit tends to be at a higher cost for those with fewer assets. Consider credit card debt versus home equity debt. Credit card debt is generally floating rate, meaning the increase in rates has significantly increased the cost of these kinds of debt.

Altogether, some relief from high rates could be a real help, as would be an ongoing decline in inflation. We think this is why the Fed wants to be able to begin lowering rates. A stable rate policy while inflation falls would amount to the Fed being more restrictive and reducing the benefit of lower inflation by keeping the cost of debt high. At the same time, it's never easy for the Fed, and a growing economy with low unemployment and rates that are a little high is better than unemployment rising and the Fed having to lower rates for that reason.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)