Unemployment hits highest level in nearly three years

First Fed rate cut may be as soon as September

This past week, we saw several data points related to the job market. Inflation is still the key economic topic, but with two-thirds of our economy supported by consumer spending, the job market is always important.

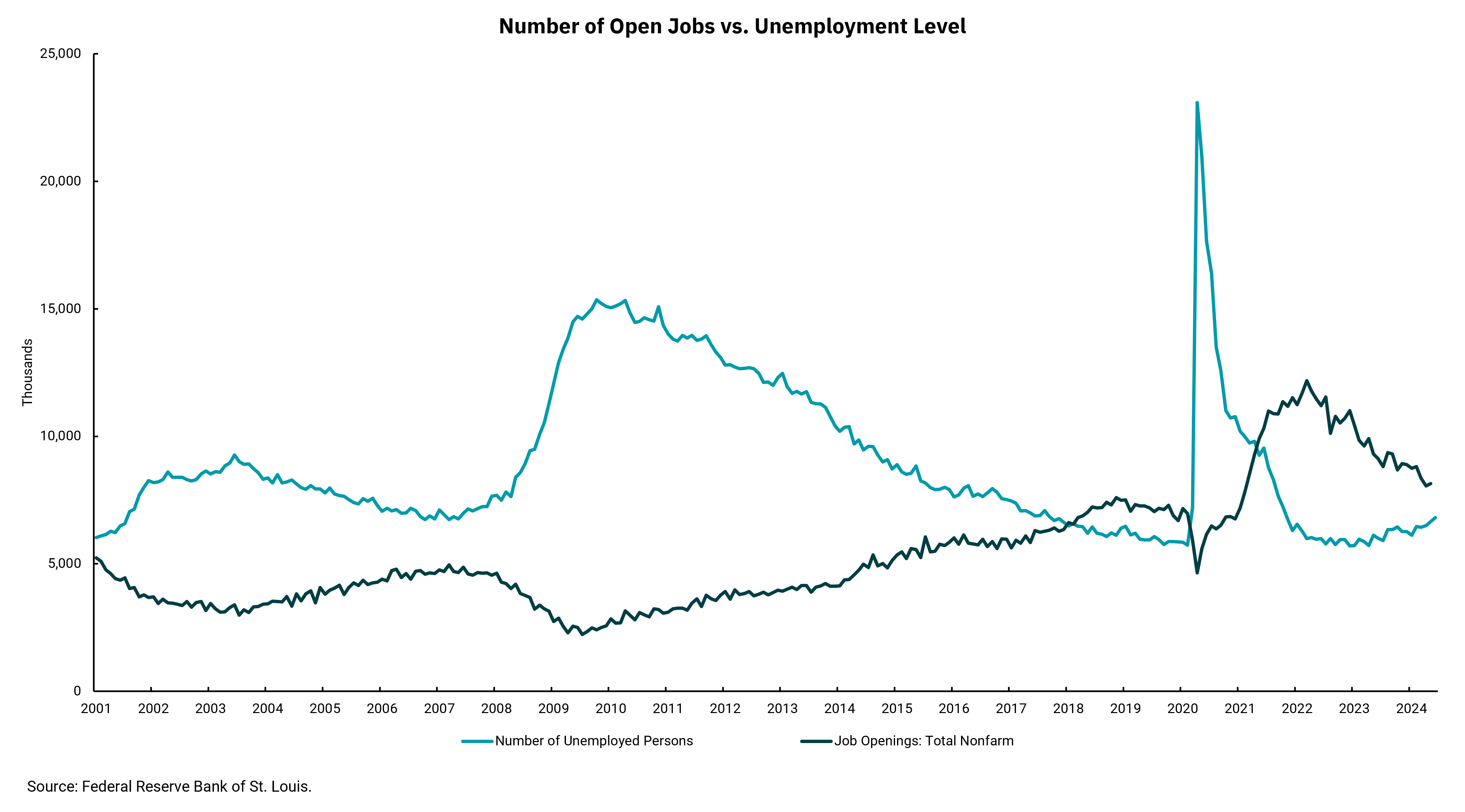

We started the week with the monthly Job Opening and Labor Turnover Survey (JOLTS), where we monitor the number of open jobs and how many workers quit. Many job openings indicate that competition for workers will be robust and is usually accompanied by many "quits." The good news is that job openings and quits have been trending lower, which should provide some confidence to the Federal Reserve that wage pressures will continue to moderate. We can see the trend in our chart as the darker line is in a clear downtrend, yet there are still about 1.2 open jobs for every unemployed person.

We saw the all-important monthly employment report from the Department of Labor (DOL) on Friday morning. We follow several pieces of data in this report. The first is the number of new jobs created within the economy for the previous month. For June, we were expecting about 200,000 new jobs. The report showed job growth of 206,000. So far, so good. We also get a measure of wages within the data, the average hourly earnings, or AHE. This number came in as expected at 0.3%, which means the annual number is now below 4% at 3.9%. This is also a good number.

However, some parts of the report reduced some of our optimism. For example, the previous month's job growth was revised lower by 111,000, meaning net new job growth for May and June was less than expected. In addition, the headline unemployment number ticked up to 4.1%, the highest since November of 2021 and ending a long streak of headline unemployment at or below 4%. The job market is not recessionary, but the Fed still should be about ready to begin lowering rates. We still think September is their first move.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)