Is the tide finally turning for smaller companies?

Small-cap stocks benefitting from expectations that the Fed will cut rates

We have written before about the concentration of equity returns within the domestic stock market. Large-cap growth stocks have dominated performance, leading to significant performance differentials between "passive" indexes. Investors were "paid" in the form of excess performance if they were overweighted towards these high-flyers, and a broadly diversified approach led to less positive returns.

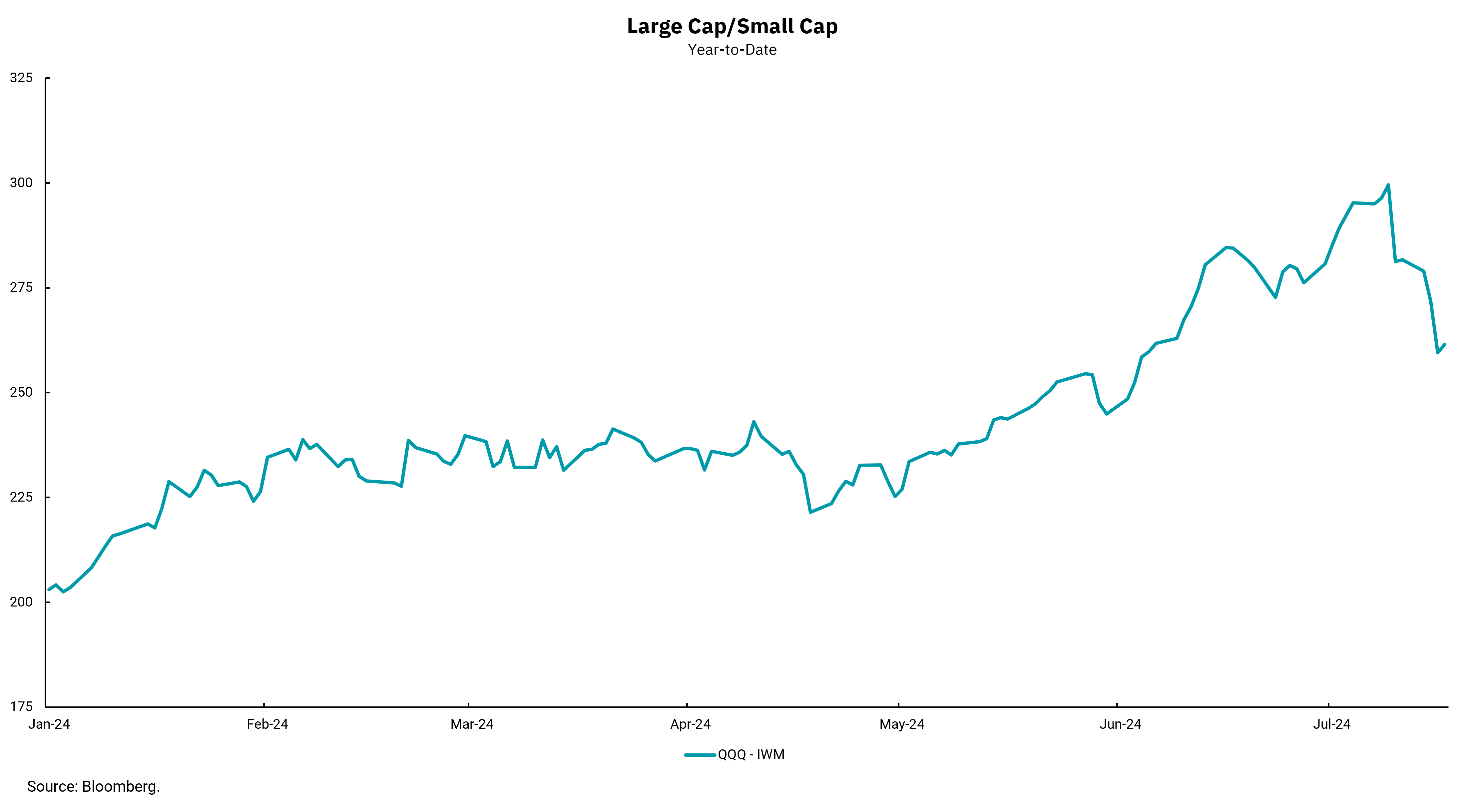

With this in mind, this week's chart gives a visual perspective of the difference in year-to-date performance between the NASDAQ 100 index, ticker QQQ, and the Russell 2000 small cap index, ticker IWM. Until recently, it was clear the performance differential was material.

However, while the year-to-date differential still favors QQQ, the rotation from large-cap to small-cap has been violent since the recent release of a somewhat benign Consumer Price Index (CPI) inflation report for June. Overweighting large versus small caps has been a hugely profitable trade, which inevitably led to some investors becoming a bit too aggressive, setting the table for the move we have seen. Yes, valuations of large-cap stocks were higher, yet we know that valuation is not a good timing tool.

When the June inflation report was released, monetary policy expectations shifted towards a lower-rate environment than we’re in now. The Federal Reserve's high interest rate policies have been significantly impacting smaller companies, as their access to capital can be more expensive and variable in nature than larger companies’ access. And so, when the Fed starts to cut rates, it should provide a slightly better earnings environment for small-cap companies.

For diversified investors, this broadening of investment performance is a welcome development. Particularly if we continue to see an economic picture that shows overall growth remaining positive while inflation continues to decline towards the Fed's 2% target. We believe it is unlikely that the Fed will make any change to rates at their upcoming July meeting. However, we will be watching to see how their communication shifts to see if they are setting the table for a September move. There are a lot of moving parts that could impact the ultimate Federal Funds rate, as well as the overall economic outcome, but the bottom line is that the market is shifting towards a lower-rate outlook.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)